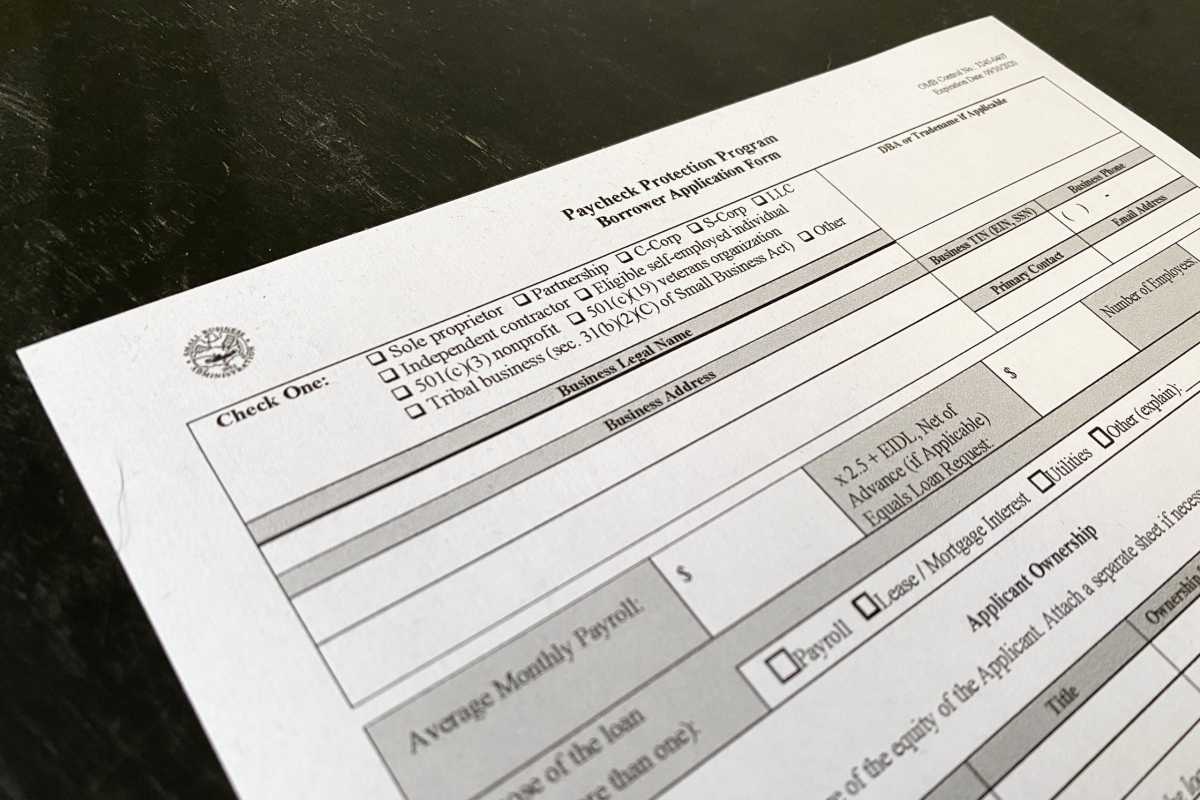

Improvements have been made to the Paycheck Protection Program (PPP) to aid Queens’ small business owners that were impacted by the coronavirus pandemic.

Congresswoman Grace Meng on June 13 announced the enactment of the Paycheck Protection Program Flexibility Act (H.R. 7010), which passed the House by a vote of 417-1 on May 28.

The measure, which was passed by Congress and signed into law by President Donald Trump on June 5, increases flexibility and access to the Paycheck Protection Program, an initiative created by the Coronavirus Aid, Relief and Economic Security (CARES) Act that provides loans to struggling small businesses.

Meng said she has heard from many constituents about the need to make the PPP more flexible so that initiative better meets their needs, such as extending the loan forgiveness period and increasing the amount of the loan that can be spent on non-payroll expenses.

“The Paycheck Protection Program Flexibility Act achieves these goals, and makes other enhancements that will benefit small businesses in Queens. Making PPP loans flexible is vital to entrepreneurs, and will help them make decisions that fit their economic needs while retaining their employees. I encourage all PPP loan recipients to consult with their lenders immediately,” said Meng, an original co-sponsor of the bill.

The Paycheck Protection Program Flexibility Act increases flexibility and access to PPP loans by allowing loan forgiveness for expenses beyond the eight-week covered period to 24 weeks, and extending the rehiring deadline.

It increases the current limitation on non-payroll expenses (rent, utility payments and mortgage interest) for loan forgiveness from 25 to 40 percent.

Furthermore, the measure extends the program from June 30 to Dec. 31, extends loan terms from two to five years, and ensures full access to payroll tax deferment for businesses that can take PPP loans.