Local elected officials are expending “energy” to ensure Morgan Stanley doesn’t get a quick “fix” to its illegal pricing ploy.

Senator Michael Gianaris and Councilmember Peter Vallone Jr. are pushing a federal judge to reject the proposed settlement in the price-fixing case involving the investment bank and two western Queens energy plants – Astoria Generating Company and KeySpan Energy Corporation.

The scheme, which caused ratepayers to lose roughly $300 million over two years, generated $21.6 million for Morgan Stanley.

Gianaris and Vallone recently sent a letter to the judge overseeing the case, William Pauley, requesting a re-evaluation of the $4.8 million settlement reached between the bank and the U.S. Department of Justice (DOJ). The officials are hoping the fine is increased, and believe a provision should be included compensating ratepayers who suffered financial losses.

“Allowing a deep-pocketed investment bank to get away with just a slap on the wrist would be treated as the cost of doing business and would continue to permit the bank to reap the benefits of its illicit profits,” Gianaris said. “The settlement proposal is an insult to ratepayers during a difficult economic time, and I encourage Judge Pauley to protect the public by rejecting this proposal.”

According to DOJ, KeySpan and Morgan Stanley entered into an agreement in January of 2006 which provided KeySpan with a financial interest in the electricity capacity sales of its largest competitor, Astoria Generating Company. By providing KeySpan revenues from its competitor’s capacity sales, the agreement had the anticompetitive effect of eliminating KeySpan’s incentive to sell its electricity at lower prices.

A spokesperson from Morgan Stanley declined to comment.

“This settlement with a major financial institution will signal to the financial services community that use of derivatives for anticompetitive ends will not be tolerated,” said Sharis Pozen, acting assistant attorney general in charge of DOJ’s Antitrust Division. “Disgorgement of ill-gotten gains, as was paid here, is an effective Antitrust Division tool to remedy harm to competition.”

KeySpan reached a $12 million settlement with DOJ for violating antitrust laws.

“This issue was resolved last year through a settlement with DOJ, and we consider the matter closed,” said a spokesperson for National Grid, which purchased KeySpan. “We believe the private class actions lack merit and we will continue to act accordingly.”

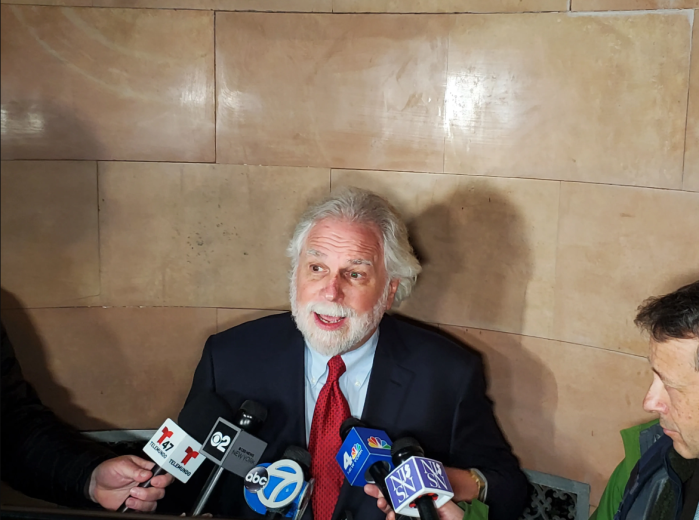

John Reese, senior vice president of U.S. Power Generating Company, which owns Astoria Generating Company, declined to comment regarding the settlement, but he did emphasize the importance of fair play in the economy.

“We were doing an agreement with Morgan Stanley, and we were not aware of their agreement with KeySpan,” said Reese. “The deal they did, we had no knowledge of. We received none of the benefits of what happened in that deal, and that is why were not fined and received no violations. For a market to work efficiently, everyone has to follow the rules. When you break the rules, you have to be punished accordingly.”

The current court settlement would allow Morgan Stanley to keep roughly $16.8 million of the profit they received through the price-fixing scheme, which Vallone and Gianaris believe to be egregious.

“Who came up with this deal – Bernie Madoff,” Vallone asked. “How could DOJ and the court allow Morgan Stanley to conspire with KeySpan to artificially raise rates and make millions of dollars without returning one cent to the ratepayers?”