By Emily Keller

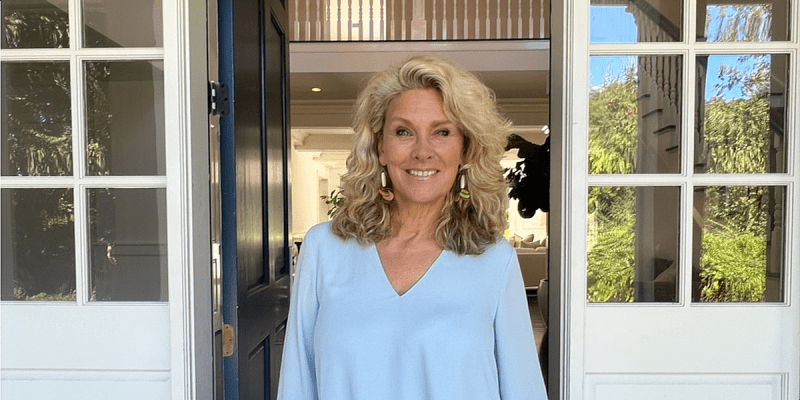

There are few things that can dampen a homeowner’s enthusiasm upon learning that his or her home has risen in value. Her new property tax bill is one of them. “The values of many of our homes…have gone up, and we’re glad,” Councilmember Letitia James said at a Tuesday night forum on tax equity at Brooklyn Technical High School, 29 Fort Greene Place. The problem is, “There is a significant number of people who cannot afford to pay the property taxes.” Those facing the greatest inequity are owners of homes with four or more units but less than ten, who fail to qualify for the protections granted to owners of one- to three-unit homes by a contentious 1981 state law, but also fail to reap the financial benefits that those with more than ten units have. According to the law – which the city’s Department of Finance must enforce but cannot change – the tax rate for owners of homes within the lowest category is 6 percent of assessed value, while for those in the second class, which includes all residential properties that are four units or more, it is 45 percent. The final price tag is determined from other factors as well, although income is not one of them. Terrence Smith, who owns a four-family home on Warren Street with his wife, Ahalia, said their 45 percent tax rate and fluctuations in the system have led them to increase their tenants’ rent, causing good tenants to leave. “We have revolving door rentals and that’s not stabilizing for anyone. It’s anarchy,” said Terrence, calling the system damaging to small owners. Longtime homeowners also pay the same rate as new owners, which critics charge is punishment. “There is something fundamentally unfair about that,” said James. She was preaching to the converted. Of the approximately 150 people who attended the February 21 forum, none spoke in favor of New York’s property tax system. And the system is being accused of more than just unfairness – it was also called unnecessarily confusing by the department’s commissioner of four years, Martha E. Stark, who has been working towards simplifying the system and making it fair since she became commissioner. Anyone who understands the process by which homes are assessed might have a job in the Finance office, she said. “It’s a real complicated process and most people don’t understand it.” At the meeting, which took place at her alma mater, Stark fielded questions from baffled homeowners about their recent assessments – some of which rose, fell, and then rose again within months – and tried to break the valuation process down for the crowd while injecting humor into the tense situation, and also bluntly stating, “I think we need a new system in New York.” Grouping the owners of all residential buildings into one tax class would help, she said. Irene Porges, who has lived in a five-unit brownstone condo in Prospect Heights for 19 years, said the forum was helpful, but the system is still too layered. “It’s extremely confusing,” she said about New York’s property tax system, comparing it with California’s system, which is more predictable but charges new owners a higher rate than long-term owners. ”Here you have no idea where your taxes are going, and for a senior citizen that can be pretty critical…If you don’t know the questions you won’t get the answers.” Porges said she recently received a notice that her tax bill would be $17,000, and a month later received another saying it dropped to $5,000. Last week it rose again to the first price. She considered appealing the change but decided to leave it. Ironically, the system that is so frustrating to New York homeowners also protects them, albeit it in mysterious ways. Rather than devise the property tax rate directly from the market value of a home, the department determines the rate from its assessed value – a number that takes other factors into account besides the whims of the market, and includes deductions for seniors. The assessment cannot be raised more than 6 percent per year or 20 percent in five years for class 1 homeowners, or more than 8 percent per year or 30 percent in five years for class 2 homeowners. However, that assessment cap does not apply to homes that have undergone construction or renovation, which critics, such as those who pay higher taxes than their neighbors after fixing their homes, call a loophole, and say construction and renovation should not be grouped together. Stark agrees but has been unable to influence State lawmakers to distinguish them, although she passed a bill passed last year that caps the increased assessment of renovated homes at 15 percent – applicable to the additional market value but not the original value – for class 2 homes that are less than ten units. Another peculiarity in the law is that it requires the department to value coops and condominiums as if they are rental properties. “Makes absolutely no sense to me,” said Stark, who must enforce the law and is also subject to it as a coop owner herself. Once the assessed value is determined and capped where applicable, the tax rate determined by City Council and Mayor Michael Bloomberg is applied (for fiscal year ’06 it was about 15.75 percent for class 1 and about 12.4 percent for class 2), and the funds generated are significant. The City collects a total of $14 billion per year in property taxes, which is one quarter of its $52 billion budget. The money is used to pay for services such as fire protection and schools, Stark reminded the crowd. “We have taxes for a reason. We’re not just trying to make your lives miserable,” she said. The reason for a post 9/11 tax increase, which homeowners are still receiving rebates for, was to prevent the loss of those services. The significance of the tax, and its widespread effects, caused Stark to literally fall in love with property tax, she said, because “it is the tax that touches every person in the city and it pays for the things we all care about, and there could be no better tribute [I could pay to this city] than to fix the property tax system.” Although the department is unable to simplify the process by changing the law, which is under the State’s jurisdiction, “What we need to be held accountable for is getting the market value correct,” said Stark, urging homeowners who think their estimates are off to contact the office. “The one thing we can control is to make sure the market value is correct.”