By Rich Bockmann

While the number of foreclosures in Queens is on the decline, according to new data, neighborhoods in the borough’s southeast region lead the city in the number of at-risk homeowners and ultimately the number who end up losing their homes in foreclosure.

According to an analysis of data from the first half of 2011, the Neighborhood Economic Development Advocacy Project found that 35,590 90-day pre-foreclosure notices were sent to homeowners in Queens, second only in the state to Suffolk County.

Southeast Queens had some of the highest numbers of at-risk homeowners, with as many as 150 mortgages in distress for every 1,000 homes.

Since 2009, the state has required mortgage services to send notices to homeowners who are 30 to 90 days delinquent on their mortgages.

The borough also led the city in the number of first-time foreclosures during the first quarter of 2012, according to a recent report by propertyshark.com. The website found Queens’ 82 first-time foreclosures — a figure which is down from 94 during the corresponding period last year — represented 39 percent of the city’s total numbers.

Those properties ultimately end up at the Queens foreclosure auction held Fridays at Queens Civil Court in Jamaica. Of the 10 properties auctioned off last Friday, six were in southeast Queens.

All but one property, an apartment building in East Elmhurst, were purchased by the bank holding the mortgage.

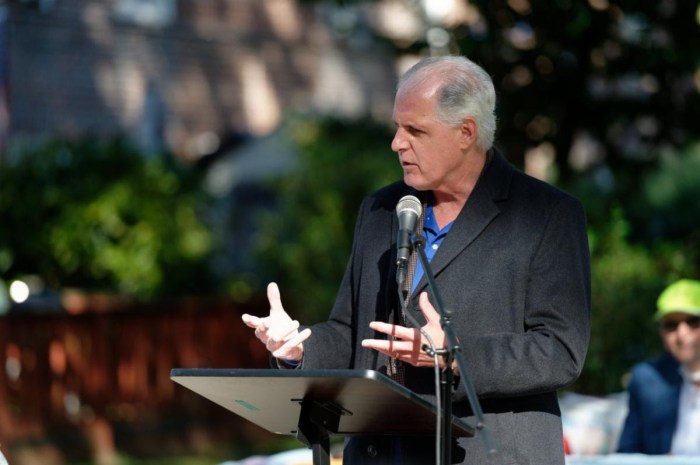

U.S. Rep. Gregory Meeks (D-Jamaica) said that at the peak of the crisis, his 6th Congressional District had about one in every 150 homes going into foreclosure.

“When we look at the numbers now, we see that gap is widening, so that number is now about one in every 1,000 … still too many,” he said at his Jamaica office Monday, when he stood with City Councilman James Sanders (D-Laurelton) and other community members to announce an upcoming event to help at-risk homeowners.

“Oftentimes when you have a scenario like this, individuals are proud. They don’t want their neighbors to necessarily know what they’re going through. They don’t come forward,” said Meeks, accompanied by a number of local clergy members, who he said have been a good liaison between his office and individuals seeking help.

The congressman announced that, at his request, the Neighborhood Assistance Corp. of America plans to host the Save the Dream Event for distressed homeowners April 26-30 at the Jacob K. Javits Convention Center in Manhattan.

NACA spokesman Darren Duarte said every major lender in the country will be at the event, including Sallie Mae and Freddie Mac, and they can reduce interest rates as low as 2 percent and, in some cases, reduce a mortgage’s outstanding principal.

“If we can document and verify that the homeowner’s mortgage is unaffordable, there’s a great chance we can help that homeowner stay in their home,” he said.

Duarte suggested homeowners visit NACA’s website, naca.com, to see what kind of documentation they should bring to the event.

He said the organization can get homeowners 30-year fixed-rate mortgages with no down payments or new fees.

Reach reporter Rich Bockmann by e-mail at rbockmann@cnglocal.com or by phone at 718-260-4574.