Over the course of the summer of 2024, viewed as the peak rental season, Queens and Brooklyn each experienced sharp increases in competition among renters compared to the same time in 2023 and Manhattan maintaining a high degree of such competition, according to a Rental Competitiveness Report by the real estate listing site RentCafe.

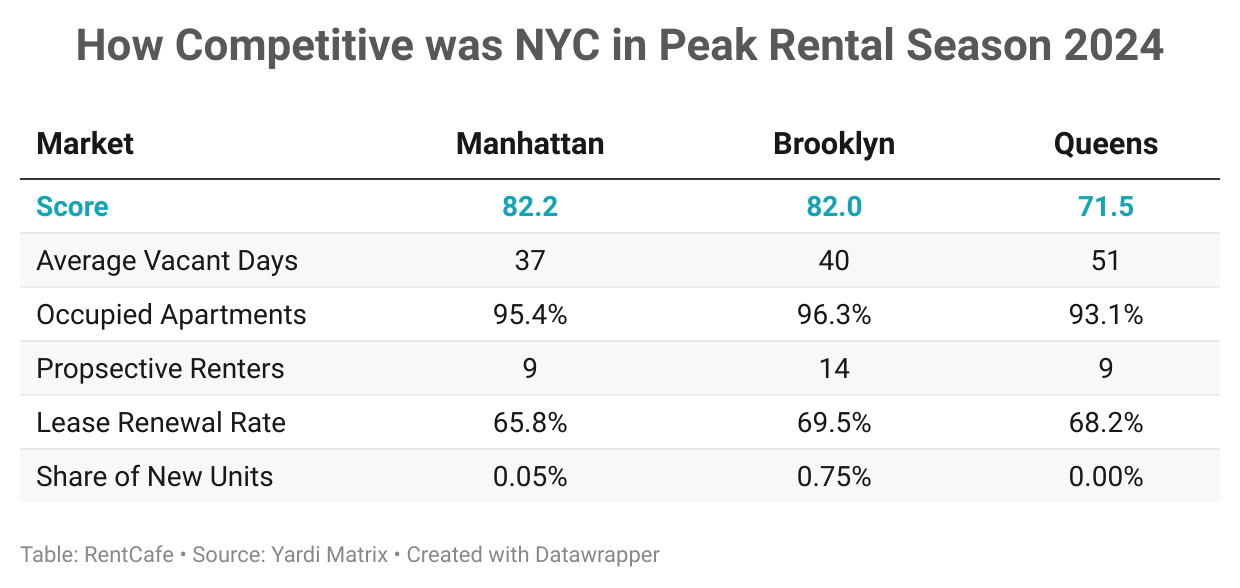

In the study, five relevant metrics in terms of rental competitiveness were applied to each city. These metrics were the number of days apartments were vacant and the percentage of apartments that were occupied by renters. the number of prospective renters competing for an apartment, the percentage of renters who renewed their leases and the share of new apartments completed recently. Based on the results from these metrics, a Rental Competitive Index score was calculated.

Manhattan was determined to have the ninth-hottest rental market across the United States in the summer of 2024, with a Rental Competitive Index score of 82.2. This is reflective of how challenging it is to get a rental apartment there. With so few units available, competition is fierce for the few that do enter the market. Apartment hunters in Manhattan faced a 65.8% lease renewal rate as virtually no new units opened there recently, leading to a high occupancy rate of 95.4% in peak season, up from 94.7% last summer. The few vacant apartments there are typically leased within 37 days, with nine renters competing for each available unit on average.

Queens and Brooklyn are facing growing challenges similar to those of Manhattan, including rising lease renewal rates amid limited new apartments. This is due in large part to the existing challenges in Manhattan, which are leading prospective renters to pivot to these nearby areas.

Brooklyn is ranked right behind Manhattan in the Rental Index score, at 82 – the tenth-highest in the nation. This marks a huge year-over-year increase, up 10.3 points from 2023. While the amount of new apartments in Brooklyn ended up increasing by 0.75% over this period of time, there was still a 3.3% jump in tenants renewing their leases, from 66.2% last year to 69.5% this year. Consequently, less than 4% of apartments in this borough are available for prospective renters, with an average of 14 people competing for each unit.

While the Rental Index score in Queens may not be as high as Manhattan or Brooklyn, this borough has seen the most significant boost in score among them, up 12.8 points from 58.7 in 2023 to 71.5 in 2024. The lease renewal rate has also gone up over this period of time, from 63.8% last year to 68.2% this year. That large increase has played a big part in apartments being highly sought after, with nine renters competing for each unit.

The notable increases in competitiveness across these boroughs and New York City as a whole can mainly be attributed to a combination of high lease renewal rates, limited new supply, and the city’s ongoing economic strength. While renters looking for more affordable options have been turning to Brooklyn and Queens more often, these areas have now become just as competitive as Manhattan.

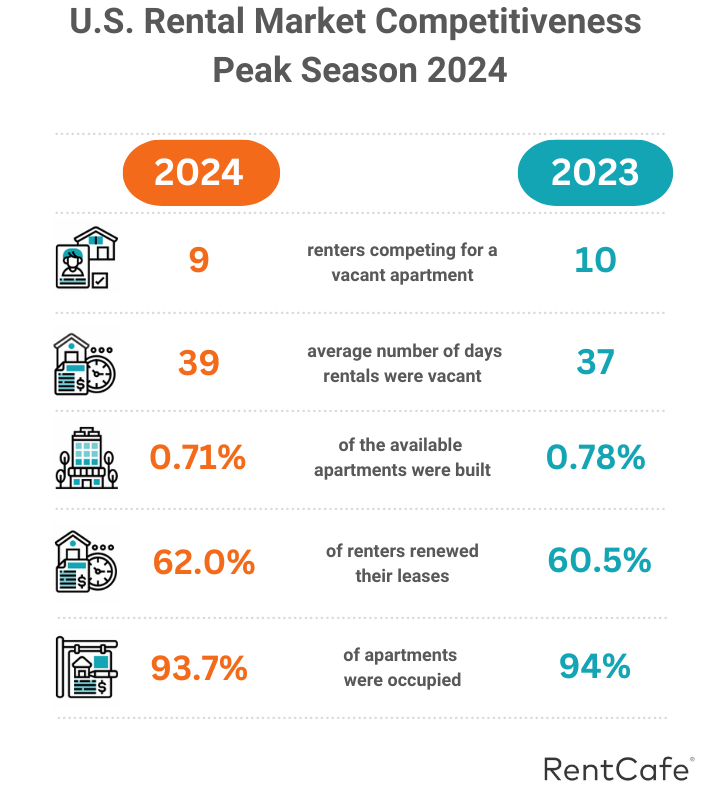

Based on the study’s results, the national Rental Competitive Index score was 75.8. The average number of days that rentals were vacant increased from 37 last year to 39 this year, causing the average number of renters competing for each apartment to decrease from 10 to 9.