Two days after Queens District Attorney Melinda Katz announced she had brought charges against a Flushing man for scamming more than $600,000 from seniors across the country, her office hosted a presentation at the Ridgewood Older Adult Center on Mar. 12 to coach participants on how they can avoid being victims of similar schemes.

“Education is key to preventing fraudulent activity, particularly among the senior population,” Katz said. “To this end, my office has been actively engaging with senior centers across the borough, providing insights on the warning signs of common scams.”

Fei Liang, 39, of 45th Avenue in Flushing is accused of working with a co-conspirator who called seniors and claimed to be from the Social Security Administration, their bank or a vendor. He told them their accounts had been compromised and instructed the seniors to wire money to accounts he controlled in banks in Bayside and Flushing for “safekeeping.” Six victims lost nearly $630,000 before he could be stopped.

“We will continue to make education an important part of our overall efforts to combat fraud in the community,” Katz said.

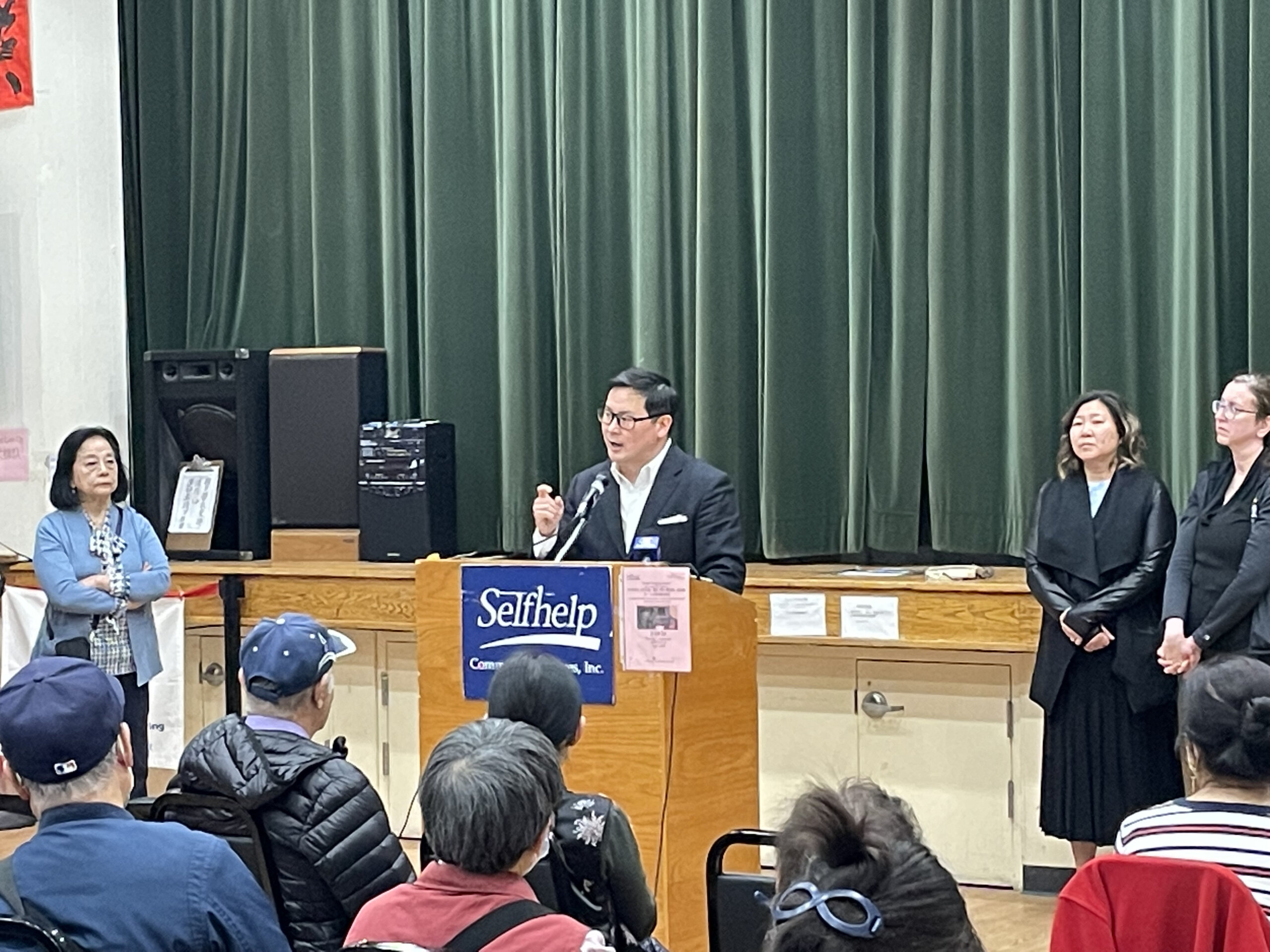

On Mar. 14, Assemblymembers Ron Kim and Nily Rozic and Congresswoman Grace Meng held a press conference at the Rosenthal Selfhelp Senior Center in Queensboro Hill on fraudulent scams targeting older adults. They emphasized that financial scams affected everyone, but older adults are often more vulnerable based on age and financial status.

Kim, who chairs the Assembly Committee on Aging, spoke to the community about some of the most common scams perpetrated against seniors including government impersonation scams, sweepstakes and lottery scams, computer tech support scams, robocalls or phone scams and computer tech scams.

“I want to urge the public that if someone contacts you and tries to scare or intimidate you, or asks you to trust them with your finances, you are likely being scammed,” Kim said. “There are very common techniques that certain criminals use to get you to lower your filters and make hasty decisions which you might later regret.”

One prevalent scam is known as the grandparent scheme, which begins with a caller telling the victim that their grandchild is in jail.

“Never give out your personal information or allow a stranger access to your devices,” Kim said. “Instead, contact your local authorities or our offices.”

Meng said her office is making protecting seniors from scams a top priority.

“Whether it’s spoofing, stealing SNAP benefits, mail theft or other schemes, these unconscionable crimes make it essential for older adults to do all they can to protect themselves from thieves seeking to steal their money or personal information,” Meng said. “To avoid becoming a victim, seniors cannot let their guard down and need to always be on the alert for these despicable fraudsters.”

NYPD Officer John Vlaovich of the 109th Precinct’s Crime Prevention Unit gave helpful advice to the public about best practices to avoid these kinds of schemes. He discussed cases he and his colleagues had encountered in the past and common mistakes that victims often make when falling for such scams.

Rozic warned that seniors are targeted by scammers seeking to exploit their trust and vulnerability. ”We must equip our seniors with the knowledge and resources to safeguard themselves against these predatory actions,” Rozic said.

The elected officials spoke briefly about legislation Kim introduced called the Enhanced Public Payment Systems Act, which would protect potential victims from such schemes by enacting a system of individual digital wallets or payment accounts, linked to a single master account, that enables payments to move between individual wallets or payment accounts. Kim explained that this would provide additional safeguards and help crack down on the exploitation and fraud currently taking place in the benefits system.

“With this new bill. I look forward to working with the Governor on ways we can digitize public payments,” Kim said. “I believe it has the real potential to reduce ongoing fraud and theft in the current system, which is costing millions to taxpayers, and better safeguard older adults from such schemes.”