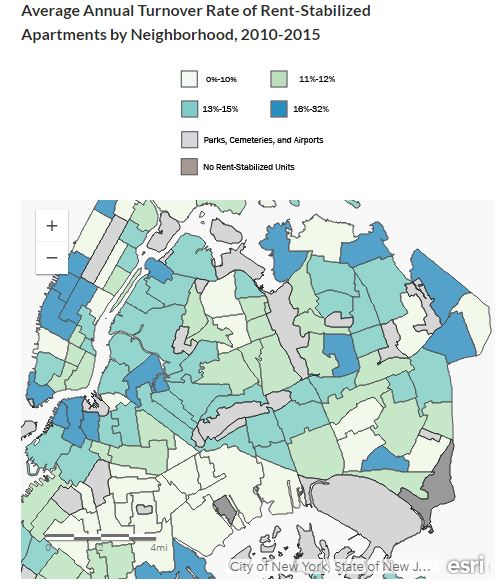

A group of Queens communities were among the top three neighborhoods that saw the most turnover rates of rent-stabilized apartments over the last few years, a study has found.

The study conducted by the New York City Independent Budget Office (IBO) looked at the tenant information for more than 925,000 apartments that were rent stabilized for at least two years between 2010 and 2015, and found that the Douglas Manor/Douglaston/Little Neck area had a 25 percent turnover rate for these types of apartments.

Topping the list was Battery Park City in Lower Manhattan with a 32 percent turnover rate, and New Dorp-Midland Beach on Staten Island with 28 percent.

It is no secret that rent-stabilized apartments are prime pieces of real estate in Queens, for residents who need a respite from the surging rent prices, and for developers to buy them for cheap, renovate and deregulate them.

Rounding out the top five Queens neighborhoods with the highest turnover rate for rent-stabilized apartments are:

- Springfield Gardens North – 19 percent;

- Totten/Bay Terrace/Clearview – 17 percent;

- Pomonok-Flushing Heights-Hillcrest – 17 percent; and

- College Point – 16 percent.

The Queens neighborhoods with the lowest percentage of turnover rates are:

- Glen Oaks/Floral Park/New Hyde Park – 6 percent;

- Lindenwood/Howard Beach – 8 percent;

- Whitestone – 8 percent;

- South Jamaica – 8 percent; and

- Elmhurst – 9 percent.

The rest of Queens averaged between 10 and 15 percent turnover rates.

It should be noted that Baisley Park had a 0 percent turnover rate, but there are only four rent-stabilized units in the neighborhood, all built after 1974.

The IBO study took into account the major differences in turnover rates between buildings built before 1974, and those built after — many of which were built in exchange for special tax breaks and tend to have rents closer to their neighborhood’s market rate.

When it comes to neighborhoods with a high number of pre-1974 rent-stabilized units, Astoria had the second highest turnover rate in New York City, with 15 percent.

The IBO received the data for their study from New York State Homes and Community Renewal and New York City Department of Finance Real Property Assessment Data.