Find Van, Storage Unit Full Of Tobacco

A Jackson Heights man has been charged in connection with a scheme to sell untaxed cigarettes by using counterfeit tax stamps, prosecutors announced last Thursday, Sept. 27.

As part of their investigation, authorities reportedly seized 11,423 packs of untaxed cigarettes, more than 21,000 counterfeit cigarette tax stamps and thousands of dollars in cash.

Queens District Attorney Richard A. Brown identified the defendant as Manuel R. Espinal-Ramirez, 54, of 95th Street in Jackson Heights, who was arraigned on Sept. 22 before Queens Criminal Court Judge Suzanne Melendez on a criminal complaint charging him with 21,559 counts of first-degree criminal possession of a forged instrument and various violations of New York State Tax Law 1814 (Cigarette and Tobacco Products Tax).

Espinal-Ramirez, who faces up to 15 years in prison if convicted, was ordered held on $5,000 bail.

“Tobacco bootleggers who illegally bring thousands of untaxed packs of cigarettes from other locations to New York for resale cheat the public by failing to contribute their fair share of the dollars,” Brown said. “For every dollar or two dollars a store owner or consumer saves by purchasing an untaxed pack of cigarettes, the honest taxpayer becomes the victim by being forced to dip into his or her pocket to pay higher taxes. In today’s case, it is alleged that the defendant was seeking to shortchange New York State and New York City out of nearly $200,000 in tax revenue.”

“The Sheriff’s Tobacco Enforcement Unit is out on the streets, snuffing out illegal cigarette activity wherever we find it,” added City Finance Commissioner David M. Frankel. “Working with all of our partners in law enforcement, we are unified in our fight against the plague of illegal cigarettes in New York City. In addition to Sheriff Domenech and the hardworking deputies and investigators who investigated this case on behalf of the City, I would like to thank District Attorney Brown and his team for bringing charges in this case and for their dedication to prosecuting those who try to cheat taxpayers and undercut legitimate small business owners who play by the rules.”

“This arrest is the direct result of cooperation between the Department of Finance, the District Attorney and the Tax Department,” said state Taxation Commissioner Thomas H. Mattox. “I applaud District Attorney Brown and Commissioner Frankel for their vigorous effort in bringing such criminals to justice. We will continue our work together to vigor- ously pursue and prosecute those who attempt to profit from tax evasion.”

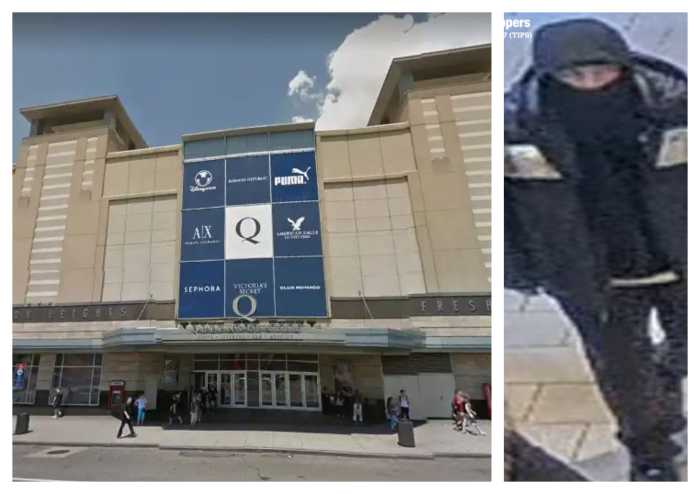

An investigation into the illegal sale of untaxed and counterfeit cigarettes led investigators to a storage structure in the rear of a location on 35th Avenue in Corona. According to the criminal charges, on Sept. 21, city and state tax investigators executed court-authorized search warrants drafted by the District Attorney’s Crimes Against Revenue Unit on the storage structure and a nearby gold Toyota Sienna minivan that Espinal-Ramirez allegedly had been using to transport the illicit cigarettes.

State investigators had observed the suspect exit the minivan and then walk toward and enter the storage structure while holding an opaque black plastic bag believed to contain cartons of cigarettes.

From within the structure, investigators allegedly seized 1,142 cartons of cigarettes that either contained counterfeit tax stamps or no stamps, 15,600 counterfeit joint state/city tax stamps, 5,959 counterfeit state tax stamps and $6,241 in cash ($4,500 that had been tucked into the ceiling and $1,741 from Espinal Ramirez’s person). From the Toyota mini-van, investigators allegedly seized $500 in cash from the ashtray and a GPS device.

Brown said that all cigarette packages sold in New York City must bear a joint New York City/New York State tax stamp and only a licensed stamping agent can possess untaxed cigarettes and affix the tax stamp on the packages.

The investigation was conducted by Investigators Marta Rivera and Julio Monell, of the city Department of Finance, and by several investigators of the state Department of Taxation and Finance under the direction of Supervising Investigator Angela Murray and Assistant Chief Carlton Richards.

Assistant District Attorneys Michael-Sean Spence will be prosecuting the case under the supervision of Assistant District Attorneys Andrew H. Kaufman, chief of the District Attorney’s Crimes Against Revenue Unit, Anthony M. Communiello, bureau chief of the District Attorney’s Special Proceedings Bureau, and Oscar W. Ruiz, deputy bureau Chief, and the overall supervision of Executive Assistant District Attorney for Investigations Peter A. Crusco and Deputy Executive Assistant District Attorney for Investigations Linda M. Cantoni.

It was noted that a criminal complaint is merely an accusation and that a defendant is presumed innocent until proven guilty.