A new study by real estate website Point2 Homes found that the Queens housing market is one of the least affordable in the United States.

The study, which analyzed how fast a family could pay off their home if they spent their entire annual income, found that Queens was ranked the 10th least affordable city out of 32 cities. To determine affordability, researchers calculated the median multiple of each city. To do this, they divided the median home sales price by the median annual family income.

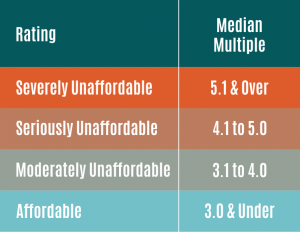

The higher the ratio is — 3 and lower is considered affordable — the longer it will take a family to pay off their home.

Not surprisingly, Manhattan ranked 1 on the list while Brooklyn was the third least affordable city. Queens also made the top of the list, coming in at 10. The median multiple in Queens is 7.9, beating out cities like Washington, D.C., the Bronx, Denver, Portland, Chicago, Nashville and more. It would take a family making the median family income 7.9 years to pay off their home if they contributed their entire salary toward the house.

The median home sale price in the borough is $490,867 and while that price tag may be less than other cities on the list, the median family income in Queens is $62,207. The median family income in the United States is $56,516.

The study also analyzed the median multiple in North America and included cities in Canada and Mexico. Queens ranked 11th on that list, making it less affordable than cities such as Toronto and Ottawa in Canada and Mexico City.

Another report by PropertyShark released earlier this year found that in 2016, first-time foreclosures in the borough have reached highs not seen in five years. In 2016, 933 of 2,2002 homes scheduled for foreclosure in New York City were located in Queens.