Would Hit $9/Hour At End Of This Year

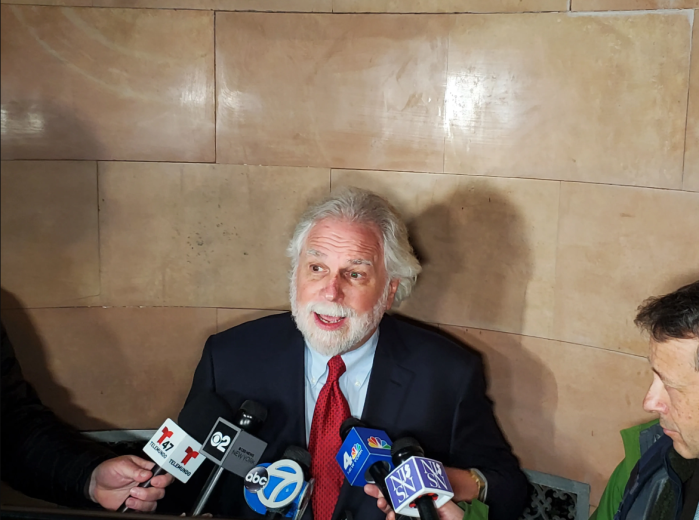

Assemblyman Mike Miller announced his support for legislation to increase New York State’s minimum wage to $9.00 per hour a full year ahead of schedule and index future increases to inflation.

“A higher minimum wage helps everyone, from workers to businesses,” Miller said. “Putting more money into the pockets of those most likely to spend it increases demand for products, and in turn, jobs. Statistics back up this claim. Ten states already index their minimum wage to inflation, and those states have reported positive economic results-high rates of growth in companies, job creation and payroll. Higher, fairer wages also result in better worker productivity and less worker turnover.”

Last year, the Assembly passed a law to increase the minimum wage to $8 per hour starting on Dec. 31, 2013, and to subsequently increase it to $8.75 per hour at the end of 2014 and $9 per hour on Dec. 31, 2015. The legislation introduced last Thursday, Jan. 9 (A.8343) would require the full increase to $9 per hour to take effect on Dec. 31, 2014, a full year in advance, and would tie future increases to the annual rate of inflation according to the Consumer Price Index (CPI).

“Waiting two more years to earn $9 an hour is a long time,” Miller added. “It’s a long time to try and support a family on wages that leave a worker below the poverty line. It’s a long time to agonize over how to afford prescription drugs and heating costs while still putting food on the table. It’s a long time to worry about how to pay the rent or mortgage on a full-time salary of less than $17,000 per year. Simply put, it’s too long for hardworking Queens families to wait.”

The new legislation would also benefit food service workers by increasing the cash wage to $5.50 per hour immediately, to $6.20 per hour on Dec. 31, 2014, and by subsequently tying the cash wage to annual inflation. Moreover, the bill requires a wage board to conduct a review to ensure that cash wages are adequate to protect the health and livelihood of all workers in the hospitality industry.

Another piece of legislation introduced last Thursday would put an end to tax credits for employers who pay the minimum wage to students ages 16-19 years old (A.8344). Originally intended to help offset costs associated with the minimum wage increase, these tax credits have unintentionally resulted in certain employers taking advantage of the credit by laying off older workers or only hiring younger ones.

“Taxpayer dollars should not be used to subsidize large companies who can afford to pay their workers a modest minimum wage,” Miller said. “Repealing the tax credits will save taxpayers millions and ensure that tax incentives are used to benefit workers, not hurt them.”

The state of California recently increased its minimum wage to $10 an hour, while New Jersey voters approved a measure to increase its minimum wage and index future increases to inflation.