Queens’ relatively low land prices, access to public transportation and growing popularity has helped the borough attract a significantly larger amount of money from real estate investors in 2014 than in previous years, according to a new report.

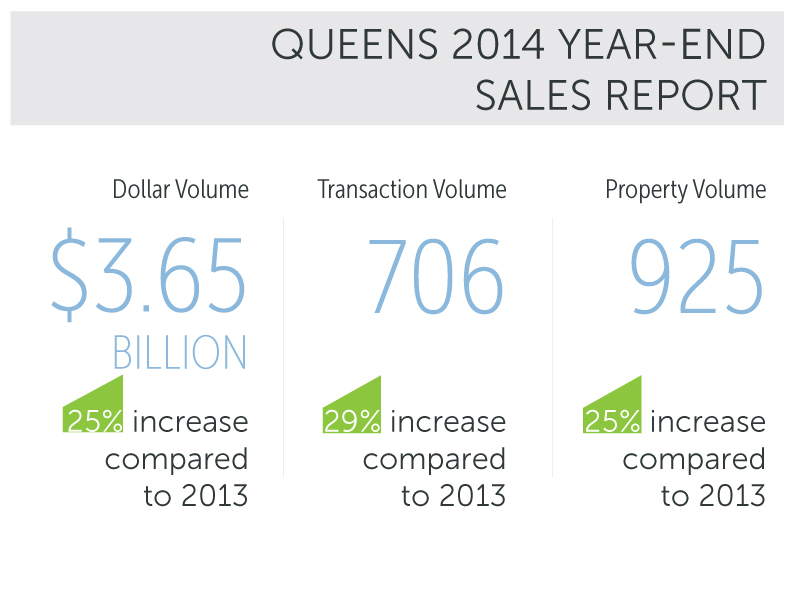

Firms and individuals shelled out about $3.65 billion last year to buy Queens investment properties—large-scale real estate costing at least $850,000—which is a 25 percent increase from 2013, according to a report by Ariel Property Advisors.

The study pointed out that about one-third of the investment properties in Queens last year were development sites, which alone accounted for more than $1 billion, or a 191 percent gain when compared to 2012.

“Queens still presents developers with the opportunity to produce large-scale developments, and they are willing to pay a premium for prime sites,” said Daniel Wechsler, vice president of Ariel Property Advisors.

Wechsler pointed out that land parcels with at least 50,000 square feet of buildable rights were purchased all over “The World’s Borough,” including Astoria, Long Island City, Elmhurst, Woodside, Glendale, Jamaica, Ridgewood and Flushing, “further indicating the bullish attitude of investors on the entire borough. “

The report found that 925 properties were traded during the year, which is also a 25 percent year-over-year increase.

Some of the year’s highest profile transactions include the $110 million sale of the Standard Motors Building in Long Island City, which traded for just $70 million in 2008, and the sale of a 53-building portfolio in Kew Gardens Hills for $216 million.

There was also the $26.5 million sale of a garage near Queens Place mall in Elmhurst, which has about 227,352 buildable square feet.

Click here to read the full report.

RECOMMENDED STORIES