By Patrick Donachie

The Federal Emergency Management Agency will revise its projected flood maps, which could potentially save thousands of homeowners in Queens and throughout the city from facing a stark increase in flood insurance premiums they would have to buy in the aftermath of Hurricane Sandy.

The announcement came after Mayor Bill de Blasio appealed FEMA’s flood risk calculations last year, which added 35,000 more homes and buildings into the highest flood risk areas.

“We are building a stronger, more resilient city to confront climate change. Our city needs precise flood maps that reflect real risks, both today and years from now – and we have to do that fairly,” de Blasio said in his announcement earlier this month.

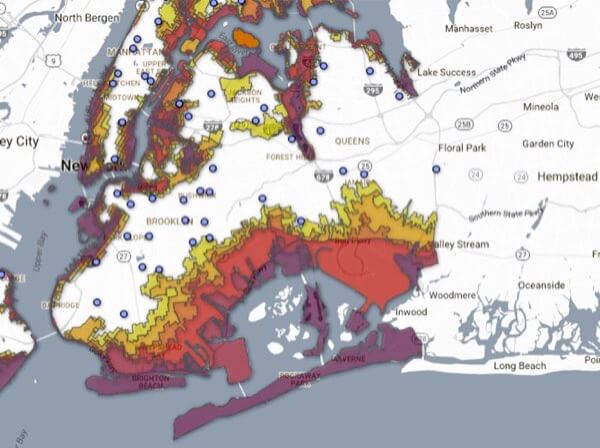

In June 2013, FEMA released a revised version of flood maps that put a large portion of Queens’ waterfront property into high-risk zones for the first time in 30 years. Residents in some neighborhoods, such as Hamilton Beach, found themselves classified in the same flood zone as the Rockaways.

Now that FEMA has agreed to reconsider the new lines, homeowners in the potentially affected areas will not have to pay thousands more in flood insurance, saving coastal homeowners tens of millions of dollars, according to the agency. FEMA Regional Administrator Jerome Hartfield said FEMA’s coastal flood risk assessments had not been updated since 1983.

City Councilman Donovan Richards (D-Laurelton), who sits on the Committee on Recovery and Resiliency and represents areas like Edgemere, Arverne, the Rockaways and Rosedale that were struck by the storm, said FEMA’s announcement that the agency would reassess its flood lines could save homeowners as much as $10,000 per year. He noted, however, that the mayor’s office still stressed that people in the path of potential storms should purchase flood insurance in the interim.

“This is why Build it Back has to be successful. As people build up, it lessens the need for flood insurance later down the line,” Richards said. “You should still plan for a storm. The main thing is to build more resiliently.”

Richards said the Council was considering amendments to residential zoning that would allow homeowners to build higher, which could help them supplement an increase in necessary flood insurance with money coming in from renters.

“Affordability is important here; people might be renting their cellar out,” he said. “If you’re losing your cellar because you have to fill it in, we want to be able to give homeowners back that density.”

Additionally, FEMA announced that future flood maps will more accurately incorporate the future risks of climate change and sea level rise. FEMA will create a new set of maps to measure what could potentially happen in areas based on projected changes in the sea level, as well as the severity of potential storms. However, FEMA said flood insurance would still be priced against maps based on the current risk of flooding to homeowners.

Reach reporter Patrick Donachie by e-mail at pdona