By Jeremy Walsh

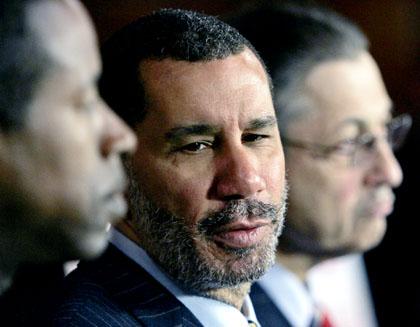

Just under the gun, Gov. David Paterson and the state Legislature reached a tentative agreement on a record $131.8 billion state budget over the weekend, eliminating cuts to education, but imposing higher taxes on households earning more than $300,000 a year and adding a nickel deposit to bottled water.

The plan drew heavy fire from Albany Republicans and debates in both chambers of the Legislature continued past press time Tuesday night. The deadline for the budget was midnight Tuesday.

“The agreement we are announcing today closes the largest deficit in state history, stabilizes our finances and institutes critical reforms that will help eliminate waste and inefficiency in our government,” Paterson said Monday.

But Republicans, like state Sen. Frank Padavan (R−Bellerose), attacked the plan for its secrecy after Paterson, Senate Majority Leader Malcolm Smith (D−St. Albans) and Assembly Speaker Sheldon Silver (D−Manhattan) spent the weekend behind closed doors in Albany hammering out the details.

“No conference committees, no budget resolutions, a host of secret budget negotiations all add up to a willful violation of the Budget Reform Act of 2007 and that is completely unacceptable to every hardworking New Yorker who is struggling to make ends meet,” he said in a statement.

The budget reflects a 10 percent increase over last year’s budget, although Paterson said the increase is due entirely to federal stimulus money. Remove that from the budget, he said, and it reflects no overall growth from the previous year.

But Phil Ragusa, chairman of the Queens Republican Party, slammed Democrats for not using the stimulus funds to offset the proposed tax increases in Paterson’s executive budget proposal.

“This kind of out of control spending and taxing was hard to stomach in a good economy,” Ragusa said.

Because the state’s budget gap grew to $17.7 billion, an increase of $4.7 billion over the past two months as the economy deteriorated, Paterson said he agreed to a controversial income tax hike on high−income wage earners. Between 2009 and 2011, households making more than $300,000 will be charged 7.85 percent, up from the current 6.85 percent , he said. The tax would go to 8.97 percent from 6.85 percent for households making more than $500,000 a year. The increase is expected to produce $4 billion in revenue in the 2009−10 fiscal year, coming close to negating the growth of the budget gap over the last two months.

During a news conference Monday, Paterson was asked if he thought increasing income taxes made sense during an economic downturn.

“No, none of this makes sense,” Paterson said. “We don’t want to tax the wealthy. … This is a response to a crisis.”

The budget will also establish a 5−cent deposit for bottled water, expected to raise roughly $115 million, Silver said.

Among the items provided for in the budget agreement was $350 million for the state’s film tax credit program, which has allowed Queens studios like Silvercup and Kaufman Astoria to thrive for the next three years.

Proposed cuts to education were eliminated, with funding sustained at 2008−09 levels. Cuts to health care were reduced by $1.2 billion from the $3.5 billion proposed in Paterson’s executive budget. The STAR property tax rebate program was also eliminated, creating an uproar from Long Island residents.

Paterson also warned that if the budget gap grows any further, the Legislature would have to return to more of the Draconian cuts he proposed in his executive budget.

The agreement was reached during closed−door negotiation sessions this weekend, drawing criticism that the move was a departure from the more transparent government promised by Paterson’s predecessor, Eliot Spitzer.

The governor, Silver and Senate Majority Leader Malcolm Smith (D−St. Albans) countered that the situation was a crisis.

“We did the best we could to get everyone involved,” Smith said. “Are we happy with it? No. Will we do better moving forward? Yes we will.”

The legislators also drew flak for not reducing the $170 million allocated for their member items, which go to nonprofit groups in the legislators’ home districts.

Silver and Smith defended the decision, noting that nonprofits have been devastated by the economic downturn.

“These member items deal with housing, with human services,” Smith said. “These are not pork barrel programs.”

Reach reporter Jeremy Walsh by e−mail at jewalsh@cnglocal.com or by phone at 718−229−0300, Ext. 154.