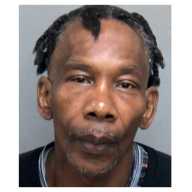

For Harold Marks, a 72-year-old retiree living on a fixed income in the Bay Terrace section of Bayside, the 18.5% property tax increase is bad news. It could raise his co-op taxes by as much as $500 a year, cutting into his already tight budget and his patience for a mayor he sees as favoring the rich.

"Its terrible. The poor people are going to have to pay for it," said Marks. "The rich men like Bloomberg should donate money to help the city. I know its farfetched, but they can afford it."

David Dankin, 30, renting an apartment in Bayside, agrees but for a different reason. He says it comes at a bad time for the country as a whole.

"Its definitely unfair with the economy so bad, so many people out of work. Its just too high. We pay a lot to commute to the city now." Dankin is getting married in June and has started looking for a house. However, the raise in property taxes will not affect his search much, "because were looking in the city, but also Long Island and New Jersey where taxes are already high," he said.

The City Council voted overwhelmingly on Monday to increase the property tax, the first such raise in 10 years, by 18.5% just under the 25% sought by Mayor Bloomberg. The new rate is expected to cost roughly $343 to the annual property tax bill of a single-family homeowner.

The increase is predicted to net $839 million for the city in the current fiscal year and $1.7 billion next year. (For councilmembers voting record, see sidebar.) That revenue would provide much- needed funds to preserve important programs at existing levels. Still, many middle class homeowners feel that they will have to bear the brunt.

Asked what the overall effect the tax increase may have in Queens, Michael Stillwagon, a single-family homeowner in College Point, said, "I think its just terrible. It might drive people out."

Objections from various advocates representing real estate groups, homeowners, landlords and others, voiced concerns that overall fell on a muted Councilas the tax hike took on an air of inevitability.

Many questioned felt resigned to the fact that they would have to bear some of the burden to close the gap of New York Citys $1.1 billion deficit this year and $6.4 billion for the fiscal year that begins in July 2003.

To Jill Callabrese, who works part time and owns a home in Bayside with her husband, the increased tax is a necessary evil.

"Im not happy about it, but Im willing to pay. Because after 9/11, I feel I can do my part."