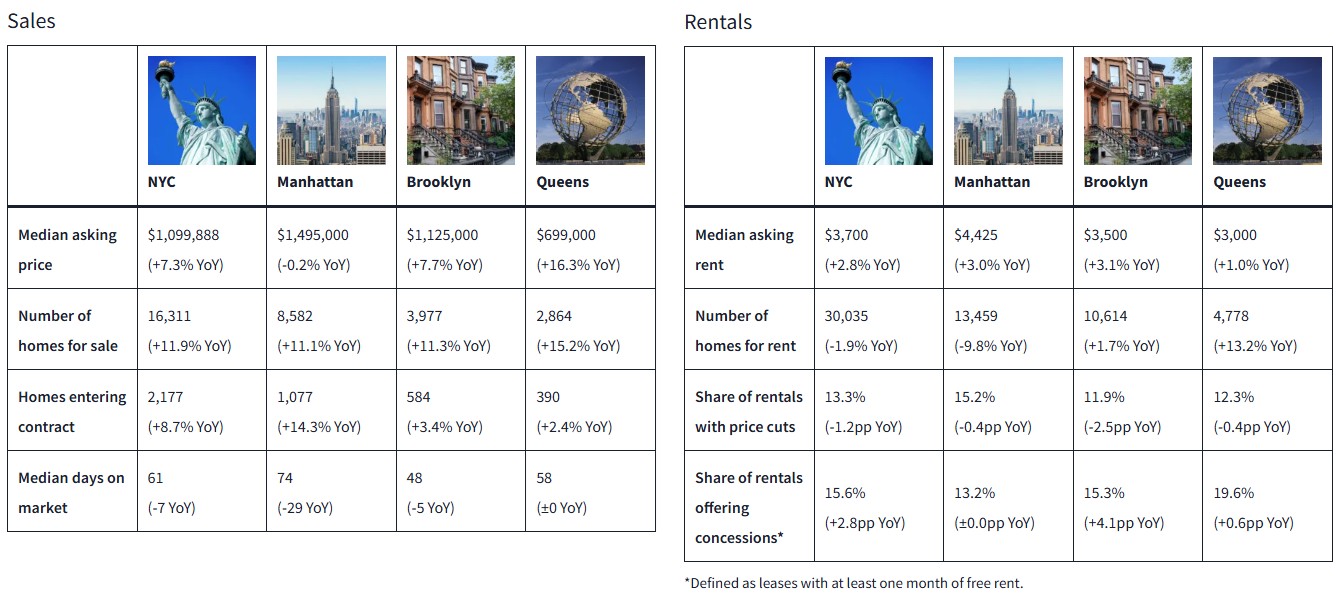

March 2025 marked the seventh consecutive month in which the number of homes to enter contract in New York City increased year-over-year, according to a report by the real estate listing site StreetEasy.

Over this period of time, homes entering contract rose 8.7%, from 2,003 in March 2024 to 2,177 in March 2025. The median of 61 days that homes spent on the market in March 2025 is one week shorter than the previous year.

Even as homes continue to enter contract at a higher and quicker rate, the inventory of available homes continues to go up in New York City. With homes on the market rising 11.9% year-over-year, from 14,577 in March 2024 to 16,311 in March 2025, potential buyers have more opportunities to find a place to live. This has also helped to balance out the market, ensuring buyers and sellers are on equal footing.

Ever since the monthly mortgage rates in New York City reached $3,306, it has steadily declined. In March 2025, the mortgage rates dropped to 3,204, representing a 0.7% drop from the same month the previous year, at $3,227. Such improvements in affordability will likely influence the real estate market in Spring 2025. There is some optimism that market activity will continue to improve, thanks in large part to anticipated improved buying power, including for those looking to sell their current home and look for a new place to live.

When it came to the boroughs of Queens and Brooklyn, a surge in new developments helped offset the declining inventory in Manhattan and thus stabilize the rental market in New York City. Thanks to more new developments opening, there has been an increase in concessions being made across the city, with 15.6% of rentals offering leases with at least one month free in rent this year, compared to 12.8% last year.

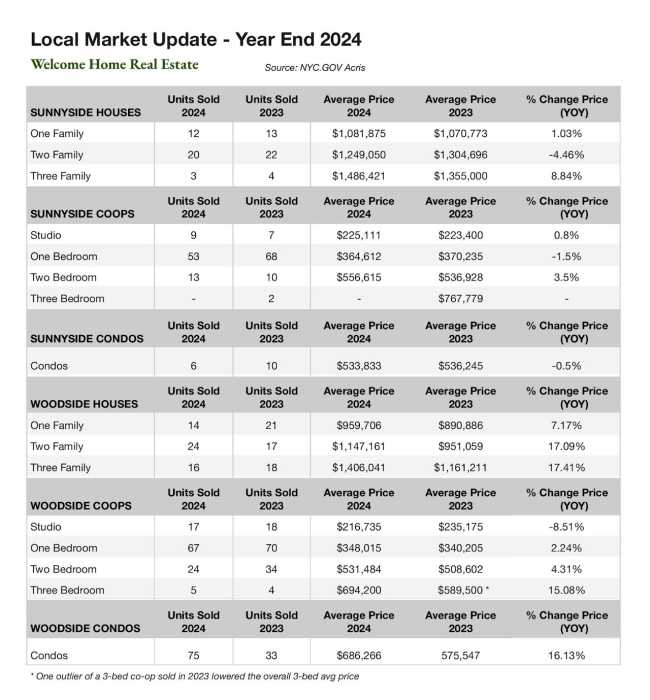

In Queens, the sales market lagged well behind those of Manhattan and Brooklyn in terms of the median asking price, number of homes for sale and number of homes entering contract. However, the median asking price and number of homes for sale in Queens had the biggest percentage jump year-over-year among the three boroughs. The median asking price to purchase homes in Queens went up 16.3%, from $601,032 in 2024 to $699,000 in 2025. The inventory of homes for sale rose 15.2%, from 2,486 last year to 2,864 this year. New homes entering contract, meanwhile, went up just 2,4%, from 381 to 390.

In Brooklyn, the median asking price for homes went up 7.7% year-over-year, from $1.045 million in 2024 to $1.125 million in 2025. This percentage jump equates to less than half of that of Queens. The number of homes for sale rose 11.3%, from 3,574 last year to 3,977 this year. Homes entering contract in Brooklyn went up 3.4%, from 565 to 584.

Unlike in Queens and Brooklyn, Manhattan experienced a slight decline in the median asking price of homes for sale, down 0.2%, from just under $1.498 million in 2024 to $1.495 million in 2025. However, homes entering contract in this borough were up by a significantly larger margin, having risen 14.3%, from 943 last year to 1,077 this year. The number of homes for sale in Manhattan rose 11.1%, from 7,725 to 8,582.

The median asking price for rentals in Queens had a modest increase, going up 1%, from $2,971 a month in 2024 to $3,000 in 2025. Similar to the inventory for homes, the number of homes for rent in Queens went up the highest percentage among the three boroughs, but still lags behind Manhattan and Brooklyn. Homes for rent rose in Queens by 13.2%, from 4,221 last year to 4,778 this year. The percentage of rentals that had price cuts decreased slightly in Queens, from 12.7% to 12.4%. While the increase in the share of rentals providing concessions was modest in the borough, Queens still offered the highest percentage, with the number having gone up from 19.3% to 19.6%.

Rentals in Brooklyn trended up in median monthly rent by 3.1%, from $3,395 in 2024 to $3,500 in 2025. The number of homes available for rent also went up there, rising 1.7%, from 10,437 last year to 10,614 this year. While the share of rentals offering price cuts went down from 14.4% to 11.9%, the share of those offering concessions in Brooklyn rose from 11.2% to 15.3%.

In Manhattan, the median monthly rent went up 3%, from $4,297 in 2024 to $4,425 in 2025. However, the number of rentals available plummeted 9.8%, from 14,922 last year to 13,459 this year. The share of rentals offering concessions remained static at 13.2% over this period of time, but the share of rentals with price cuts went down from 15.6% to 15.2%.