By Howard Koplowitz

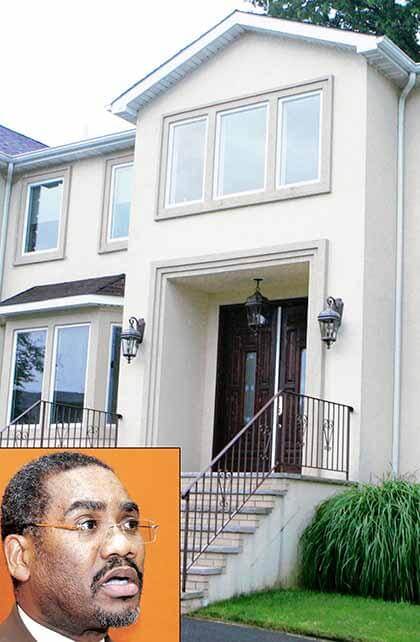

A Washington, D.C.-based, nonpartisan ethics group has filed a complaint with the Office of Congressional Ethics against U.S. Rep. Gregory Meeks (D-Jamaica), alleging the congressman violated federal law and House rules for accepting a $40,000 personal loan from a Richmond Hill real estate developer in 2007 that he failed to disclose until last month.

Citizens for Responsibility and Ethics in Washington claimed Meeks knowingly failed to report the loan — the congressman called it an “oversight” — in 2007 and 2008 and therefore “made false statements in violation of federal law,” a felony punishable by up to five months in prison, the group said.

The congressman said he repaid the $40,000 loan from Edul Ahmad with interest and replaced it with a lower-interest loan last month, although the New York Daily News reported Meeks repaid the loan only after the FBI questioned Ahmad about the arrangement.

The News story prompted the ethics group to file the complaint with the Office of Congressional Ethics.

“Rep. Meeks got caught with his hand in the cookie jar and came up with an after-the-fact explanation to justify his conduct. Too bad for him, his story doesn’t hold water,” said CREW Executive Director Melanie Sloan. “The real questions now are what did Rep. Meeks do for Mr. Ahmad in return for the money and exactly what is Congress going to do about this?”

Meeks said he “made all the necessary amendments to ensure compliance with House disclosure rules.”

“It is unfortunate that Citizens for Responsibility [and] Ethics in Washington is now using distorted and sensationalized media reports as the basis for a complaint to the Office of Congressional Ethics,” he said in a statement.

Sloan said it was “clear that he got the money from Mr. Ahmad in 2007 and didn’t pay down the loan in any way. I think the facts speak for themselves. I’d like Mr. Meeks to address exactly what’s not true.”

CREW also said Meeks violated House rules by accepting “an impermissible gift” — a $59,650 home equity loan — from Four Investments, a company headed by Democratic donor and Meeks campaign contributor Dennis Mehiel, last month.

The group said the loan from Four Investments constitutes an impermissible gift because members of congress can only accept loans from financial institutions on terms available to the general public.

“Since Four Investments does not make home equity loans, the loan Rep. Meeks received is obviously not widely available,” CREW said.

The congressman has not provided any loan documents from his arrangement with Ahmad.

“There’s nothing to suggest there was a loan from Mr. Ahmad,” Sloan said. “He can’t find [the documents] because there [are] none. Mr Meeks’ after-the-fact rationalizations don’t ring true.”

Sloan said she expects it will take months before the OCE makes a determination.

Reach reporter Howard Koplowitz by e-mail at hkoplowitz@cnglocal.com or by phone at 718-260-4573.