Queens/Bronx Congresswoman Alexandria Ocasio-Cortez discussed updates to the FEMA COVID Funeral Assistance program, infrastructure bills and the new child tax credit at a virtual town hall on Thursday, July 15.

Ocasio-Cortez mentioned that some families have not been able to benefit from the funeral assistance because, in the early days of the pandemic, some cases were not recognized as COVID-19. Now, Ocasio-Cortez announced that death certificates from Jan. 20, 2020, to May 16, 2020, that do not list COVID-19 as the cause of death do not have to be formally changed to receive financial relief.

A signed letter will suffice, according to Ocasio-Cortez. In New York City, individuals may call 311 for more information on how to access FEMA Funeral Assistance.

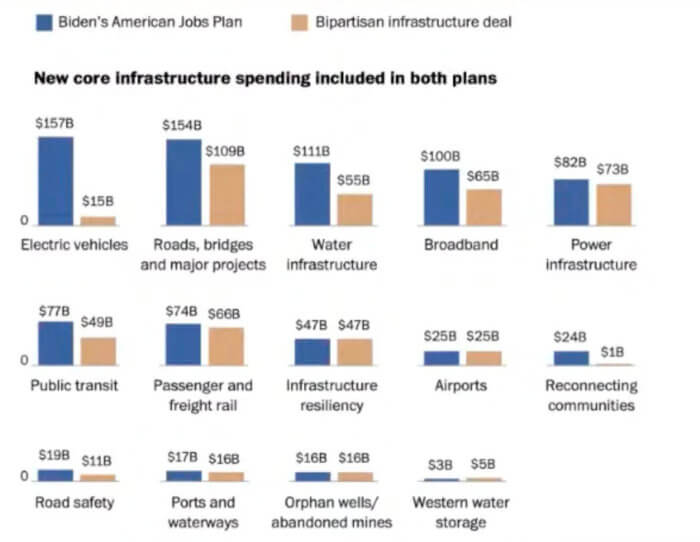

During the virtual town hall, Ocasio-Cortez also explained different federal infrastructure deals. Specifically, she outlined the differences between Joe Biden’s American Jobs Plan and the bipartisan infrastructure deal. Biden’s plan spends more than the bipartisan bill on every aspect of the country’s infrastructure.

On the other hand, the bipartisan deal excludes housing, long-term care, tax credits and manufacturing. Ocasio-Cortez criticized the bipartisan deal for being too small.

“We do not need a bipartisan deal in order to pass this bill,” Ocasio-Cortez said.

“I think it’s great that Republicans are wanting to join some Democrats, but this country elected Democratic majorities,” she said. “Republicans are not in charge of dictating what policies we pass and what policies we don’t pass.”

Susan Gainous, an IRS congressional liaison, appeared during the town hall to explain the distribution of money.

Part of the American Rescue Plan expanded the previous child tax credit for 2021 only. Eligible families can receive up to $3,000 per child ages 6 to 17 and up to $3,600 per child under age 6. This has increased by $1,000 from 2020. Payments started to go out to eligible families on July 15.

For more information on the Child Tax Credit, visit the IRS website.