The Great Depression started in the fall of 1929, famously triggered by the Stock Market Crash. Subsequently, a number of banks across America failed, including the Bank of Glendale.

There was no Federal Deposit Insurance Corporation (FDIC) at that time, and depositors of banks that failed faced severe hardships.

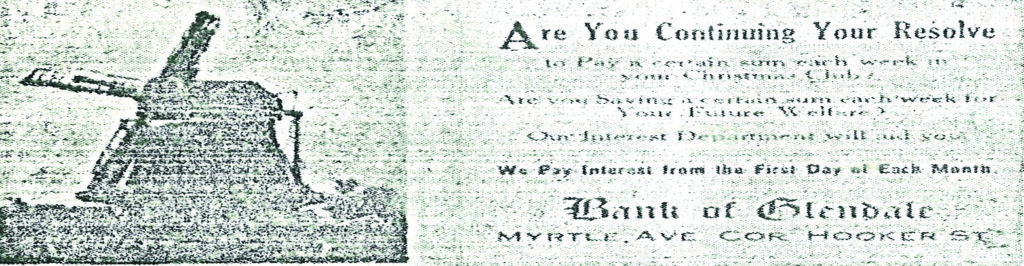

In 1923, Charles Schreiber had organized the Bank of Glendale, installing himself as president, and Frederick Sprower as vice president. Sprower had been vice president of the Ridgewood National Bank.

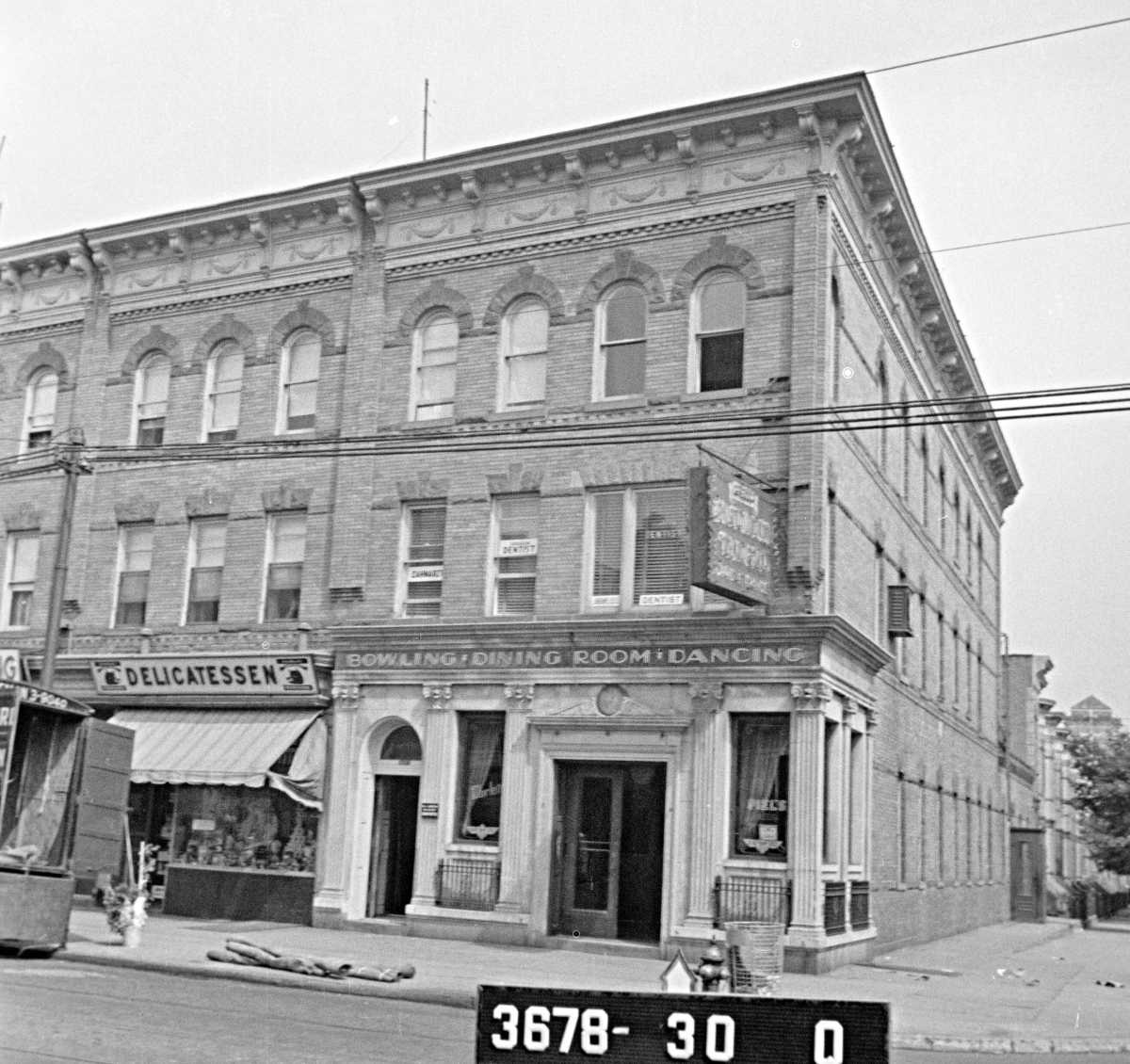

The Bank of Glendale was located at what was then 2681 Myrtle Ave., at the northwest corner of Myrtle Avenue and Hooker Street (present-day 66th Place). Hooker Street was named for Major General Joseph “Fighting Joe” Hooker, who commanded forces in the Union Army during the Civil War and died in Garden City, Long Island, on Oct. 31, 1879.

By August 1928, the Bank of Glendale had $2 million in deposits; this is equal to just about $29.1 million in today’s economy. However, by the fall of that year, it was taken over by the Globe Exchange Bank, and as the new street numbering system was placed into effect in Queens, the new address of the Bank of Glendale became 66-17 Myrtle Ave.

By the winter of 1929, the name of the bank was changed again — this time, to the Globe Bank and Trust Company, which had its headquarters on Church Avenue in Flatbush, Brooklyn.

As the depression deepened, the Globe Bank and Trust Company found itself unable to maintain adequate liquid reserves. On Saturday, Aug. 20, 1931, the bank closed its main office and its branch in Glendale.

Arthur May, who had an undertaking establishment across the street from the bank at 66-32 Myrtle Ave., and who was a depositor, called a meeting of the depositors of the Glendale branch at the nearby Belvedere Theatre, located at 64-34 Myrtle Ave. The theater is now the home of Christ Tabernacle Church.

May’s funeral parlor would, in later years, become Schwille Funeral Home.

Henry Petry, senior vice president of the Globe Bank and Trust Company and manager of the Glendale branch, was invited to attend. Two of the trustees of the bank were local hardware store owner Otto Herrmann of Herrmann’s Hardware and Charles Schildknecht, who owned a lumber business.

In early December 1931, the New York state superintendent of banking appointed the Manufacturers Trust Company to act as dispensing agent for the Globe Bank and Trust Company. Homeowners who had mortgages from the Globe Bank and Trust Company were urged to pay off their mortgages so the depositors could be paid.

On Dec. 7, 1931, the Manufacturers Trust Company issued new passbooks to the Globe Bank and Trust Company depositors for 50 percent of the amount that they had on deposit, with the comment that as additional assets were liquidated, they would pay out more money.

In those days, home mortgages were not amortizing. The bank collected the interest due twice per year, and if it was a five-year mortgage, on the due date, the full amount had to be paid unless the bank agreed to an extension with the possibility that the interest rate may be modified.

To help the Globe depositors receive their money, Rudolph Stutzmann, president of the Savings Bank of Ridgewood (now Ridgewood Savings Bank), announced that his bank would make available $500,000 for new mortgages to replace those held by Globe. Charles Schreiber, who had organized the Bank of Glendale, also announced that he would make mortgage money available to help.

On Jan. 18, 1932, the Globe Bank and Trust Company sold to the Bank of Manhattan Trust Company the land that their Glendale branch buildings occupied. Eventually, as the assets of Globe Bank and Trust were liquidated, every depositor was paid in full.

In later years, the former bank premises became the Bank Tavern. Today, the site is the home of a fruit and vegetable store.

As a result of the bank failures during the Great Depression, in 1933, the U.S. Congress passed the Banking Act of 1933 and, with the new Franklin D. Roosevelt Administration, created the FDIC. The corporation was initially created as a temporary insurance plan to protect bank deposits and restore the public’s confidence in banks. The plan was made permanent in 1935.

As the plan went into operation, each member bank paid a small premium to the FDIC for the insurance. Gradually, a substantial fund exceeding $10 billion was accumulated. It is a wholly bank-owned and government-managed insurance fund which today protects individual bank deposits of up to $250,000 at member banks.

All losses and expenses in connection with the operation of the fund are paid out of income generated from invested surplus and the premiums paid by member banks.

Source: The Aug. 9, 1984 Ridgewood Times

***

If you have any remembrances or old photographs of “Our Neighborhood: The Way It Was” that you would like to share with our readers, please write to the Old Timer, c/o Ridgewood Times, 38-15 Bell Blvd., Bayside, NY 11361, or send an email to editorial@ridgewoodtimes.com. Any print photographs mailed to us will be carefully returned to you upon request.