Rental competitiveness was very high across the New York City boroughs of Queens, Brooklyn and Manhattan in 2025, according to a report by RentCafe.

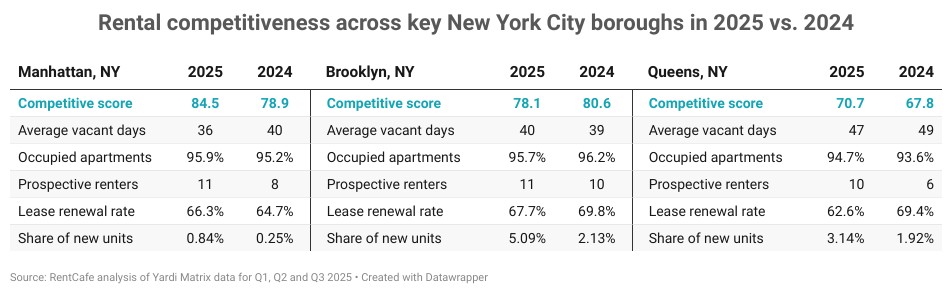

Each borough had rental competitiveness index (RCI) scores above 70 from January to September of 2025. These scores were calculated based on an analysis of the average number of days apartments were vacant, the percentage of apartments occupied by renters, the number of prospective renters competing for a vacant apartment in a given area, the percentage of renters who renewed their leases and the share of new apartments completed recently. These metrics were given percentage weights, with apartment occupancy rate and renewal lease rate both at 30%, average vacant days and prospective renters per unit at 15% each and the share of new apartments at 10%.

Queens had an RCI score of 70.7 in 2025, up from 67.8 in 2024 and ranking 54th among cities in the United States included in the study. One big contributing factor to this increase was the fact that the number of people vying for each apartment in Queens nearly doubled over this period of time, from six last year to ten this year. While the share of new units went up considerably, from 1.92% to 3.14%, not as many people are renewing their leases, with the rate having gone down from 69.4% to 62.6%. Occupied apartments rose from 93.6% in 2024 to 94.7% in 2025. Additionally, apartments leased quicker this year, at an average of 47 days, compared to 49 days last year.

Brooklyn had the 21st-highest RCI score in 2025, at 78.1. However, this represents a decline from its score of 80.6 in 2024. The share of units more than doubling, from 2.13% in 2024 to 5.09% in 2025, played a big role in the RCI score going down. This has led to the lease renewal rate dropping from 69.8% last year to 67.7% this year, providing prospective renters with even more options. Apartments took 40 days to lease in 2025, compared to 39 in 2024. Occupied apartments went down from 96.2% last year to 95.7% this year. Despite the boost in options in Brooklyn, there is still very high demand, with the number of applicants per unit going up from 10 last year to 11 this year.

Manhattan ranked fourth in the country in RCI score this year, at 85.5, up from 78.9 last year. With in-office work in the borough finally returning to pre-pandemic levels in 2025, the housing supply in Manhattan was squeezed even further. The share of new units did not increase by much, having gone up from 0.25% to 0.84%. The lease renewal rate rose from 64.7% last year to 66.3% this year. The minimal rise in new units and increase in renewal rate led to occupied apartments increasing in Manhattan from 95.2% in 2024 to 95.9% in 2025. The few vacant units available had more people attracted to them than the previous year, with 11 prospective renters per unit in 2025, compared to 8 in 2024. Available units also spent fewer days on the market, averaging 36 this year compared to 40 last year.

The only cities to have higher RCI scores than Manhattan were Miami, Florida, at 92.9, Chicago, Illinois, at 88.2, and Suburban Chicago, Illinois, at 88.1.