Audit: Condos, Co-Ops Overvalued

City Comptroller John C. Liu announced that numerous homeowners were subjected to unexpectedly high property assessments at a time when home prices were stagnant because the Department of Finance (DOF) failed to adequately explain significant changes it made to its market value calculations and, in numerous cases, either assigned questionable values or made errors.

The findings were the result of two new audits released last Friday, Apr. 13.

The comptroller’s audits found that the DOF not only caused upheavals in condominium and co-op property values-a determining factor in property taxes-when it changed its formula for calculating them in Fiscal Year 2011-12, but also sparked public shock and confusion by operating in the dark, with no timely warning to the public of the volatility it knew would result.

The audits also determined that the DOF compounded the drastic swings with inexplicable values it applied to a core group of co-op and condo owners, predominantly in Queens, who saw their market values

“While real estate taxes are an important source of revenue for the city, homeowners should not have to endure the stress of being unable to anticipate their property taxes year to year,” Liu said. “DOF’s recent arbitrary decisions will affect many families for years to come and raise serious questions. Even after enormous public outcry, there is still no explanation behind many of the agency’s measurements of market value.”

Numerous complaints about large spikes in residential tax bills prompted the comptroller’s office to initiate the two audits.

In Fiscal Year 2008-09, the DOF changed its methodology for assessing property values, resulting in market value and tax volatility. Then, in Fiscal Year 2011-12, the agency switched back to its original formula.

This, of course, resulted in further volatility, which prompted the widespread complaints from homeowners that led to the two audits released today.

According to the audit, the DOF’s changes to its market value calculations, while permissible, particularly affected the values of condos and coops in buildings with 11 units or more. The DOF offered little explanation for this volatility until widespread homeowner complaints demanded answers.

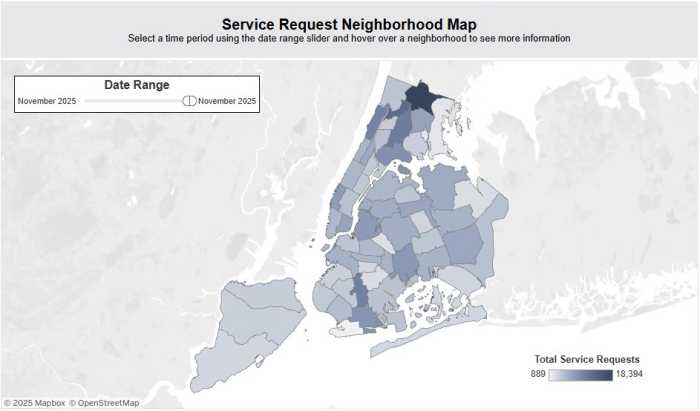

The complaints were especially acute in Queens where the agency acknowledged the market value of nearly 30 percent of larger co-ops rose by more than 50 percent and drove tax bills significantly higher.

While co-op owners citywide were handed an average 12 percent increase in the market value, co-op owners in Queens saw an average 32 percent increase in market value based on the DOF data for FY 2011- 2012.

The DOF compounded the increases in market value by sticking many co-ops and condos with questionable values. Under state law, the DOF assigns market value to co-ops and condos by comparing them to equivalent, nearby rental properties. In many cases, however, the agency seemed to ignore its own so-called “comparable” rental properties and chose market values that were much higher than they should have been.

At least 10 percent of all the 859 co-op buildings in Queens received much higher property values than the DOF’s formula should have allowed.

The DOF has not explained why it assigned these 92 co-ops higher market values-and likely higher tax bills-than seemed feasible. In one instance, when auditors went back and redid the DOF’s math, they discovered the agency gave a Forest Hills co-op a market value that was 227 percent higher than its formula should have assigned to the building.

Since August 2010, the DOF has relied on its Computer Assisted Mass Appraisal system (CAMA) to make valuation calculations based on property related information from different DOF systems.

The auditors found that, in many instances, CAMA selected inappropriate properties to use as comparables for calculating property values of co-ops and condos.

For example, the DOF assessed the value of a co-op building in Brooklyn by comparing it to a parking lot; the agency compared a co-op in Staten Island to an adult care facility; it assessed a co-op in Alphabet City by comparing it to a rental property in Washington Heights; and it assessed the value of a condo building in Flushing by comparing it to a rental property miles away in Far Rockaway.

The audits called on the DOF to increase the transparency of its property valuation decisions and make other changes to ensure more accurate market values were assigned to homeowners. The recommendations include that the agency:

– ensure its computer system selects appropriate comparable properties for its annual valuations and review and modify its criteria in making comparisons;

– re-evaluate properties that were over-assessed and under-assessed for the current year to make sure they are valued properly in the future and select appropriate comparable properties for annual valuations; and

– notify the public of changes in assessment methods and evaluate those changes to ensure assessment criteria are consistently applied.

The DOF, in its responses to the audits, said it already ensures that properties are valued properly and does not agree that properties were over-assessed or under-assessed simply because there is a change in value from year to year. It agreed that “continual improvement of the modeling criteria for selection of comparable properties is appropriate.”

Real estate taxes account for $17 billion, or 26 percent, of allcity general fund revenue in Fiscal Year 2011.

Liu credited Deputy Comptroller for Audit Tina Kim and the Audit Bureau for presenting the findings. The audits are available online at www.comptroller.nyc.gov/audits.