By Naeisha Rose

The New York City Commission on Property Tax Reform is making its way to York College Wednesday to get ideas from Queens constituents on how to make taxes more fair, straightforward and transparent, according to the mayor’s office.

The Oct. 3 public hearing is scheduled to begin at 6:30 p.m., at the school’s Milton Bassin Performing Arts Center, located at 94-45 Guy R. Brewer Blvd., in Jamaica.

“It’s [purpose is] to take a look at the property tax system in New York City, which is complicated and sort of hard to understand,” according to Marcy Miranda, a spokeswoman from the mayor’s office. “We would love to have people come out and share their experiences with us and the ways they think we can make things better for them.”

The last time there was an in-depth review of the tax system by a government-appointed commission was 1993, according to Miranda.

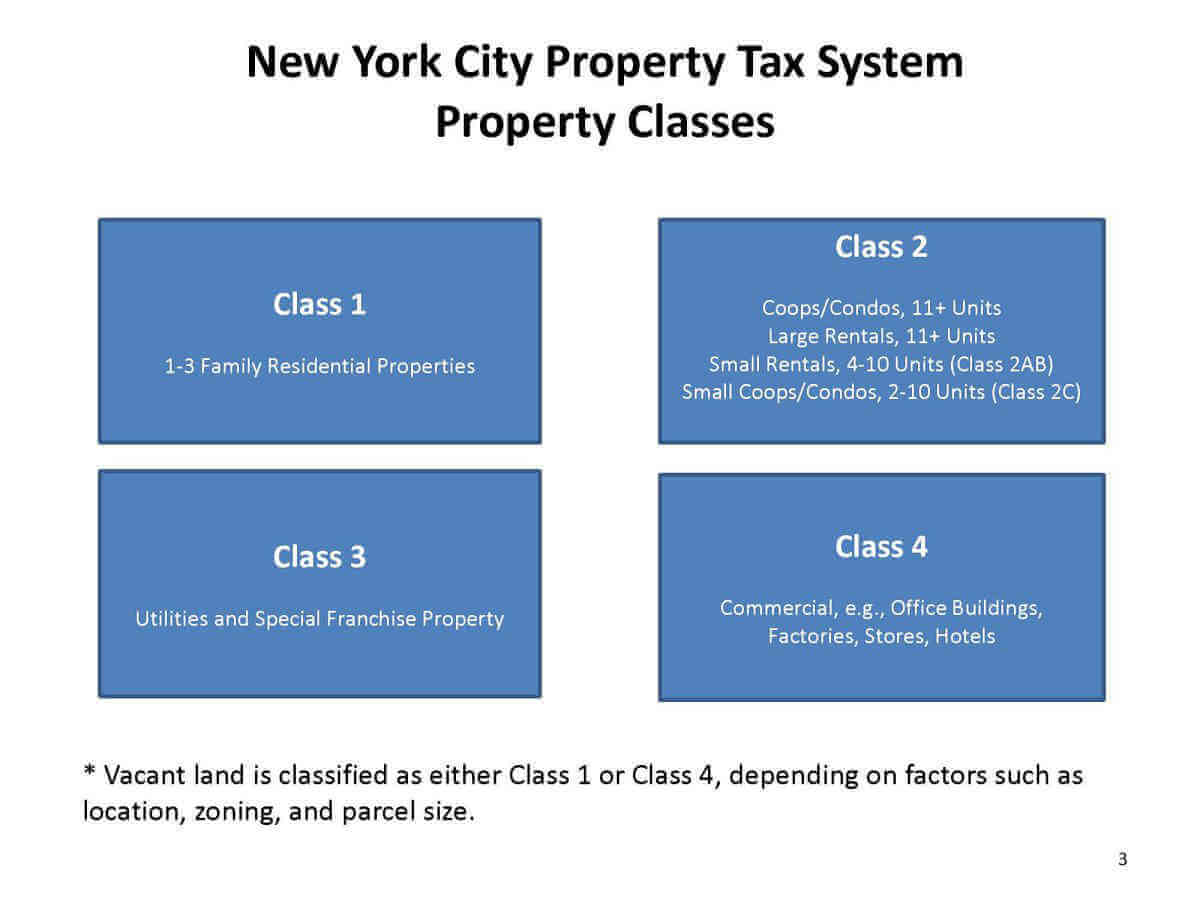

“State regulators set a lot of regulations for [the tax system], so the city is limited in what it can or can’t do,” Miranda said regarding why taxes are complicated in the city. “The other part of that is that the tax system is divided into four different property classes.”

New York City no longer had a single tax class since 1983, according to a July 20 background review of the tax system made by the city’s Department of Finance. Under the current method the four different tax classes that were created have their own valuation rules and rates.

The NYC Commission on Property Tax Reform was created in May by Mayor Bill de Blasio and City Council Speaker Corey Johnson (D-Manhattan) and intends to evaluate all aspects of the current tax system in the city in terms of one-to-three family residential properties (Class 1), co-ops, condos, and rentals (Class 2), utilities and special franchise properties (Class 3) and commercial, office buildings, factories, stores and hotels (Class 4), according to the mayor’s office.

“Depending on what type of class a property is in you pay a certain amount essentially,” said Miranda, “What has happened over the years is that for Class 1 properties there is a cap on how much taxes can go up every year.”

Class 1 property can have taxes go up to six percent annually, but not more than 20 percent over five years, according to the city’s Department of Finance.

“What ends up happening is that properties that are in really hot neighborhoods, because of the cap won’t grow as quickly as other properties that are gentrifying a little bit quickly and developing a little bit faster,” said Miranda. “Lets say I’m a property owner, and my property value goes up, that doesn’t necessarily mean that my income goes up, so it’s going to make it harder for people to make the higher payment on their taxes.”

Co-ops and condos with more than 11 units, utility properties and commercial properties can be assessed for a 45 percent tax of the market value, according to the city’s DOF. Small rentals of four to 10 units and small co-ops of two to 10 units can have taxes up to eight percent a year, but the tax can’t be more than 30 percent over five years.

“The first part of the hearing is talking to residents, homeowners, and tax payers in order to get a sense to know what are the real issues, where is it that they need some help,” according to Miranda. “Then [the commission] wants to take that information and come up with some preliminary recommendations sometime in the winter.”

Proposals based on community recommendations are expected for a spring presentation to residents next spring and another community meeting with elected officials and residents is expected for next summer, according to Miranda.

“We want people to come and learn of some ways to make things better,” said Miranda.

Reach reporter Naeisha Rose by e-mail at nrose