Despite the claim that most Americans save regularly, the U.S. Department of Commerce puts the national savings rate at a measly 1.6 percent.

In fact, a recent poll commissioned by the GE Center for Financial Learning, an award-winning objective financial education resource, and conducted by Goodmind, LLC, exposed that a staggering 53 percent of Americans claim they cannot afford to save. And yet, surprisingly, 58 percent of those polled regularly treat themselves to movies and restaurant meals.

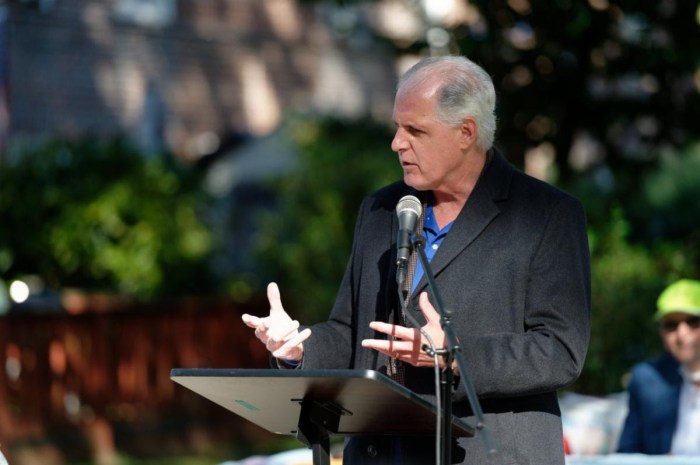

This year, The GE Center is working to help all Americans realize that they have the power to save. “The belief that you need a lot of money to save money is one of the country’s most crippling myths. And, a dangerous one at that,” said Derek Dingle, an advisor to the GE Center for Financial Learning and vice president and executive editor of Black Enterprise magazine.

“What escapes most people is the fact that financial health isn’t about income amount, it’s about your behavior and lifestyle choices. The dollar amount being saved is far less important than the conscious practice of saving.”

The myth is prevalent. The GE Center’s poll also uncovered that people earning more than $100,000 a year are significantly more likely to save — a statistic suggesting that Americans believe, ‘If I don’t make enough, I can’t save enough,’ Dingle said. Further, nearly 1/3 of the survey participants aren’t even sure how much they’re saving or are saving less than 4 percent of their income, supporting the notion that Americans have still not adopted a healthy financial plan.

When it comes to saving, paying off debt and building a retirement nest egg are always important long-term goals. Short-term goals are equally important. Whether you’re saving for a car, a house, a child’s education or just a weekend trip to the Bahamas, you can save in a relatively painless fashion no matter what your income.

Have you ever thought about how the cost of your daily cup of coffee adds up over time? Or, perhaps you’ve never realized that brown-bagging lunch just three days a week could provide you with the down payment on a condominium or a car in only five years. How much could you save if you really put your mind to it?

Start Out Saving

Little changes equal big savings. Smart planners can begin their trek towards financial freedom with easy, small steps or “Ones” — one act a day, week or month — that, at first, may seem small, but could equal big savings.

The GE Center for Financial Learning has created a list of “Ones,” including the total savings over 30 years, assuming the money is put to work in a financial vehicle averaging 8 percent interest compounded annually. These Ones can easily become a habit:

• By bringing your morning coffee to work instead of buying that $1 cup at the office or deli, you could save close to $30,000

• By renting a movie instead of going to the theater, you could save yourself more than $20,000

• If you were to give yourself a manicure instead of visiting a salon each month, you could save yourself almost $30,000

• The use of only your bank’s ATM could total more than $17,000.

With 35 percent of the respondents identifying entertainment and travel resources as a leading reason to save, more than twice the number of people save for leisure activities than those who save for their own or a child’s education … or even a home. If the respondents comprising that 35 percent opted to eat at home rather than dine out just one more time a week, they could save more than $190,000 over 30 years.

The trick? There is none. Merely decide and commit to your One of choice and invest the dollars saved in any of today’s financial products.

For additional information, more Ones, tips and discussion, visit the GE Center for Financial Learning at www.financiallearning.com and achieve your personal finance goals.

– Courtesy of ARA Content