ELIJAH STEWART

Bayside-area residents say they are getting fed up with what they believe to be unfair tax increases on co-ops and condos throughout northeast Queens.

“They look at it as they might as well buy a house, which is a larger down payment, than come here and pay enormous amounts in taxes,” said John DePasquale, general manager at Alley Pond Owners Corp., a self-managed co-op in Bayside.

The unhappy apartment owners say this problem stems from Mayor Michael Bloomberg’s lack of action in pushing for a new state tax code that would eliminate the high tax increases on middle-class co-op and condo owners. They hope the next mayor will take action on the issue.

Warren Schreiber from the Presidents’ Co-ops & Condos Council, which represents more than 100,000 owners, said northeast Queens has been hit the hardest by the increased tax evaluations.

“There have been double-digit and in some cases triple-digit increases in tax evaluations,” said Schreiber.

The city Department of Finance lists private homes as Class 1 properties. This means their assessed value, which is set at six percent of the property’s market value, cannot be increased more than six percent a year.

However, co-ops and condos are listed in Class 2, along with rentals and other revenue streamed housing. Their assessment value is 45 percent of the property’s market value, and there is no cap on yearly assessment increases.

While the property tax code is a state law, it is up to the mayor to request changes to city tax classifications.

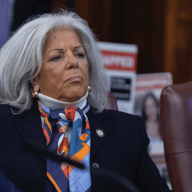

“Mayor Bloomberg and his predecessor Rudy Giuliani have always opposed changes in the classification system,” said State Senator Toby Ann Stavisky.

Stavisky said the property classification system for co-ops and condos is unfair and has led to inconsistencies in tax assessments throughout the city. She said she’s working closely with Assemblymember Edward Braunstein to address this issue.

“We’re just part of a middle class that continues to get squeezed harder and harder,” said Arthur Getzel, a teacher at P.S. 26. Getzel, 59, said many co-ops in the area have been forced to charge higher maintenance fees due to increased tax assessments.

Kevin O’Brien, a recently retired co-op owner at Bell Park Gardens, agreed that the tax situation is unfair.

“If you go to any other co-op development here, Windsor Park, Windsor Oak, Hollis Court, they’re all going to say the same thing,” said O’Brien, 43. “They don’t understand why we’re paying so much property tax for a small number of square feet.”

Others worry about the effect on older owners.

“I think the tax increases are going to push the elderly people out,” said Jennifer Santaniello, 48, of Hollis Court. “I don’t think they’re going to be able to afford to live in Queens.”

A co-op since 1983, Hollis Court currently houses 376 families, according to Santaniello, and 60 percent of its residents are elderly.

Schreiber said the city’s co-ops and condos house tens of thousands of working-class people who are the backbone of the city.

“What many people don’t understand,” said Schreiber, “is that without the money from the co-ops and condos, the city would go bankrupt.”

RECOMMENDED STORIES

- City Council passes condo, co-op resolution

- Co-ops, condos still waiting for disaster aid

- HUD grants not enough say co-op, condo owners