By Rich Bockmann

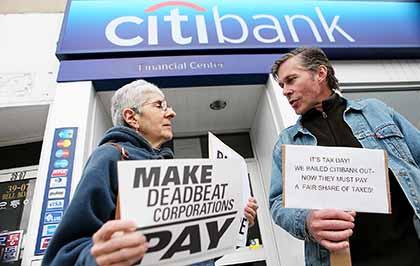

With federal budget talks on their minds, protesters gathered outside the Citibank branch at the corner of Bell Boulevard and 39th Avenue in Bayside Monday to draw attention to what they claimed are unfair corporate tax practices.

About 20 protesters chose to participate on Tax Day in moveon.org’s “Make Them Pay” campaign, which claims millionaires and corporations avoid paying their fair share of taxes by taking advantage of tax loopholes. Moveon.org is a progressive, political action advocacy group.

“We bailed them out and then they turn around and use loopholes,” said the event’s organizer, David Yale. Yale said the specific loophole he refers to is one that allows a foreign subsidiary of a U.S. company to exempt foreign-generated earnings from U.S. corporate income tax as long as it does not bring the cash back to the U.S.

The United States imposes one of the highest corporate tax rates at 35 percent. U.S. companies do pay local corporate taxes to the country where the income is generated, and if the cash is repatriated to the United States, the company pays the difference between the foreign tax and the U.S tax. Yale, a Bayside resident, said he had not personally written his legislators about the corporate tax loophole.

Citigroup Monday reported its first-quarter earnings plummeted 32 percent from a year earlier to $2.99 billion from $4.43 billion in the January-March quarter of 2010, while revenue was down 22 percent to $19.7 billion. The banking giant announced late last month that it would resume paying a dividend after the crushing financial problems it faced before the federal bailout.

Moveon.org contends that Citigroup — along with GE, Bank of America, Google, BP, Amazon, Wells Fargo, Boeing, ExxonMobil, FedEx, Goldman Sachs and Chase — are some of the wealthiest corporations in the country doing everything in their power to avoid paying U.S. taxes. The organization’s web site frames the issue in the context of tax breaks for the wealthy at a time when the federal government is slashing public services.

“During these difficult economic times, when all Americans are being asked to sacrifice, it is simply wrong that Citigroup is shirking their American duty to pay their taxes,” said Yale. “We are protesting on Tax Day because corporate tax dodgers have a responsibility to our community and our nation to pay their fair share. We pay our taxes. Citibank should, too.”

Yale said Citigroup has 427 offshore tax havens and, if it paid its fare share of taxes, it would owe $1.5 trillion. Officials at Citibank would not comment on the group’s claim.

For about an hour protesters held up signs — with one reading, “It’s tax day! We bailed Citibank out now they must pay their share of taxes” — and handed out literature to Citibank customers and passersby.

Michael McGrath said he has been laid off from his union plumbing job for 15 months and owes New York state $2,900 in taxes since he did not have anything deducted from his unemployment check.

“How come I have to pay my taxes and they don’t? These are people who don’t need tax breaks. Their incomes are through the stratosphere,” he said.

He acknowledged that while the corporations on moveon.org’s list are taking advantage of legal tax loopholes, their participation makes them complicit in an unfair system.

McGrath also said he did not think the protest was aimed at employees of this particular branch.

“I don’t think this branch thinks it’s against them. I think they know it’s against the corporation,” he said.

Reach reporter Rich Bockmann by e-mail at rbockmann@cnglocal.com or by phone at 718-260-4574.