By Daniel Arimborgo

Automated teller machine surcharges have increased threefold for Queens residents and other New Yorkers in the past five years, a study by the New York Public Interest Research Group has found.

The report, “The Five Year Gouge,” released March 29 follows up on a NYPIRG study published a year ago, “Guilty as Surcharged: Automated Teller Machines Asking Too Much.” The new study, surveyed 42 banks in New York City, including 25 in Queens.

“Today, New York City consumers pay more than three times what they paid five years ago for the same ATM transaction,” said Tracy Shelton, A NYPIRG consumer attorney. “That is because now we pay two fees for one transaction and the amount of the fees continues to increase.”

The fees other banks charge non-customer patrons to use their ATM machines are called foreign fees. They went up over 300 percent in five years, the study found, from an average of 82 cents to $2.53 this year. Patrons can avoid the additional fee by only using their banks’ ATM’s, or ATMs labeled with a “No Surcharge” logo.

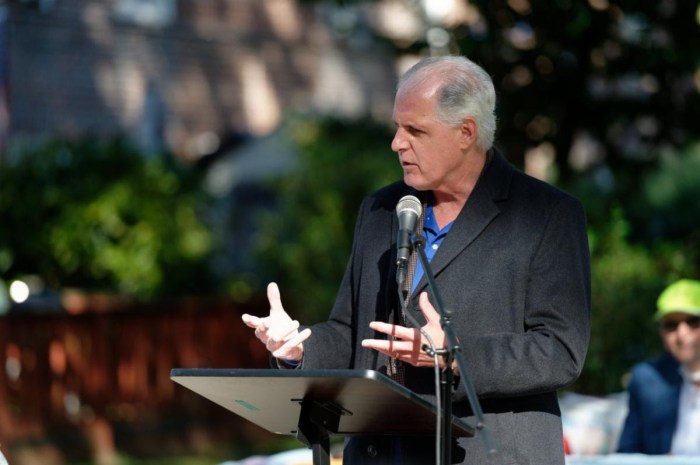

In January 2000 City Council Speaker Peter Vallone (D-Astoria) introduced a bill that would ban ATM surcharges imposed by banks in New York City. NYPIRG said the bill has the support of 34 of the 51 City Council members.

In addition to Vallone, the lead sponsor of the bill, council supporters from Queens include Julia Harrison (D-Flushing), Karen Koslowitz (D-Forest Hills), Helen Marshall (D-East Elmhurst), Walter McCaffrey (D-Woodside), Morton Povman (D-Forest Hills), John Sabini (D-Jackson Heights), and Archie Spigner (D-St. Albans).

The study found that the average amount of a surcharge is $1.51 this year, up from $1.33 a year ago. This fee is added on to a second fee charged by most banks, which averages $1.02 in the city, making the total charged to bank patrons for a transaction an average of $2.53. Prior to introduction of the new surcharge five years ago, consumers paid a single fee that averaged 82 cents.

The report found that 95 percent of the ATMs surveyed in New York state imposed surcharges in 2001, a 2 percent increase from a year ago. By contrast, in 1997, only 33 percent of banks surveyed in the state surcharged.

NYPIRG has called upon the Congress, the state Legislature, and the Council to pass legislation banning ATM surcharges.

Any legislation passed against the surcharges in New York state would most likely be appealed to higher courts by the banking industry. Similar legal battles are being fought in cities like San Francisco and San Fernando, Calif. Iowa has passed an administrative ban on the surcharges.

NYPIRG said federal court actions in some of these cities have had a chilling effect on enactment of surcharge bans. In its report, NYPIRG said the bank lobby’s stranglehold on state legislatures and Congress means that any action to protect consumers from double ATM fees will likely occur at the local level.

Thus far, courts have ruled that the National Bank Act preempts both state and local action over national banks. City, state, and consumer groups contend the non-preemptive Electronic Funds Act clearly gives them authority to regulate ATM transaction fees.

Federal ATM surcharge ban legislation has been introduced in Congress in recent years. But unfortunately, the study said, “these bills have not moved in previous Congresses.”

Reach reporter Daniel Arimborgo by e-mail at timesledgr@aol.com or call 229-0300 Ext. 141.