Looking to give parents greater choice as to where they send their children to school, Governor Andrew Cuomo announced Tuesday legislation creating tax incentives for private education.

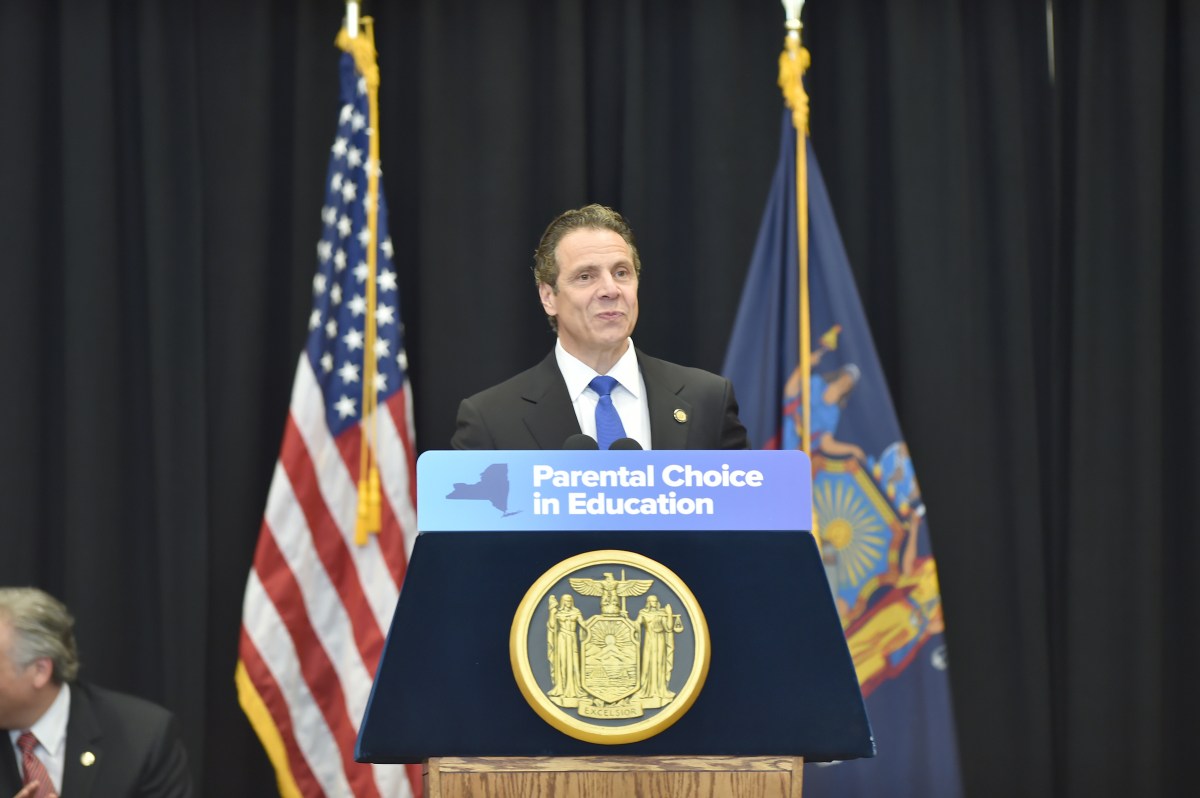

Cuomo was joined by Cardinal Timothy Dolan and elected officials, as well as parents and students, to call on the legislature to pass the Parental Choice in Education Act during this session, which concludes in June.

“Education is the greatest gift that a parent can give to their children—and it is also one of the most personal decisions that a parent can make,” Cuomo said. “That’s why we need to support parental choice in education.”

The Parental Choice in Education Act aims to support and protect alternative schooling options for parents and students across the state. It calls for $150 million in education tax credits annually that would provide tax credits to low-income families who send their children to non-public schools; scholarships to low- and middle-income students to attend either an out-of-district public school or a non-public school; incentives to public schools for enhanced educational programming, such as after-school programs; and tax credits to public school teachers for the purchase of supplies.

“By rewarding donations that support public schools, providing tax credits for teachers when they purchase classroom supplies out of pocket and easing the financial burden on families who send their children to independent, parochial or out-of-district public schools, we can make a fundamental difference in the lives of students, families and educators across the state,” the governor continued. “The legislature must pass this act this year, because families deserve a choice when it comes to their child’s education.”

More than 400,000 children attend non-public schools across New York State. Many parochial schools in New York State, however, are facing financial hardships. More than 75 parochial schools have closed in the last five years statewide, and average tuition costs and reach as high as $8,500 annually per student.

“This is not just a Catholic issue — it is an issue for every parochial, private or non-public school that is devoted to the success of their students,” Dolan said. “Our students are our greatest treasure and the Parental Choice in Education Act is all about supporting them no matter where they go to school.”

The Parental Choice in Education Act’s Family Choice Education Credit will provide $70 million in credits to approximately 82,000 families of non-public school students across the state, benefiting nearly 140,000 children. Families with incomes below $60,000 per year would qualify for up to $500 per student for tuition expenses to non-public and out-of-district public schools.

Additional tax credits in the bill would fund $67 million in scholarships to help low-income families afford private education for their students. Individuals and businesses can receive a tax credit for up to 75 percent of their donations made to non-for-profit organizations that award scholarships to students in grades pre-K through 12.

Educational improvement programs would also receive a $27 million boost. Individuals and businesses will be able to apply for a total of $20 million in tax credits for up to 75 percent of their donations made to public schools and non-for-profits that support public schools’ educational programs.

Finally, instructional materials and supplies credits totaling $10 million would provide $200 per public school teacher to support the purchase of instructional materials and supplies. This credit will be given out on a first-come, first-served basis.

RECOMMENDED STORIES