Governor Andrew Cuomo said he doesn’t support a bill that Jackson Heights State Senator Jessica Ramos and Manhattan Assemblywoman Carmen De La Rosa sponsored to place higher taxes on New York’s billionaires — but people in parts of Queens most affected by COVID-19 say that he’s just giving the richest a free ride.

The Billionaires’ Tax (S.8277/A.01041) would establish a “billionaire mark to market tax” to impose a tax on residents with $1 billion dollars or more in total assets, in order to direct that revenue into a worker bailout fund for New Yorkers who have been left out of federal and state aid during the pandemic.

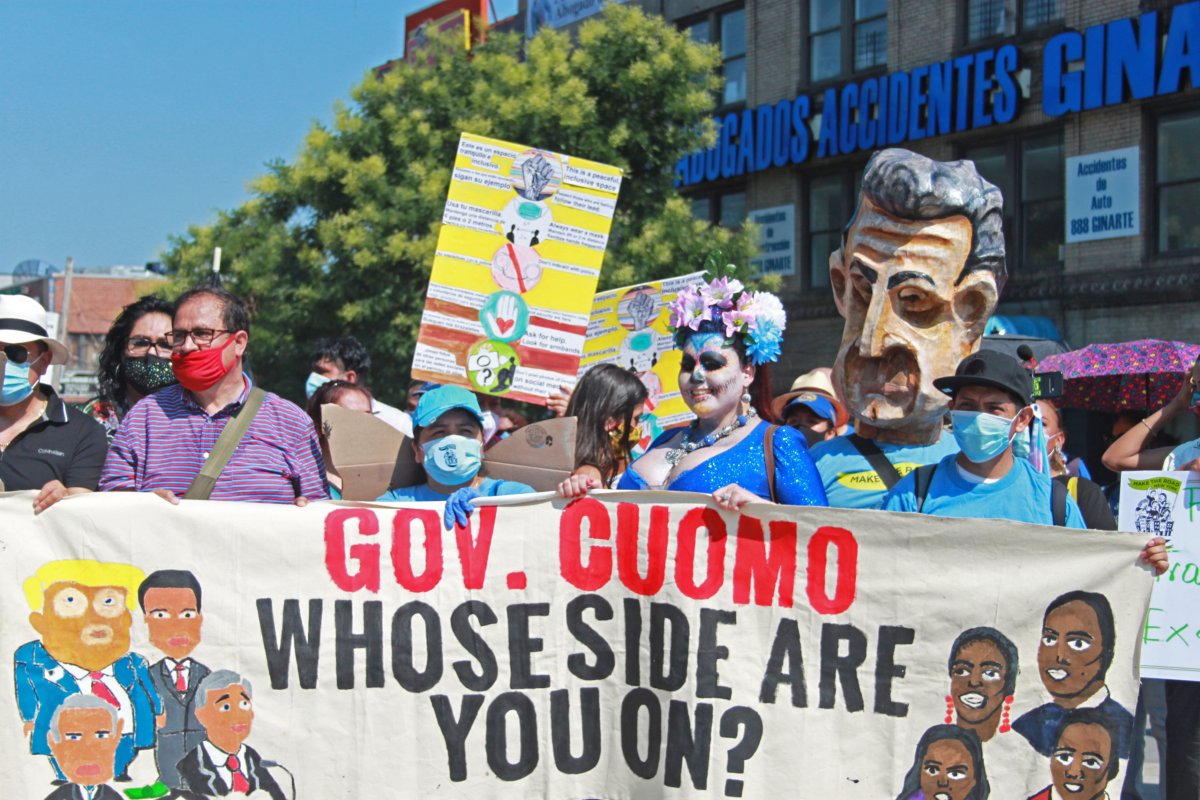

On Sunday, more than 300 people marched during Make the Road New York’s “Barrios Not Billionaires March” in support of the legislation, from Corona Plaza west along Roosevelt Avenue and down Junction Boulevard to LeFrak City complex where they called out billionaire businessman Richard LeFrak. This is just one of several demonstrations held in the last few months of the pandemic in support of the Billionaires Tax.

However, Cuomo believes the bill would chase away New York’s 119 billionaires. Ramos, De La Rosa, and the bill’s backers say “let them leave.”

Organizers with Make the Road New York (MRNY), the largest progressive immigrant-led organization in the state, said the demonstration focused on improving the Black, Brown, trans, queer, immigrant and low-income communities of New York, all of whom have been disproportionately impacted by the COVID-19 pandemic.

“We need relief and we need relief now,” a member of Make the Road New York said.

One member of Desis Rising up and Moving (DRUM) said she lost her job right after the pandemic hit, but as an international student has had to “worry about thousands of dollars” in education, medical and food bills.

a member of @DesisRisingUp says she’s an excluded worker, a student and an immigrant who lost her job due to the pandemic.

“We don’t have summer houses to go to,” she said while addressing Cuomo. pic.twitter.com/QfqBEINjxe

— Angélica M. Acevedo (@angacevedo15) August 9, 2020

“We have not received support from any institution, our city and state have failed us repeatedly,” she said. “The suffering of workers have been falling on deaf ears of Governor Cuomo, our state and government has repeatedly bailed out corporations during economic crises but have turned a blind eye on workers who are at the cusp of becoming homeless.”

There were several speakers and chants to cancel rent throughout the march, as well as music by NYC Mariachi and dances by the Traditional Indigenous Danza group who wore colorful Chinelos de San Diego garments as they led the march with energetic twirls.

Cuomo said last week that the Billionaire’s Tax bill is no good on the basis that the federal government had exacerbated the crisis in the first place, and it’s not on anyone but Washington to refill the coffers of state and local government, not billionaires.

When asked if there was a limit to his opposition of taxing billionaires, Cuomo told amNewYork Metro the state would have to be under extreme circumstances.

“If the legislation is not going to help New York, you know what I say to [federal lawmakers]? Don’t pass it,” Cuomo said on Aug. 3. “One percent of the population pays 40 percent of taxes, and they’re the most mobile people on the globe … That would be a bad place we’d have to go to [to raise taxes].”

The governor says he is holding out for another stimulus that would offer financial relief to the decimated budgets of cities and states, criticizing the executive order signed by President Donald Trump over the weekend and over the last few weeks deriding the HEALS Act.

The march ended in front of LeFrak City Apartments complex, where some members of MRNY, New York Communities for Change (NYCC) and New Immigrant Community Empowerment (NICE) gave speeches addressing Cuomo’s previous comments on the tax.

“The rich are getting richer and the poor are getting poorer, isn’t that a shame,” said NYCC Chair Leroy Johnson.

A recent study by Americans for Tax Fairness found that 119 of the state’s billionaires — of whom 113 are U.S. citizens and six are foreign-born with residence in the state — collectively saw their wealth increase $77.3 billion or by almost 15 percent during the first three months of the pandemic.

Ramos explained that the tax they’re proposing would generate about $5.5 billion, or approximately $50 million per billionaire.

“That sounds like a lot of money to us — because it is — but it’s not a lot of money to them,” Ramos said. “Richard LeFrak alone has made more than $850 million over the past four months. It’s a fraction of that. It’s like asking them to go Dutch.”

De La Rosa, who is co-sponsoring the bill in the Assembly, said once the tax is imposed, they will be able to create a worker bailout fund.

“We won’t rest until this bill passes,” De La Rosa said. “When we impose the tax, it’s important we create a fund for workers, because there’s always funds for corporations. Corporations don’t eat, feel or die — the people do.”

The event ended with the kids having a go at a piñata that had a photo of President Donald Trump and Richard LeFrak, who supports the president and is among the nearly one in 10 U.S. billionaires who have donated to his campaign.

Make the Road New York organized the event and was joined by Housing Justice for all Coalition, Street Vendor Project, Woodside on the Move, Adhikaar, among other human rights groups. Assembly members Catalina Cruz and Brian Barnwell, Democratic candidate for Jackson Heights State Assembly Jessica González-Rojas and former Queens district attorney candidate Tiffany Cabán were also in attendance.

With additional reporting by Mark Hallum.

Editor’s note: An earlier version of this story centered on another bill to raise taxes to fund the MTA. This story was edited to reflect the march’s call to raise taxes on billionaires to fund an excluded worker’s bailout fund.