By Naeisha Rose

The Center for New York City Neighborhoods released a report from its Policy Research Manager Leo Goldberg and Data Manager John Baker in late April detailing the dangerous effects of real estate speculation in Queens and the other boroughs.

The April 23 report, “How Real Estate Speculators are Targeting New York City’s Most Affordable Neighborhoods,” depicted which neighborhoods throughout the city and Queens were most affected by flippings and foreclosures in 2016 to 2017 due to the speculation.

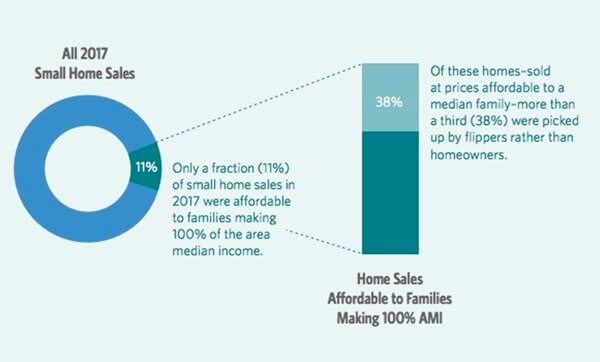

Real estate investors targeted vulnerable homeowners who were at risk of foreclosing on their home, then approached them about short selling or selling their home for less than the mortgage value, only to sell the home at an inflated price before it could hit the market, according to Goldberg and Baker of CNYCN, an independent non-profit devoted to helping homeowners at risk for foreclosure.

“In New York City, where prices are sky-high and demand for homes far exceeds supply,” said the CNYCN managers, and “flipping contributes to gentrification and displacement.”

Homeowners who want to buy affordable homes can’t because investors are buying them and then selling at prices up to 50 percent higher than similar non-flipped homes, according to Cristian Salazar, a spokesman for CNYCN. Homeowners with poor credit played only a small role in the 2006 mortgage crisis, but speculators who defaulted on the homes that they tried to upsell had a bigger part in crippling the housing market, according to the National Bureau of Economic Research.

Typically, a property flip involved an individual or real estate investor buying a house, fixing it up first and then selling it for significant amount, according to representatives of Federal Bureau of Investigations, who are investigating illegal property schemes.

The FBI, has noticed that con artists are trying to cash-in on flipping by buying homes at low prices, paying an appraiser to submit false paperwork saying there was work done on the house, therefore, justifying the high price of the home and then they get a friend or family member to take out a loan on the house from a bank as a buyer, according to the agency. The bank would unwittingly give out a high loan to the buyer and the con artist will pay the buyer a small fee and make a profit from the sale. The bank ends up taking a huge loss after the property ends up getting foreclosed on.

The community districts most affected by flipping throughout the city between 2016 and 2017 were Jamaica/Hollis (376) and Cambria Heights/Queens Village (205), according to the report.

Queens districts that fell in the middle of the pack included South Ozone Park/Howard Beach (154), Kew Gardens/Woodhaven (134), Rockaway/Broad Channel (93), Jackson Heights (80), Ridgewood/Maspeth (75) and Flushing/Whitestone (67), according to the report.

Bayside/Little Neck (51), Hillcrest/ Fresh Meadows (51), Elmhurst/Corona (39), Woodside/Sunnyside (19), Astoria (13) and Rego Park/Forest Hills (12) had the fewest number of houses flipped in the borough, according to the report.

In Jamaica, flipped homes sold for 33 percent more than similar properties not purchased by investors, and more than one out of every five homes in the neighborhood (22 percent) was a flipper, according to CNYCN. The borough-wide figure for homes sold to a flipper was 10.6 percent.

Had homeowners not been pressured into selling their homes when they weren’t ready, they could have stayed in their homes and modified their mortgage or received unbiased housing counsel using the state’s Mortgage Assistance Program, according to New York State Mortgage Assistance Program. State Sen. Leroy Comrie (D-St. Albans) has a similar program that is run out of his district office at 113-43 Farmers Blvd. every other Tuesday. It is confidential and anyone can set an appointment by calling (718) 765-6359.

“Working families in southeast Queens deserve to have affordable, quality homeownership within reach,” Comrie said. “Unfortunately, the foreclosure crisis has been a boon to predatory speculators in our neighborhoods, which is why I am working with legal service providers to ensure that homeowners in or on the brink of foreclosure have access to free assistance.”

City Councilman I. Daneek Miller (St. Albans) has also been trying to resolve the issue.

“More than a decade after the collapse of the housing bubble that triggered the worst recession in the nation’s history, the relentless exploitation of southeast Queens homeowners continues,” said Miller. “My colleagues and I worked closely with the center in creating the city’s Community Restoration Fund to buy back distressed mortgages, and keep them from wealthy investors with no interest in preserving affordable housing. This report makes it apparent more robust action is needed to deter speculators from reaping profits at the expense of communities of color, and we will deliver.”

Reach reporter Naeisha Rose by e-mail at nrose