By Mark Hallum

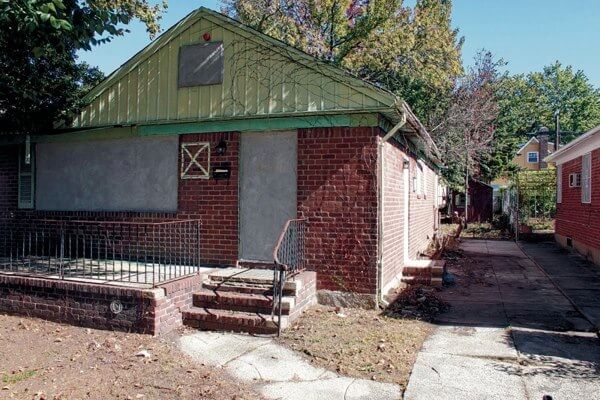

Two Independent Democratic Committee members released an in-house report claiming Queens is experiencing a foreclosure crisis alongside dropping property values as some banks act as “nightmare neighbors”in some communities.

State Sens. Tony Avella (D-Bayside) and Jose Peralta (D-East Elmhurst) found that five banks oversee “dilapidated” foreclosed properties across the city which contribute to about $54 million in depreciation to surrounding homes.

The report, “Nightmare Neighbors: How Badly Maintained Homes Damage Neighborhoods,” found Queens had the highest number of bank-owned homes with standing violations.

“The mortgage crisis wreaked havoc across my district and the rest of the state and the country, a tsunami that left an adverse effect in so many of our hard-working and immigrant communities,” Peralta said. “Foreclosed homes became eyesores in our neighborhoods when banks failed to maintain their properties, not only affecting the property values but also creating health and public safety risks. Banks have to be accountable, and this is why financial institutions should face stiffer penalties in order for us to stop the despair of our communities.”

In Queens, 50 of 155 properties owned by institutions such as US Bank, Wells Fargo, Bank of New York Mellon, Morgan Stanley and Wilmington had up to 576 open violations with the city Housing, Preservation Development Dept. and city Department of Buildings.

“Queens is unfortunately all too familiar with the damage done to communities by poorly maintained bank-owned houses. In my district alone, I seem to be in contact with the Sanitation, Buildings, and Health departments monthly to ask for their help cleaning up some of these properties. Residents are growing tired of these bank-owned properties that lower the quality of life in our communities. New Yorkers deserve better. Shame on these financial institutions for allowing this to happen to our New York communities,” Avella.

About 8,000 properties have been affected by the foreclosed homes with an average $6,368 loss in value to homeowners across the city, the report claims. Around 2,864 of the properties affected were in Queens with an average property value of $481,769 and a depreciation loss of about $17,940,775 borough-wide.

According to a release from the IDC officials, the breakaway Democratic group led the charge in an effort to give government agencies the ability to levy fines of up to $500 per day on banks allowing properties to fall into disrepair.

Known as “zombie homes”, the state Department of Financial Services now keeps a registry of such properties, the release said.

Mobilization for Justice, a Manhattan-based organization which offers legal services to low-income New Yorkers, praised the study.

“As an organization dedicated to preserving New York communities, Mobilization for Justice applauds the Senate for examining the detrimental impact on New York communities caused by the failure of financial institutions to maintain the properties they hold,” said Linda Jun, senior staff attorney at Mobilization for Justice. “To advance the stability of New York neighborhoods and protect them from harm, there must be greater accountability for these financial institutions. Mobilization for Justice strongly supports the IDC’s recommendations to increase registration, penalties, inspections, and enforcement to ensure that financial institutions no longer allow their properties to fall into disrepair.”

The IDC and mainline Democrats have warring over reunification in recent weeks as the Democratic Party offered an ultimatum to the renegade officials led by state Sen. Jeff Klein (D-Bronx): if IDC members do not form a coalition the Democratic Party to take two seats in a special election, they will be met with primary challenges.

The IDC was formed in 2011 and allied itself with the Republicans to pass legislation as the Democratic Party lost the majority in Albany.

Reach reporter Mark Hallum by e-mail at mhall