New York State Comptroller Thomas DiNapoli released a report Sept. 20 stating the COVID-19 pandemic caused a larger disparity in property tax among New York City residents. In the report, he stated this growing disparity caused housing to cost more.

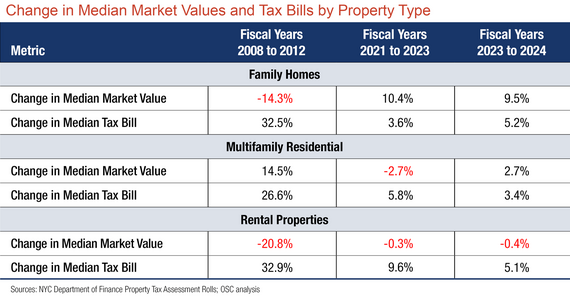

According to the report’s findings, even when property values declined for many condos, co-ops and rental apartments as a result of the pandemic, property tax bills still continued to rise. DiNapoli said market volatility and aspects of how property taxes are calculated in New York City played a role in this.

“New York City’s residential real estate market has proven resilient to the pandemic as prices remain strong,” DiNapoli said. “This benefits the city because property taxes account for about 45% of the city’s revenue. However, property tax disparity has gotten worse since the pandemic, which is concerning because it’s driving up housing costs for those less able to afford it, and at the same time, the city faces a shortage of affordable housing. A recalibration of the process used to determine tax bills is needed if the city wants to remain accessible to working- and middle-class families.”

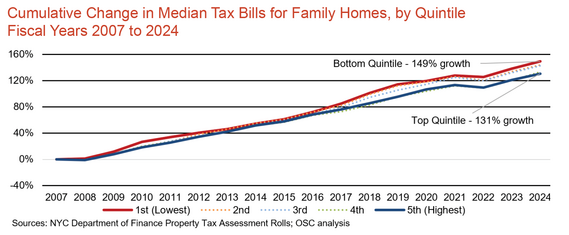

Different tax rates are set in New York City based upon the class of a property in New York City. Co-ops and condos are assessed based on the market value of similar apartments. Annual and five-year caps, which differ based on property type, put a limit on the amount market value increases. Consequently, a decline in market value on properties of lower value doesn’t often result in a lower tax bill. These properties typically bear a vastly larger tax burden than the city’s highest valued properties.

DiNapoli’s report found that from the 2007-2024 fiscal years, the median tax bills for the most expensive family homes in New York City grew by 131%. Over that same span, the least expensive homes had their median tax bills rise 149%.

The city’s tax system didn’t just impact homeowners. Rental properties in the top 20th percentile declined in value by 2% during the pandemic. These properties also had their tax bills rise 2.1%. Rental properties in the bottom 20th percentile experienced a 1.7% rise in market value and 11% increase in tax bills.

While the pandemic drove New York City’s residential property values up 11% since the 2021 fiscal year, Manhattan was the exception in this case. Some of the city’s most expensive residential real estate can be found in that borough. The outer boroughs of New York City experienced a higher concentration of market value increases in working-to-middle-class neighborhoods.

DiNapoli recommends city and state leaders continue their efforts in addressing disparities in the levying of property taxes. These represent an outsized share of owner costs, especially for lower-income households. Additionally, he suggested these leaders consider accounting for how residential property taxes respond to economic disruption in order to avoid worsening existing issues, revisiting the Advisory Commission on Property Tax Reform’s recommendations to reform the current tax system while maintaining the level of total tax collections and addressing the city’s lack of affordable housing, including considering tax incentives to promote construction and rehabilitation.