By Rich Bockmann

Approximately 4,000 African-American and Hispanic borrowers in the New York City metro area may be eligible for financial compensation after Wells Fargo reached a settlement last week in a case alleging it had engaged in discriminatory practices during the subprime mortgage boom.

The nation’s largest residential mortgage originator agreed to pay $125 million to 34,000 customers across the country who purchased Wells Fargo mortgages through independent brokers between 2004 and 2009 in order to settle a lawsuit brought against the bank by the U.S. Department of Justice.

The department’s investigation, started in 2010, alleged the bank gave its independent brokers financial incentives to steer approximately 4,000 minority customers who otherwise would have qualified for prime loans into more costly and risky subprime loans, based entirely on their race or national origin. These borrowers could receive about $15,000 each from the settlement, according to the Justice Department.

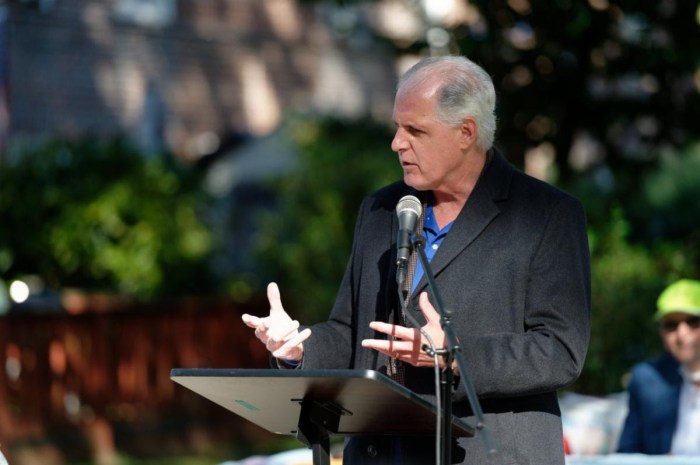

“At the core of the complaint is a simple story. If you were African-American or Latino, you were more likely to be placed in a subprime loan or pay more for your mortgage loan, even though you were qualified and deserved better treatment,” said U.S. Assistant Attorney General Thomas Perez.

Perez said minority borrowers were unaware that similarly qualified whites were getting better deals.

“That is discrimination with a smile,” he said.

The investigation also alleged that approximately 30,000 minority borrowers were charged higher fees and costs for their mortgages.

The bank issued a statement saying it denied the claims, and was settling to avoid litigation.

“Wells Fargo is settling this matter because we believe it is in the best interest of our team members, customers, communities and investors to avoid a long and costly legal fight, and to instead devote our resources to continuing to contribute to the country’s housing recovery,” said Mike Heid, president of Wells Fargo Home Mortgage.

The bank said it would also give $50 million in direct down payment assistance in areas still recovering from the housing crisis, including New York.

The Justice Department alleged senior officials at the bank had been aware of the practices since at least 2005, but did nothing to correct them.

The settlement is subject to court approval. The Justice Department said that, if approved, an independent administrator will be chosen to contact and distribute the payments.

The department said it would also investigate whether or not Wells Fargo discriminated against borrowers who purchased mortgages directly from the bank.

Reach reporter Rich Bockmann by e-mail at rbockmann@cnglocal.com or by phone at 718-260-4574.