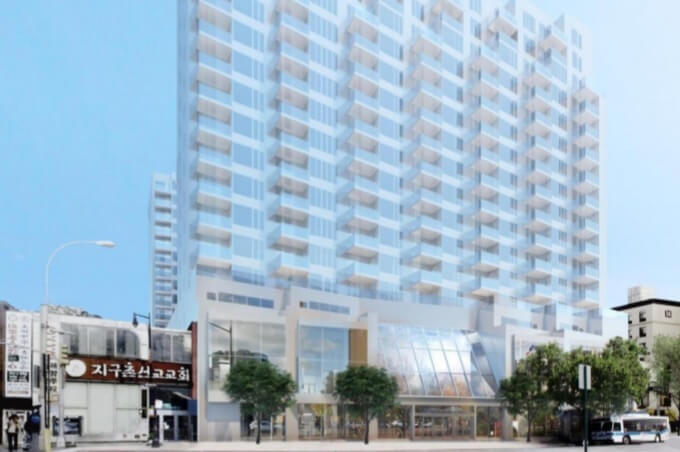

A new, 17-story, mixed-use residential development is coming soon at the former site of the landmark RKO Keith’s Theater in Flushing.

The developer, Xinyuan Real Estate (XIN), will proceed with its plans to build the condominium after receiving a $30 million financing loan from Madison Capital Realty (MRC), a New York City-based real estate private equity firm.

“This well-capitalized sponsor has done a fantastic job assembling and planning this shovel-ready site and the deal was particularly attractive at a less than $100 per square foot loan basis and less than 50 percent of cost,” said Josh Zegen, co-founder and managing principal of MRC. “MRC continues to finance high-quality real estate projects and we are confident this will be a standout property in the Flushing submarket, which is growing rapidly and stands to benefit from a very healthy development pipeline.”

The 269-unit condo will feature 17,000 square feet of retail space across the property’s first and second floors, 15,000 square feet of community space across the third floor, and 305 parking spaces at 135-35 Northern Blvd., where the RKO Keith’s Theater currently sits vacant.

The property has received press attention as a rare, one-time, former lavish movie theater. In April, The New York Times reported that although it was closed in 1986 and deteriorating, 4,000 people signed a petition to restore and preserve the historic theater. The Landmarks Preservation Commission had only designated three areas inside the theater: the lobby, grand foyer and ticket booth.

The developer plans to include restored interior portions of the landmarked former theater.

Marcus and Millichap Capital Corp. (MMCC), a leading provider of commercial real estate financing and capital markets expertise, had arranged for $30 million in refinancing for the former theater, according to Senior Vice President and MMCC National Director Richard Katzenstein. The refinancing was led by Gary Sefcik, one of the firm’s New York office, with a team including Rick Lechtman and Dan Lisser.

“We utilized Madison Realty Capital in the private non-recourse market which offers much more flexible capital than bank financing,” said Sefcik, regarding the lender.

XIN, the owner of the site since August 2016, chose to refinance and cash out on equity on the unencumbered land in order to optimize its capital structure prior to commencing the development of the site, which is entitled for an approximately 350,000-square-foot project.

The roughly 42,000-square-foot development site allows for a total zoning floor area well over 300,000 square feet. Xin plans to complete the demolition of the existing two-story structure surrounding the theater by February 2020 and commence construction shortly thereafter.

The property is one of the most high-profile development sites in Flushing and all of Queens. Development of the site had been historically held back due to complexities presented by its landmark status, particularly on the existing structure’s interior. However, the Landmark Preservation Commission approvals have been obtained.

The site is currently approved for a retail and condominium project, though the developer is currently weighing several options to further improve the business plan to meet the current demands of the Flushing market.

According to Sefcik, the transaction and future development of the site represents a significant evolution in the approach typically taken by Chinese developers which have historically joint-ventured with local New York developers.

Xinyuan will execute on the RKO site with its own team consisting of staff from headquarters and local New York real estate veterans in addition to third-party project manager, Kuafu Properties, a fellow Chinese firm.