It’s no secret that it’s expensive to live in New York City. However, according to ATTOM Data Solutions, Queens has officially broken the top 10 most expensive counties to live in, sitting comfortably at spot number nine on that list.

ATTOM Data Solutions, the country’s leading source for comprehensive housing data, released its Q3 2016 Home Affordability Index last week that sheds some light on why Queens is so expensive.

ATTOM Data Solutions’ quarterly reports rank counties on a scale of affordability based on comparing people’s incomes with market rate housing and closing costs. According to the MarketWatch, which first reported on ATTOM’s report findings, “The U.S. Department of Housing and Urban Development says a maximum of 30 percent of your income should be spent on housing or you risk having ‘difficulty affording necessities such as food, clothing, transportation and medical care.'”

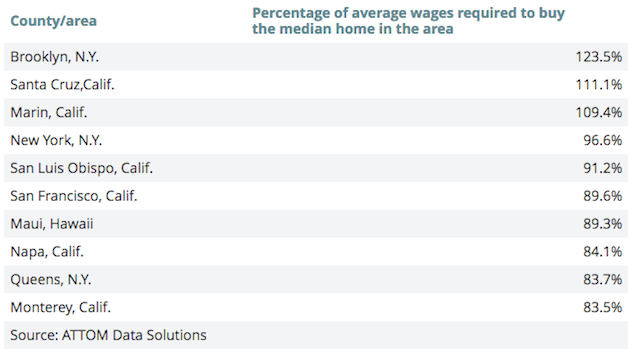

The report indicates that the average person in Queens has to pay a whopping 83.7 percent of their income to be able to buy median housing throughout the borough.

So why is it becoming more expensive to live in Queens? According to MarketWatch, many people looking to move are being priced out of other counties such as Manhattan (which sits at the number four spot on the list) and Brooklyn (which is officially the most expensive place to live based on this report) and are settling down in Queens, thus pushing the prices up. However, wages aren’t increasing to support the new increase in home prices throughout the county, making Queens less affordable.

Part of the reason why housing has become so expensive in Queens (and in other counties) is that closing costs have gone through the roof when you’re buying a house in this borough. According to the report, when you reach the closing table at the end of your house hunt, you could be spending an average of $15,908 in closing costs. This averages out to be 32 percent of a Queens resident’s annual wages.

On the bright side, Queens doesn’t stand alone in this department. ATTOM’s report found that the markets with the highest closing costs were all from New York; Brooklyn and Manhattan round out the top of the list at 47.2 percent and 42.6 percent respectively, and the Bronx and Suffolk County round out the bottom at 21 percent.