Several minority small business owners in Jamaica met with elected officials on April 4 to address the economic challenges facing their businesses and discuss what can be done for future growth as they struggle to recover from the COVID-19 pandemic and continued inflation.

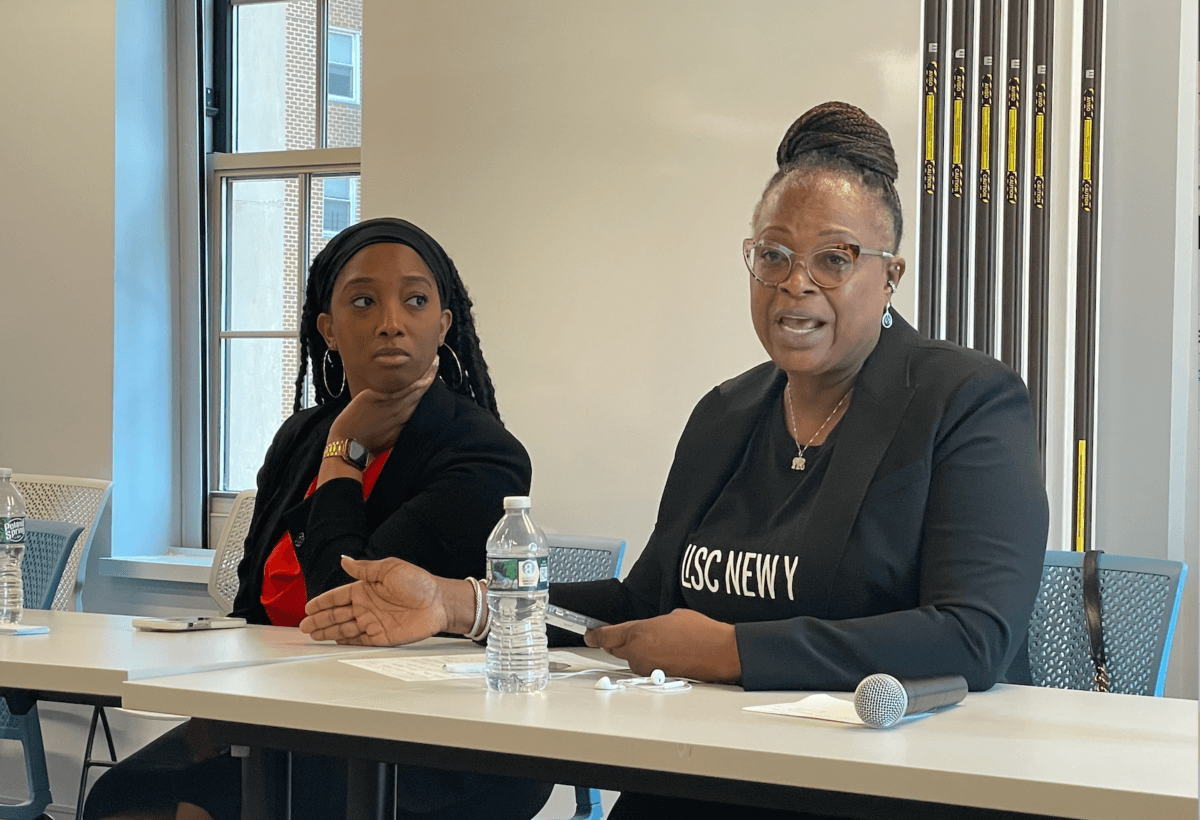

The Minority-Owned Small Business Listening Tour event, held at the Greater Nexus in Jamaica, was hosted by community development non-profit LISC NY, in partnership with the Greater Jamaica Development Corporation, to alleviate the challenges minority business owners across the five boroughs are facing and identify solutions to help them thrive and grow in their communities.

Valerie White, senior executive director of LISC NY, said that as communities face the continuous issue of rising costs and falling sales, the impact on minority-owned businesses cannot be overstated.

“Following the devastating impacts of the COVID-19 pandemic and the recent blow of inflationary prices, the fates of many Queens-based minority-owned businesses are in limbo – floating between subsistence and failure,” White said. “In our work at LISC NY, we know how important these voices are. In gathering elected officials, business owners, and economic development leaders, communities can have candid conversations about their needs and advocate for the support required from their local leaders.”

According to a survey by LISC NY, nearly 4 in 5 minority-owned businesses fear that without adequate support, their business will be forced to close. If solutions are not soon found to help these businesses recover and plan for the future, jobs will be lost and investments will dry up.

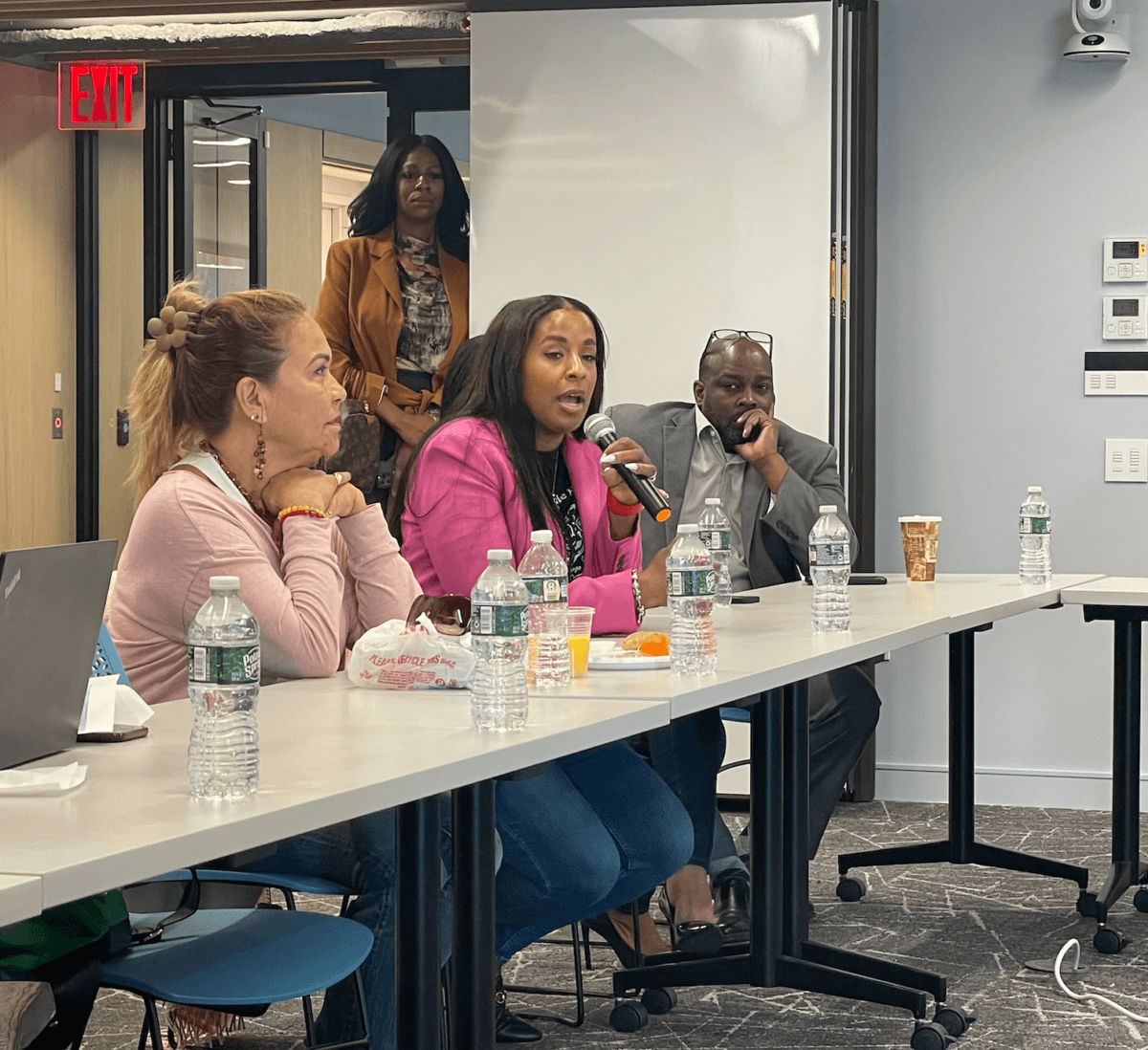

Facing higher costs, supply chain issues, and fewer sales with customers spending less due to inflation and decreasing spending habits, Black, Latinx and brown business owners called for direct community support to stabilize their businesses in the midst of economic uncertainty.

Natasha Morales, owner of Make Me Over Beauty Bar, said the pandemic, rising rent costs, bus lane changes on Jamaica Avenue and a bad economy have led small businesses to look for creative solutions to help them recover economically and to keep their businesses afloat.

“One way we are doing this is by converting our brick-and-mortar storefront into what will probably be the first mobile beauty bar in the city,” said Morales, a licensed psychotherapist who runs the Make Me Over Beauty Bar with her sister. “We don’t have to deal with landlords. Why rent when you can own?”

In March 2020, when non-essential businesses were forced to shutter to help stem the spread of the coronavirus, Morales and her sister had to come up with a plan in order to sustain their business while dealing with a difficult landlord.

“Even though our business was forced to close, we were required to pay rent and they were really, really hard on us,” Morales said. “We pushed forward and worked a lot on Instagram to manage through that time. We did videos and tried to sell products online.”

Although Morales received some financial assistance, she was still met with challenges as the pandemic started to shift, she said.

“The economy didn’t get better. The bus lane changes happened on Jamaica Avenue, and that meant that we did not get the same access to traffic,” Morales said. “Our business suffered and our counterparts have experienced the same thing.”

Elena Calderon, owner of Rincon Salvadoreno Restaurant, said the transportation and changing of the bus lanes have been detrimental to businesses in Jamaica.

“Most of my customers aren’t from the area and now coming to the restaurant is a whole issue for them,” Calderon said. “I have lost customers because of that.”

Athenia Robinson, a Laurelton resident who left her corporate job as a senior paralegal to open her bakery, Sweet Treats Delight, in October 2019, said it has been a struggle with the rising costs of items due to inflation.

“The highest things that [have] risen in this time [are] eggs, oil and flour. It’s hard for me to scale back…at Restaurant Depot I was paying for 30 dozen eggs for $50 and now it’s $140,” Robinson said. “It is getting more difficult with staffing and people don’t want to work. It’s a turnaround of influx and we’re watching the increase in costs for a business to run.”

The business owners stressed the importance of increased access to capital, business development, and other support to help and educate business owners.

Dawn Kelly, owner of The Nourish Spot in Jamaica, noted the challenges just to obtain a food handler’s license.

“The problem is you gotta go all the way to Harlem. That’s unfair for people who live in Far Rockaway and other places in Queens,” Kelly said. “As for staffing, it’s hard for me too. We need some kind of help here in this community, and we need people who want us to win to come in and teach us how to fill out RFPs the right way to get these contracts.”

Earnest Flowers III, owner of organic supermarket Earnest Foods, suggested that the city and state hire an outside consulting entity to conduct an audit to ensure that small businesses are receiving the grants and loans in a timely manner.

“When the PPP [Paycheck Protection Payroll] first came out, there were no Black businesses that received PPP loans in southeast Queens that I know of,” Flowers said. “I searched and no one got it until several weeks later.”

Flowers said there are many different creative ways that business owners can use if they think outside the box, but they need alternative revenue streams if many of them are going to survive.

“Where we are right now, many companies I speak to, are underwater, unless they receive some grants or something they don’t have to pay back they’re not going to survive,” Flowers said.