April 29, 2019 By Christian Murray

High-end condos in Long Island City were in big demand in 2018, according to a recent report.

More condos sold for $2 million and up than in any other year in Long Island City history, according to the 2018 Year-End Long Island City Condominium Report released last week by Patrick W. Smith, who recently joined the Corcoran Group in connection with that firm’s Queens expansion.

Fifteen condos sold last year for more than $2 million, compared to just five in 2017 and five in 2016, according to Smith’s report. The big numbers were also accompanied by a year when total sales volume broke the $300 million mark.

The impact of Amazon was factored out of the 2018 report. All sales based on contracts signed post Amazon’s Nov. 5 announcement were excluded (a total of eight).

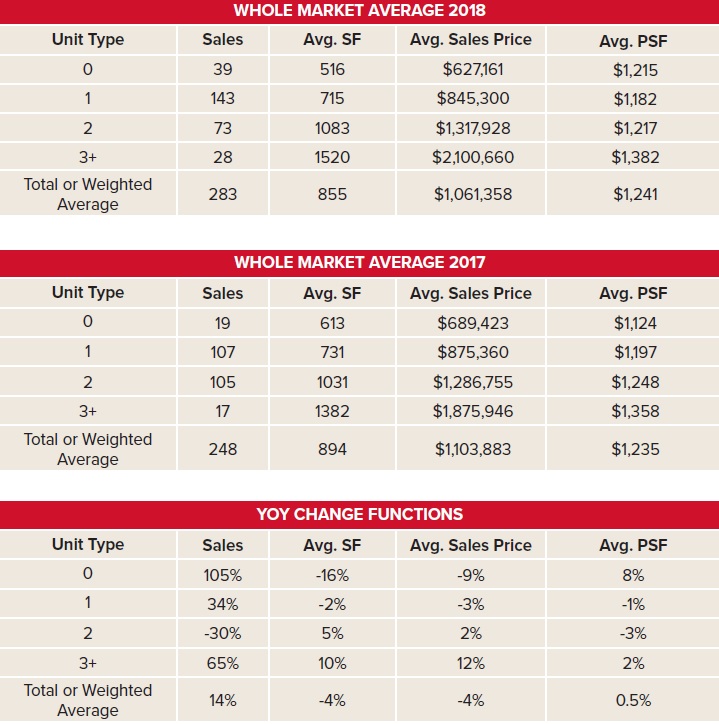

Despite the big numbers in the luxury market there are indicators that the market overall may be softening, with the average price for one bedrooms and studios weakening in 2018 and 2017.

“There are signs that sellers are meeting resistance from buyers after seven consecutive years of price growth through 2017,” Smith said, adding that the average days a listing is on the market has increased and so too has the average listing discount.

Smith, who recently oversaw Stribling’s operations in Queens, said that developers have begun to alter the units they produce to adjust for market conditions. The units, he said, are getting smaller and the prices are reflecting that.

The average price paid for a studio was $627,000 in 2018, down from $689,000 in 2017, according to the report. The average unit size of those studios that sold in 2018 was 516 square feet, significantly smaller than the average 613 square feet in 2017.

The one-bedroom market also softened based on price. The average one-bedroom sold for $845,000 in 2018, compared to $875,000 the year prior. However, the average size of those units sold dropped from 731 square feet in 2017 to 715 square feet in 2018.

Smith said that he has seen the emergence of what are efficiency-type units, where a studio is about 400 square feet and a 1 bedroom about 500 square feet. Both are about 100 square feet smaller than typical newly-developed units.

He said that the efficiency concept has benefits for the buyer, who can get into the market for less, and developers who maintain healthy price per-square-foot numbers.

The prices paid for two and three-plus bedrooms continue to show their resilience. The average price for a 2 bedroom in 2018 was $1.3 million, up 5 percent from 2017. Units with three bedrooms or more sold on average for $2.1 million, up 12 percent from 2017.

Nearly 67 percent of all condos that sold in 2018 were new developments, according to Smith’s report.

The average sales price of new condos dipped nearly 7 percent, to $1.0 million, in 2018. The drop can be attributed, in part, to the decline in the size of the units. The average size in 2018 was 781 square feet vs. 834 square feet in 2017.

The average sales price for resale condos remained firm, with the average sales price up 3.7 percent to $1.17 million.

Smith does see headwinds for the resale market.

He said that the older buildings are now over 10 years in age and common charges are increasing to fund the repair of major building systems—impacting maintenance. Additionally, most resale buildings have 15-year 421a property tax exemptions that will phase out in the near to medium term that will lift carrying charges.

Smith’s report noted that in 2018 the average condo was on the market for 72 days, up from 54 in 2017. Meanwhile, the average listing discount increased from 2.6 percent to 3 percent.

Smith said that while the Long Island City condo market is not immune from market cycles, it still remains attractive from a price standpoint.

He said that the median price of a condo in Manhattan was $1.6 million in 2018, significantly higher than $884,000 in Long Island City for the same year.

For a copy of the report, click here