By Phil Corso

The owner of an Astoria dental lab knew what he was doing when he failed to collect employment taxes, court documents showed.

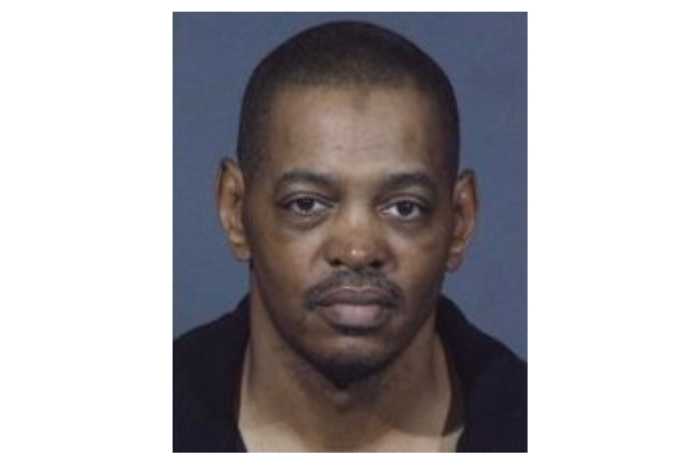

Simon Galeas, 48, pleaded guilty in Brooklyn federal court to the charge in April and was sentenced last week to five years’ probation, ultimately costing him $237,468 in restitution and an additional $10,000 fine, the Internal Revenue Service said.

The IRS also said he will spend the next six months of his probation under house arrest.

According to court documents, Galeas worked as the owner of Steinway Dental Laboratory Inc. in Astoria, which operated under the name of Steinway Fisher Dental Labs and provided hospitals and dentists with artificial teeth throughout the metropolitan area.

The IRS said that although he was required to collect and pay over Federal Insurance Contributions Act taxes to the IRS, he instead made an agreement with a commercial check-cashing company in Brooklyn to divert corporate checks and cash them.

The money was instead supposed to fund different federal benefit programs, including Social Security and Medicare, the IRS said.

Overall, he cashed more than $2 million in checks that went toward his off-the-books payroll, the IRS said.

Galeas admitted to using commercial checks to divert corporate checks payable to Steinway Laboratories, court documents showed. He cashed them at a corporate check cashier in a way that would not be reflected on financial records and then used that money to pay his employees off the books, records said.

Court records showed more than $10,000 in taxes lost on four separate occasions between 2007 and 2010. The Astoria business owner admitted to the crime in court April 12, placing the blame on confusion with the rules of play.

“In about 2006, I met a gentleman and he told me that it was possible to cash corporate checks that I can pay some of the employees and this way I don’t have to pay some of taxation that was being paid and basically that was what was done,” Galeas said, according to court documents.

Reach reporter Phil Corso by e-mail at pcorso@cnglocal.com or by phone at 718-260-4573.