As New York City experienced a large year-over-year increase in the number of homes to enter contract in January 2025, the median prices of homes entering contract went down, with the drop in Manhattan more than cancelling out increases in Queens and Brooklyn, according to a report by the real estate listing site StreetEasy.

While mortgage rates reached 7% in January 2025, homes entering contract rose year-over-year 10.7%, from 1,444 in January 2024 to 1,598 in January 2025. StreetEasy believes this jump is a good sign for the housing market during the spring months, as winter months like December and January typically have fewer homes enter contract.

As a result of more homes going under contract, the inventory of available homes in New York City has gone down over the same period of time. Homes on the market dropped 3.5%, from 15,379 in January 2024 to 14,840 in January 2025. This decline is indicative of a struggle to keep up with the high pace of sales dating back to September 2024. The drop in homes on the market occurred even with a 12.6% year-over-year jump in new listings, from 2,682 last year to 3,020 this year.

The median price for homes entering contract fell 3.8%, from $925,156 in January 2024 to $890,000 in January 2025. Even with a resilient demand among prospective buyers, there was not a strong increase in the price point of homes that entered the market. This trend shows that sellers have found success in being more strategic in their pricing, accommodating potential buyers with limited budgets in a market that features elevated mortgage rates. The converging of prices between buyers and sellers resulted in the median sale-to-list ratio rising from 95.3% last year to 95.9% this year.

Across the entirety of New York City, the median asking price dropped 2.1%, from almost $1.099 million in January 2024 to $1.075 million in January 2025. This decline in median asking price came even with big growths in Brooklyn and Queens, as Manhattan went through a deep drop, falling 6.3%, from around $1.66 million last year to $1.55 million this year. Strategic pricing by sellers who recently joined the market likely influenced this drop in Manhattan.

Queens had a 12% jump in its asking price, from $625,000 in 2024 to $700,000 in 2025. This surge is due in large part to condos taking on a larger share of the market. Condos cost more than co-ops. While co-ops remain the most common property in Queens, condos have moved quickly to close the gap. After co-ops accounted for 42% of the inventory in Queens compared to the 26% for condos last year, January 2025 had co-ops account for 38%, with condos on its heels, at 34%.

Brooklyn had its median asking price rise 4.8%, from almost $1.05 million in January 2024 to $1.1 million in January 2025. This borough accounts for the most neighborhoods on record with median asking prices of at least $1 million, with 34 such neighborhoods, up from 28 last year.

Manhattan accounts for eight of New York City’s top ten neighborhoods with the sharpest decline in median asking price for new listings. Such a large presence in that list reflects the severity of the decline in the median asking price in the borough. Manhattan neighborhoods on the list include Greenwich Village (31% decline), Midtown (27.7% decline), Chelsea (20.2% decline), Gramercy Park (20% decline), Battery Park City (17.1% decline), the Lower East Side (13.4% decline), Tribeca (12.8% decline) and Central Harlem (12.4% decline). Long Island City and Queens (27.1% decline) and Bay Ridge (18.4% decline) in Brooklyn accounted for the other neighborhoods in the top ten.

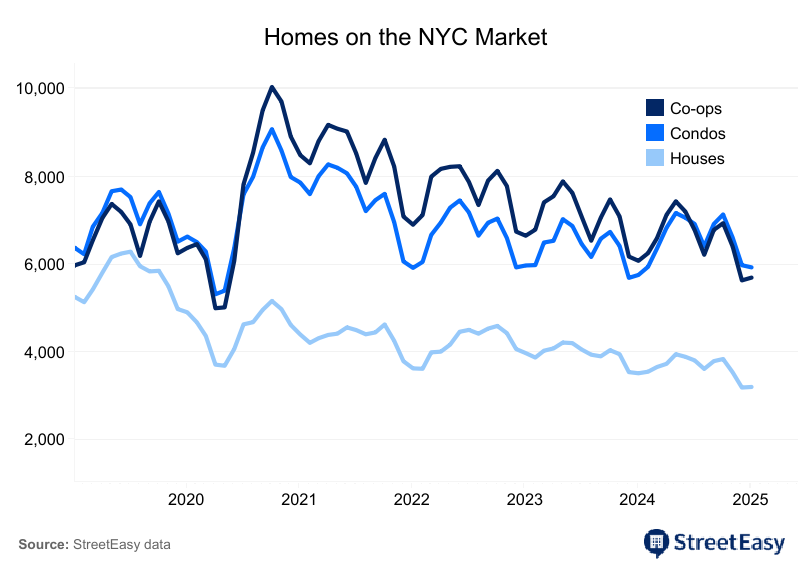

Co-ops have experienced a decline in inventory throughout the entirety of New York City. Homeowners have been disincentivized from listing their properties as a result of higher mortgage rates. Year-over-year, co-ops on the market in New York City have fallen 6.3%, from 6,089 in January 2024 to 5,705 in January 2025. Dating back to July 2021, every month has seen a year-over-year decline in the inventory of available co-ops.

With co-ops declining, many have turned their attention towards condos, which are easier for owners to market thanks to more flexible financing rules and simpler application processes for potential buyers. Across New York City, the inventory of condos rose 3% year-over-year, from 5,766 in January 2024 to 5,939 in January 2025. On a citywide level, condos have outnumbered co-ops among available homes since July 2024.

Despite the recent trends, co-ops could end up being more attractive to potential buyers in 2025, as a result of high mortgage rates. The price per square foot is more than half as much for co-ops as it is for condos in New York City. In January 2025, co-ops had a median asking price per square foot of $526, while condos were at $1,453. Even as its inventory becomes more scarce, co-ops continue to see this price drop, falling 4.9% from $554 in January 2024.