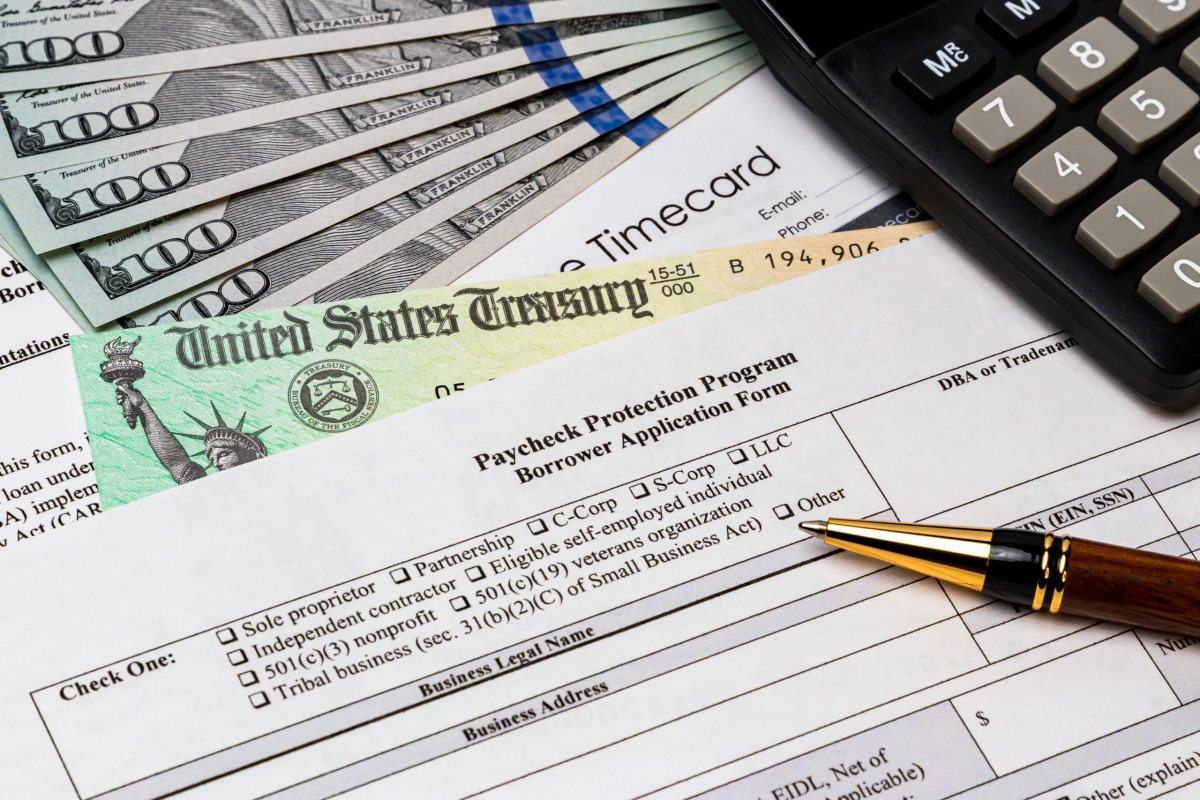

Queens’ small businesses fighting to survive the COVID-19 pandemic can now apply for a forgivable loan under the Small Business Administration’s Payroll Protection Program (PPP) that is reopening this week.

The initiative, which was closed on Aug. 8, 2020, despite more than $130 billion remaining in the program, was reopened under the $900 billion coronavirus relief package that became law on Dec. 27, 2020. The new law includes a total of $284 billion for small businesses.

This new round of PPP loans also makes other entities such as nonprofit organizations and housing cooperatives newly eligible for funding, according to Congresswoman Grace Meng, who helped pass the PPP Flexibility Act that became law and made improvements to the program.

“Small businesses and other eligible entities continue to face an uncertain future, and need help in weathering this national health pandemic,” Meng said. “I will continue to fight for additional relief, especially for restaurants which have been especially hard hit through no fault of their own. I look forward to working with the incoming Biden administration to help Queens and New York businesses and nonprofits struggling during COVID-19.”

For months, small businesses in Queens have called for help in the form of grants, tax breaks and rent relief in order to survive the pandemic, QNS reported in December. With a second wave already underway in New York City and restrictions imposed by Gov. Andrew Cuomo, such as an indefinite stop to indoor dining, some businesses felt they were running out of time.

But some were hopeful that the trial and errors of the PPP program from months past will make for a smoother rollout.

To qualify for a second round of funding, borrowers must employ 300 or fewer employees; have used or will use the full amount of their first PPP loan; and demonstrate at least a 25 percent reduction in gross receipts in the first, second or third quarter of 2020 relative to the same 2019 quarter.

First-time borrowers must employ 500 or fewer workers. The program opened to first-time borrowers on Monday, Jan. 11. For second round applicants, it begins on Wednesday, Jan. 13. Community lenders are first to participate in the program with other lenders to follow soon.

To qualify for loan forgiveness, 60 percent of the loan must be used for payroll expenses and the remaining 40 percent can be used for non-payroll expenses such as rent, mortgage or utility payments. Eligible expenses have been expanded to include personal protective equipment and supplier costs that are essential to business operations.

The deadline to apply for the new round of PPP loans is March 31, 2021, or until funds run out. For more information on the program, visit the SBA’s website here.

New York small businesses seeking PPP loans are encouraged to contact a representative from the New York Small Business Development Center (SBDC). There are over 22 campus-based centers and outreach offices across New York to assist clients with the loan application.

For businesses located in Queens, email the Queens College SBDC at sbdc@qc.cuny.edu; LaGuardia Community College SBDC at sbdc@lagcc.cuny.edu; or York College SBDC at sbdc@york.cuny.edu for assistance.