Pol Hosts Forum For Small Firms

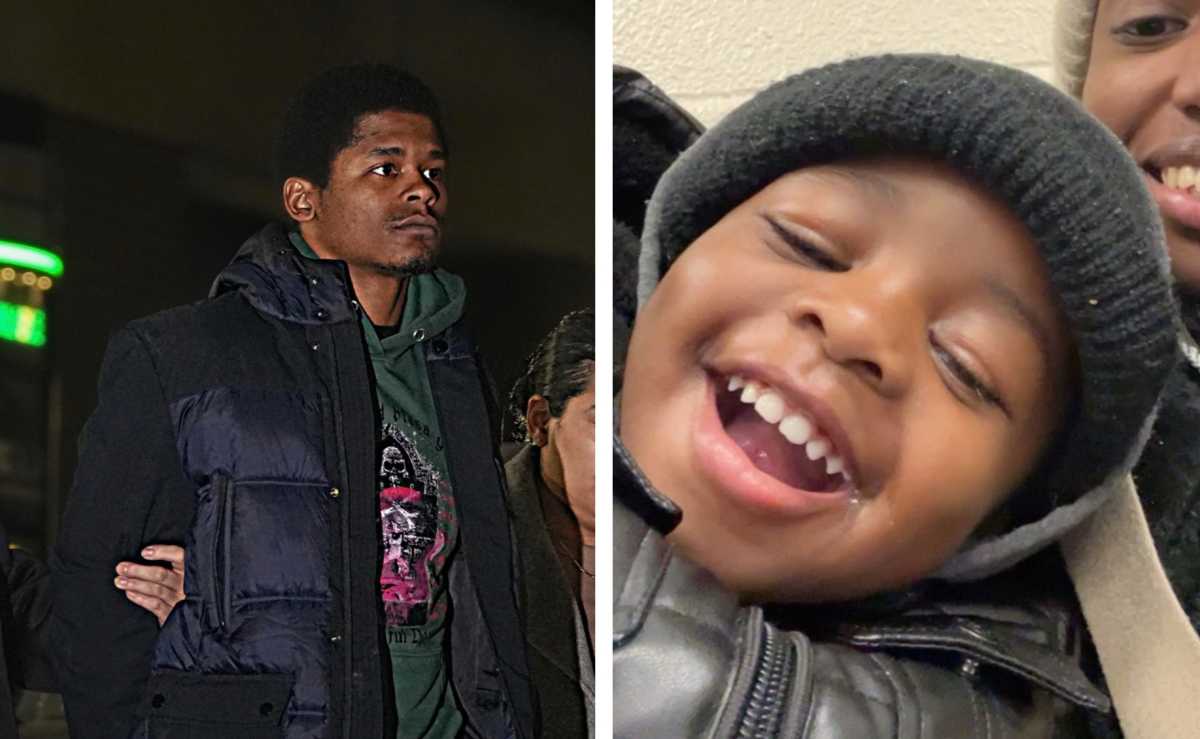

Helping small businesses in one of the neighborhoods hardest hit by the recession was the focus of a forum held by Assemblyman Rafael Espinal last Thursday, Jan. 16 at the Cypress Hills Senior Center.

City help

First up to the dais was Manuel Dominguez of NYC Business Solutions, a part of the city Department of Small Business Services, an agency he claimed helps “small business start, operate and expand.”

His agency offers free courses in marketing, accounting and other business disciplines; legal review of contracts; aid for businesses taking advantage of city and state tax incentives; recruitment services for sales positions; and financing assistance.

“We act as an honest broker,” he explained, stating that an agency rep will examine a business and determine the best place to apply for loans. “We have the freedom of sending you anywhere.”

He added that he can help businesses with less-than-idea credit ratings by sending them to agencies that will weigh other factors.

For more information, call 1-347- 296-8021.

Also from NYC Business solutions was Juanita Pair, who pointed to the city’s Business Express program, which can help businesses take advantage of over 55 different city and state incentives, “about 15” of which are monetized. Businesses can go to nyc.gov/businessexpress for more information.

Pols speak

“You guys get taxed, regulated to death,” Michael Olmeda of State Sen. Martin Malave Dilan told the crowd, adding that the state legislature is working “to basically eliminate a lot of the red tape, streamline a lot of the regulations for businesses.”

He added that he hopes to bring more funding the Cypress Hills Local Development Corporation (LDC) and similar groups to help them help local firms with training, credit and other needed items.

Andres Ledesma, representing City Council Member Erik Martin Dilan, stated that his office attempts to help small businesses affected by disasters such as water main breaks or fires.

The Council Member is also partnering with the Cypress Hills LDC on an anti-graffiti program. Companies who wish to get graffiti cleaned from their properties can call 1-718- 642-8664 beginning on Apr. 1 to have it removed.

One resident asked the two agency representatives about the lack of funding for green projects for the area, claiming that only one was funded in the area (for a company that wanted to switch from standard ink to a soy-based solution).

“It’s nice to go green but let’s take care of our people first,” he stated. “We are in survival mode here in our communities.”

“I’m looking to work for that,” said Espinal.

John Moye of the state Department of Labor was next up, noting that the state is looking to bring $200 million in funding for small businesses to the state.

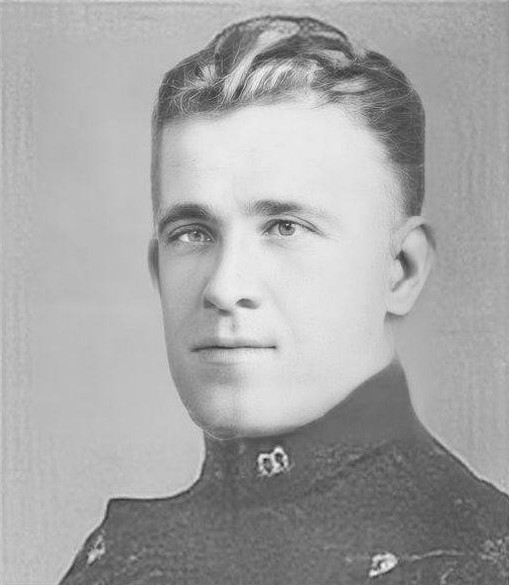

Quoting President Calvin Coolidge, who said that “the business of America is business,” he told the crowd that his agency can help businesses hold customized recruitment fairs and aid firms who need help with human resources.

In addition, its NYC Youth Works program offers tax breaks for businesses who hire youths.

Taxes 101

“Usually people have avery negative attitude of the tax department,” Mwisa Chisunka of the state Department of Taxation and Finance admitted, noting that many people’s first interactions with the agency come when they are subject to audit.

She implored the crowd to subscribe to their online newsletter to be informed of changes in the law, later reminding business owners that “when we come after you, we come after you hard.”

One of those changes is a new initiative that requires all sales tax payments to be made online starting Mar. 1. In addition, anyone who uses tax preparation software for their returns is required to file those returns online. Filers who print and mail the forms will be penalized.

Another change is the easing of the payroll tax, with is used to fund area transportation; small businesses who have quarterly payroll under $312,500 will no longer have to pay; those between $312,500 and $375,000 will now have to pay a lower-than-standard rate.

Business owners who have more questions can e-mail chisunka at mwisa.chisunka@tax.ny.gov.

DCA, Workers’ Comp

Ricky Wong of the Department of Consumer Affairs (DCA) broke down his agency’s job into two parts: consumer protection and education; and business education and licensing.

The DCA monitors “most of the retail businesses that operate within the five boroughs,” he noted, totaling over 50 industries in all, and offers enforcement for any business as long as it involved a monetary transaction.

One business owner, who claimed to be a licensed massage therapist, complained to Wong about area businesses who illegally have “massage” signs in their windows.

Wong noted that the New York State Department of State, which offers the licenses, are responsible for the enforcement, but that they have only six or seven inspectors for the entire city (as opposed to the DCA’s 60).

“We have no jurisdiction on massage therapy-type businesses,” he stated.

Neil Gilberg of the state Workers Compensation Board reminded the crowd that workers’ comp insurance is required; the penalties for not doing so are $2,000 for every 10 days the insurance is not provided.

“Our goal is to get businesses compliant so its a level playing field,” he stated.

He added that a husband and wife who operate a business may still require workers’ comp insurance depending on the structure of the company.

Companies that may receive a letter claiming they are being fined should call the Board to ensure that they are being fined the right amount, as recent changes in state law have modified the penalties based on the size of the offending company.

Gilberg also spoke of a “debarment law” that bars a company fined for by the Board from doing business with a governmental agency for a year. He noted that for firms that do most of the business with the city, the penalty is “punitive and draconian.”

A bill winding its way through state government would amend the law to prevent firms that are usually upstanding businesses from being unfairly treated.

Visit wcb.ny.gov for more information.

Business incubations

Rick Miranda of the Kings County Hispanic Chamber of Commerce told the crowd about his group’s “business incubator for aspiring entrepreneurs,” where applicants will be able to take 85 online classes in all aspects of running a business. Once residents complete their three-month curriculum, the Chamber’s housing component will help the entrepreneur find space for their business, and U.S. Small Business Administration (SBA) loans of $5,000 to $50,000 are available for those who pass a background check.

In addition, other (SBA) loans are available for expansion as well as for the lease or purchase of a mixed-use business.

“It is a very good time to buy,” he told the crowd.

Veterans and their spouses are also eligible for “Patriot Loans.”

The Chamber can help eligible companies get certified as city and state Minority and Women-Owned Businesses.

Finally, he announced that the Chamber is opening up satellite offices in three of the borough’s most financially distressed areas, starting with Cypress Hills. The office will be located at an area bank branch.

Bushwick and Sunset Park will also be receiving satellite offices later this year.

More business

One man asked Miranda and the rest of the panel to help bring a wider variety of businesses to the area.

“We need to have more than just a bodega,” said the resident.

Espinal responded that Fulton Street is a priority for his office. Olmeda, of State Senator Dilan’s office, added that the last mixed-use development in the area was planned 15 years ago thanks to the work of elected officials in the area, and took a dozen years to come to fruition.

He added that his office is also looking at beautification efforts in the area, including work on the elevated train line.