Support is growing for state Senator Michael Gianaris’ legislation to remove the state tax break for the Trump-era federal Opportunity Zone program. Twenty-four community, labor and advocacy organizations signed a new memo supporting the proposal to end the tax giveaway to luxury real estate developers.

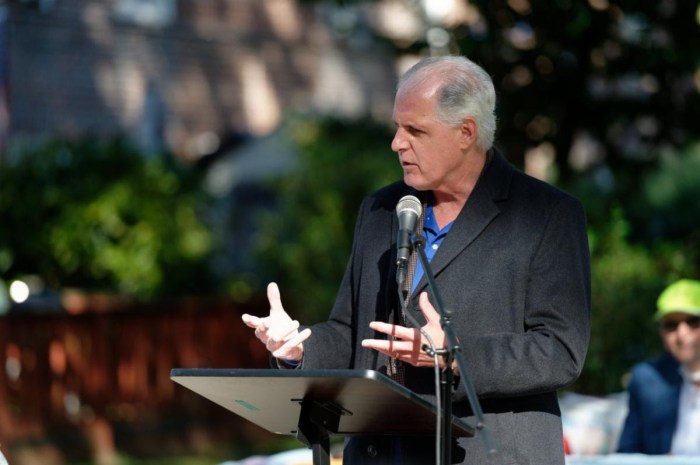

“The Opportunity Zone program was intended to help economically distressed areas but is being abused to grant tax breaks to already overdeveloped neighborhoods,” Gianaris said. “At a time when the state budget is in dire straits, a giveaway to wealthy developers is the last thing we need.”

The federal tax overhaul passed in 2017 included a provision aimed at incentivizing investment in economically distressed areas and in 2018, the state was supposed to designate census tracts that qualified as Opportunity Zones but also included other areas already impacted from overdevelopment and gentrification. These areas included parts of Long Island City and Astoria, already among the fastest growing neighborhoods in the nation.

Investors who create opportunity funds to invest in these census tracts are able to defer large amounts from their federal taxes. Much of New York’s tax code is linked to the federal tax code, and Gianaris’ legislation would present a massive and unjust giveaway of state resources to the wealthy.

Groups supporting the legislation, which is co-sponsored by state Senator Jessica Ramos, include 1199 SEIU, Make the Road New York, Coalition for Economic Justice, RWDSU, Good Jobs First, Legal Aid Society and UFCW Local 1500.

“There is zero evidence that the program actually boosts the communities it means to serve,” they wrote in the memo. “Many studies find that similar programs benefit large corporations instead of revitalizing economies.”

Both the city and state are faced with enormous budget shortfalls brought on by the COVID-19 economic downturn.

“Both New York City and state have budget shortfalls of several billion dollars over the next few years, and budget cuts are likely to have a major impact on school districts and social services across the state,” the memo continued. “Opportunity Zone subsidies cannot be justified in the best of times, so there is no reason why New York should continue forgoing precious tax dollars during a historic budget crisis.”

Bronx Assemblyman Jeffrey Dinowitz is carrying the bill in the lower chamber.

“If there were ever a time for New York to stop giving away tons of money to the super-wealthy, this is the year to do it,” Dinowitz said. “It is outright foolish for New York state to forego this tax revenue so that high-powered and well-connected real estate developers can make extra profits on projects that they were more than likely already in the process of building. As we continue to work in the Assembly for a budget that prioritizes the middle class, working class and low-income New Yorkers, eliminating this de facto double dip by luxury real estate developers into the taxpayers’ pocket is common sense.”