The New York City Council passed two pieces of legislation that will help property owners keep their homes during these unprecedented times.

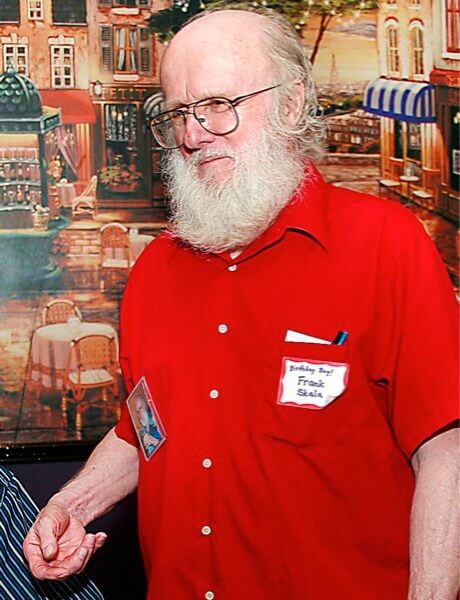

One bill, known as Intro 2039-A, prime-sponsored by Councilman Daniel Dromm, would retroactively extend the filing deadline for an initial or a renewal application from March 16 to July 5 for various real property tax exemption/abatement programs that were due in the calendar year 2020.

According to the city’s Department of Finance, approximately 2,650 eligible initial and renewal applications were received after the existing deadline, but prior to July 15. The legislation would permit the approval of these applications this year rather than requiring the homeowners to wait until the next tax year to qualify for benefits.

“Intro 2039-A will help hundreds of New Yorkers keep their homes,” Dromm said. “The COVID-19 pandemic hit New York City like a bolt of lightning in late March of this year. Shortly before the mass hospitalizations, the busiest city in the world went silent as millions of New Yorkers went into lockdown as ordered by the city and state.”

“Mid-March was one of the most frightening periods in the city’s history as we were awaiting the approaching storm and contending with a virus that was almost completely unknown to us. Amidst fear and confusion in the early days of the COVID-19 pandemic, many homeowners missed these program deadlines,” Dromm added. “This is an understandable oversight, but it is one that could have dire consequences for the many working families who rely on these exemptions and abatements to stay afloat financially. This retroactive extension will keep homeownership affordable for many people with lower incomes.”

Dromm’s second bill, Intro 1225-A, would require the Finance Department to make best efforts to collect the name, telephone number, and email address of every owner of real property in the city.

Currently, the department does not have a systematic way of collecting and maintaining contact information other than a physical mailing address for property owners.

Email and telephone information are crucial for efficient communication. This legislation encourages the Department to ensure that emphasis is also placed on those alternative and often preferred means of contact.

“Intro 1225-A will help city officials conduct quick and efficient outreach to homeowners. As a Council Member, I find it extremely frustrating that the New York City Department of Finance asks us to reach out to our constituents about critical issues like the lien sale or renewing property tax exemptions without providing phone numbers and email addresses,” Dromm said.

“Right now, all my office can do is send another snail mail letter. In many instances, we can save low income and middle-class homeowners from the terrible experience of having a lien placed on their property simply by notifying them in a timely manner,” he added. “We are in the middle of a pandemic and housing insecurity is on the rise. As elected officials, we must do everything in our power to help homeowners during these extremely challenging times. This common-sense effort does just that.”