Help may be here for many homeowners facing foreclosure in Queens and throughout the rest of the state.

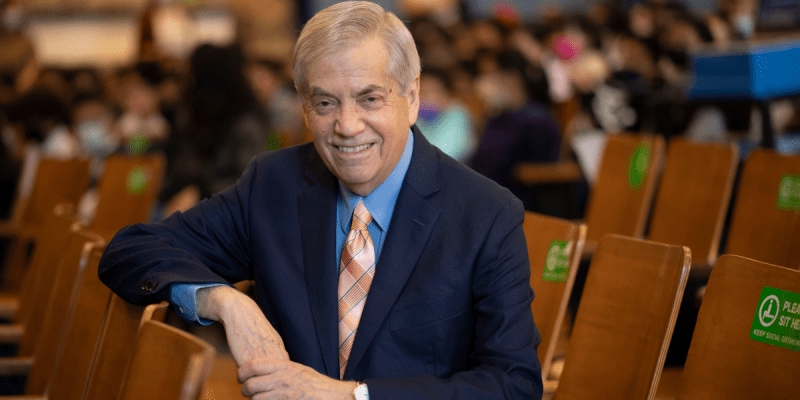

Governor David Paterson joined more than a dozen Queens elected officials at Queens Borough Hall on Tuesday morning, August 5, to sign legislation that he hopes will begin to slow down the record-high foreclosure filings across the state.

“The statistics are staggering, and it is shocking to find out what happened to so many people who were invested in the America dream,” said Paterson, who cited more than 5,000 foreclosure filings during the past six months in Queens alone. “That’s the point that people feel they have arrived, they bought a home, and now it’s the biggest crisis in their life.”

The legislation has a dual aim to help those currently in foreclosure as well as take steps to avoid another crisis in the future.

Under the new legislation, lenders have to send a pre-foreclosure notice to borrowers at least 90 days prior to beginning foreclosure proceedings allowing them the opportunity to seek assistance before the proceedings commence. In addition, it creates a mandatory settlement conference for foreclosure proceedings for homeowners with some subprime loans as well as provisions to address rescue scams that target at-risk homeowners.

Meanwhile, the legislation also attempts stem the tide of future foreclosure filings by establishing a condition in the state’s Banking Law to enact stronger consumer protections for subprime loans and minimum underwriting standards to protect borrowers. It also said that all mortgage-servicing loans on residential property in the state would have to register with the Banking Department, and it toughens the penalties on mortgage fraud.

Paterson praised the State Legislature for putting their partisan differences aside to pass this critical piece of legislation, which he believes will serve as a model for other states to adopt.

Queens State Senator Frank Padavan, who was one of the prime sponsors of the legislation, made it a point to say that the legislation was not a bailout, and they were not using taxpayer money to pay people’s mortgages.

“What we’re doing is helping them deal with the crisis - stay in their homes,” Padavan said.

Paterson chose to come to Queens for the historic bill signing because parts of the borough, particularly neighborhoods in southeast Queens have been devastated by the foreclosure crisis.

Congressmember Gregory Meeks, who represents many of those neighborhoods, delivered an impassioned plea noting that during the last 18 months, a half-mile stretch in Jamaica saw nearly 100 foreclosures, and if that pattern continued, the community would deteriorate.

The state legislation comes on the heels of the federal government passing a bill that would help some homeowners currently embroiled in the foreclosure crisis. In addition to Meeks, Congressmembers Joseph Crowley and Anthony Weiner praised the state’s work and said that the federal government would have to do more to help combat the crisis.