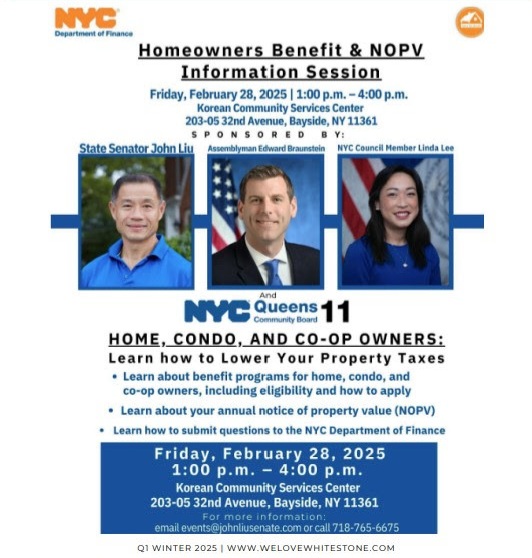

Council Members John Liu and Linda Lee, along with Assembly Member Ed Braunstein, will host a Homeowners Benefit and Notice of Property Value information session on Friday, Feb. 28, from 1 to 4 p.m. at the Korean Community Services Center in Bayside, located at 203-05 32nd Ave.

The event is part of a series of free informational sessions launched in February in partnership with the New York City Department of Finance and Queens Community Board 11. These sessions aim to help homeowners, condo owners, and co-op residents better understand their property tax options and learn how to reduce their tax burden.

Attendees will receive guidance on available homeowner benefit programs, eligibility requirements, and the application process. Additionally, the session will include a review of the Annual Notice of Property Value (NOPV), with Department of Finance representatives on hand to answer any questions.

The event is free and open to the public.

Some of the programs that attendees can learn more about and find out if they are eligible for include:

- Notice of Property Value informs homeowners of the DOF’s assessment of property value for the coming tax year and determines how much property tax the homeowner needs to pay.

- Basic STAR is for homeowners whose total household income is $500,000 or less.

- Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live with them is $107,300 or less.

- Senior Citizen Homeowners’ Exemption is for seniors who own one-, two-, or three-family homes, condos or cooperative apartments with an income of $58,399 or less. The program can reduce your home’s assessed value by as much as 50 percent, depending on income.

- Disability Homeowners Exemption for disabled New Yorkers who own one-, two-, or three-family homes, condos or cooperative apartments with an income of $58,399 or less. The program can reduce your home’s assessed value by as much as 50 percent, depending on income.

- Veterans Tax Exemption lowers property taxes of qualified veterans, spouses, and parents of soldiers who died in the line of duty.

- Disability Rent Increase Exemption is for tenants with disabilities who qualify to have their rent frozen at their current level and exempted from future rent increases.

- Senior Citizen Rent Increase Exemption freezes rent for senior citizens 62 and over.

The final session will be on Monday, March 10, from 4 to 7 p.m. at the Flushing Library, 41-17 Main St.

For more information, email events@johnliusenate.com or call 718-765-6675.