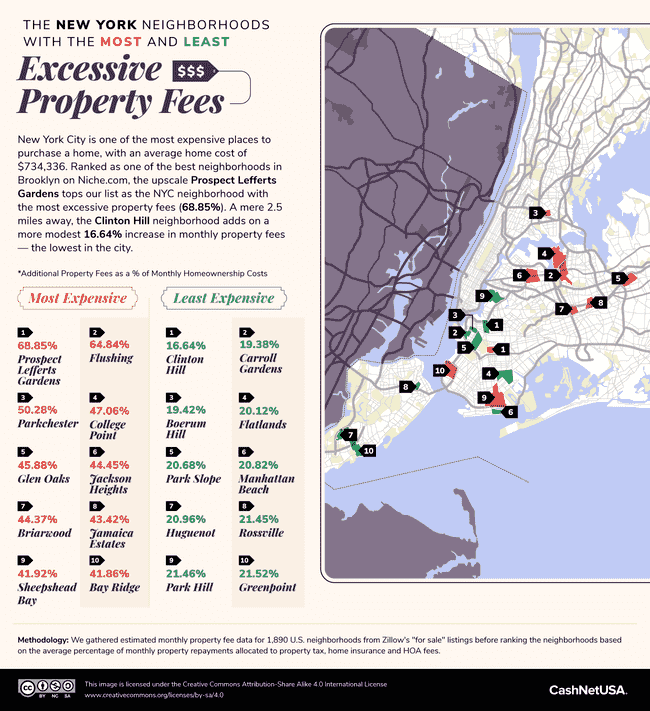

The Queens neighborhoods of Flushing, College Point, Glen Oaks, Jackson Heights, Briarwood and Jamaica Estates ranked within the top ten neighborhoods in New York City with the most excessive property fees, according to a report by the financial services company CashNetUSA.

The property fees taken into account for this study include property tax, home insurance and Homeowner Association fees. The property tax is calculated by the local government and based on the value of a property. Set by the mortgage company, home insurance provides protection against property damage and destruction. HOA fees are payable to cover shared amenities and areas in communities governed by homeowners associations.

With 64.84% additional property fees, Flushing had the second-highest excessive property fees not just in New York City but in the entire country. It trailed behind Prospect Lefferts Gardens in Brooklyn, which had 68.85% additional property fees. With these additional fees, the total monthly property fees in Flushing totaled $4,951.88.

College Point ranks fourth in the city and 15th nationwide with additional property fees of 47.06%. It also boasts the third-highest average monthly property fee among the top 20 U.S. neighborhoods, amounting to $3,008.67.

Meanwhile, Glen Oaks holds the fifth position in the city and 19th in the country, with its additional property fees reaching 45.88%. The monthly property fees in Glen Oaks total $1,653.58.

Jackson Heights ranked sixth in the city in excessive property fees, with 44.45% additional property fees. Briarwood placed seventh, with 44.37%, followed by Jamaica Estates in eighth, with 43.42%.

Five New York City neighborhoods ranked among the top 20 in the United States with the most excessive property fees. In addition to Prospect Lefferts Gardens, Flushing, College Point, and Glen Oaks, the Bronx neighborhood of Parkchester also made the rankings, placing ninth at 50.28%. While the overall cost of housing in New York City is among the highest in the country, this did not factor into the study, as fees are looked at as a proportion of total housing costs.

The conclusions reached in this report were made by using the real estate marketplace Zillow’s “for sale” listings to collect data in February 2024 on the estimated monthly payments for homeowner association properties in total before breaking them down by principal and interest, property tax, home insurance and homeowners association fees. In total, there were 1,890 neighborhoods across the country included in the study. Neighborhoods with the highest and lowest average percentages of monthly property repayments dedicated to property tax, home insurance and homeowner association fees were then ranked.