The Democratic-run House on Thursday voted to pass a bipartisan bill aiming to deliver further relief to small businesses impacted by the COVID-19 pandemic.

The bill, called The Paycheck Protection Program Flexibility Act (H.R. 7010), passed the House by a vote of 417-1 and will head to the Senate.

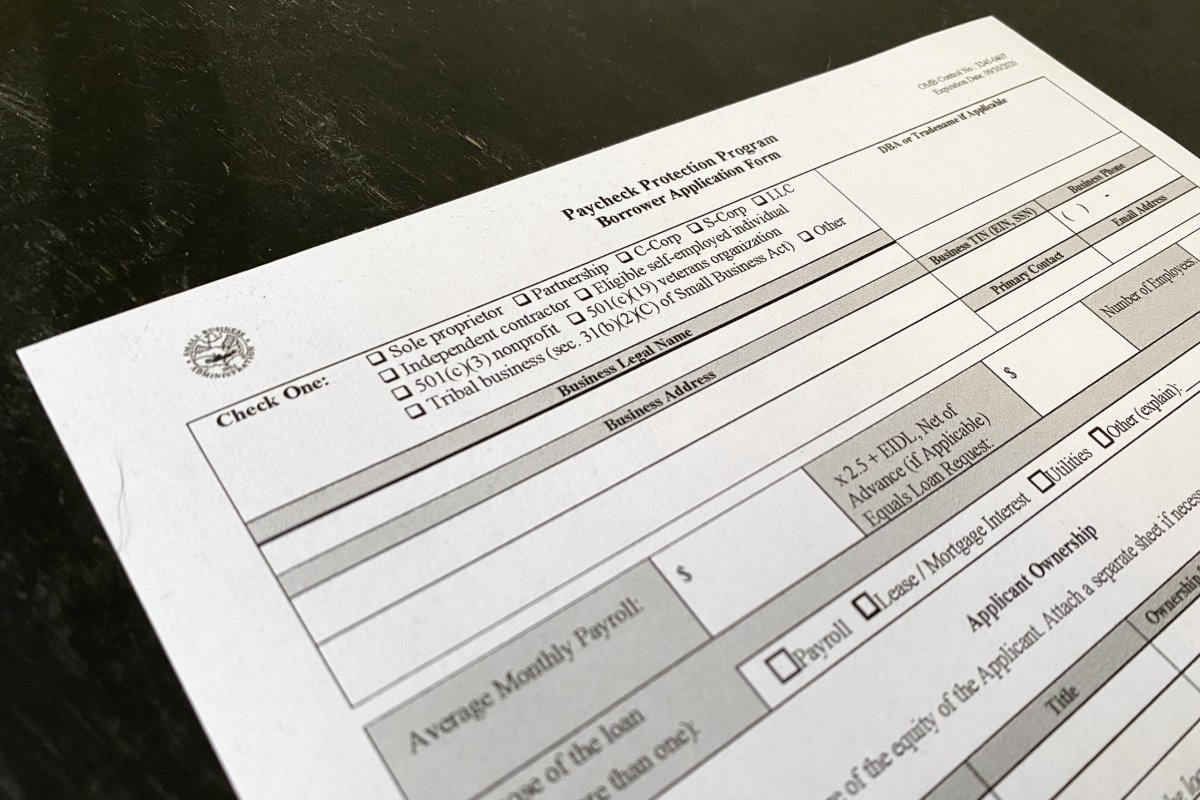

The plan would increase flexibility and access to the Paycheck Protection Program (PPP), an initiative created by the Coronavirus Aid, Relief and Economic Security (CARES) Act that provides loans to struggling small businesses.

Congresswoman Grace Meng, who voted in favor of the bill, said the new bill, along with other improvements, are critical fixes to helping small businesses recover from the unprecedented economic impact of the pandemic.

“I have heard from so many small businesses in Queens that the current limit in the PPP program of only 25 percent of loan proceeds being used for non-payroll expenses such as rent, prevents them from applying for PPP loans,” Meng said.“We know that rent cost is high for our district. We need to make sure this program truly helps those businesses that are in most need.”

Under the current program, PPP loans convert to a forgivable loan as long as a small business uses it within eight weeks of the enactment of the CARES Act by June 30. At least 75 percent goes towards keeping employees on the payroll with the remaining 25 percent used for necessary expenses such as rent, mortgage interest, and utilities.

However, many small businesses have reported that with these restrictions, the loans do not meet their needs.

The new measure would improve PPP loans by allowing forgiveness for expenses beyond the eight-week covered period to 24 weeks and extending the rehiring deadline. It also increases the current limitation on non-payroll expenses (rent, utility payments and mortgage interest) for loan forgiveness from 25 to 40 percent.

Additionally, the measure includes an extension of the program from June 30 to December 31 and an extension on loan terms from two to five years. It also ensures full access to payroll tax deferment for businesses that take PPP loans.