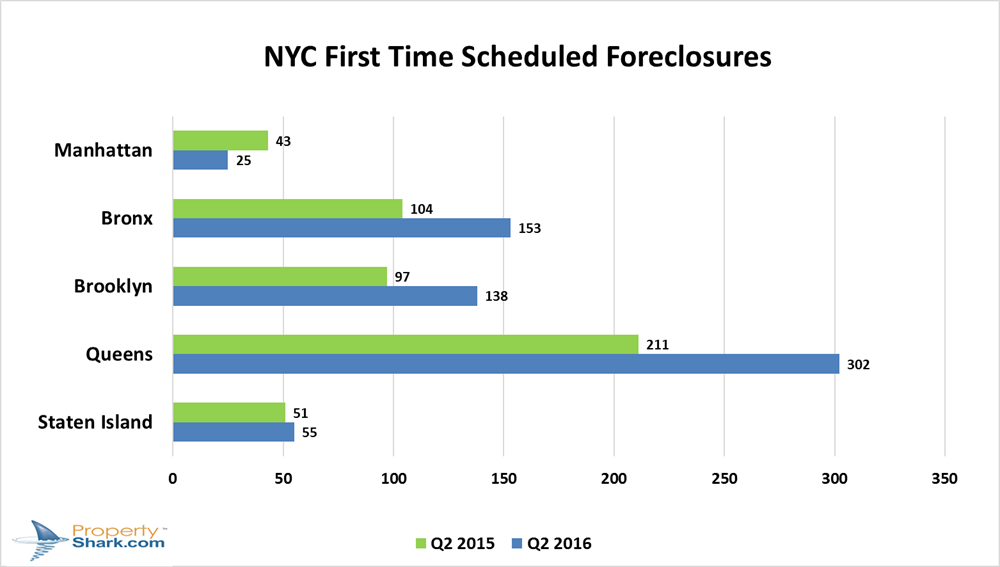

New York City has seen a surge of first-time foreclosure auctions this year compared to 2015, and most of these foreclosures are concentrated in Queens, a study found.

According to a PropertyShark report, Queens has 302 foreclosed properties scheduled for auction this quarter, the highest number of any borough. This number represents a 43 percent increase from the same time last year, where 211 homes were scheduled for first-time foreclosure auctions.

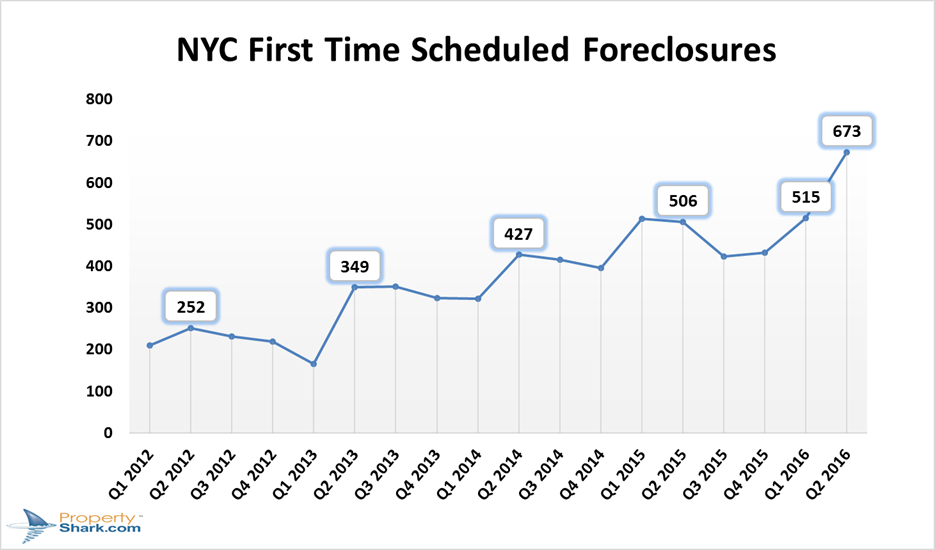

In the second quarter of 2016, there were 673 properties scheduled for auction across the entire city, which represents a 33 percent increase from the same time last year. The amount of first-time foreclosure auctions has risen to “levels unseen in the past six years,” according to the report.

Southeast Queens has been hit hardest by the city’s housing bust in 2008 and the largest foreclosure activity is concentrated in Jamaica, South Jamaica, Hollis and St. Albans, with 32 properties scheduled for auction.

The average lien on the properties in the Jamaica area was $413,456. A lien is the amount of debt a homeowner owes to the mortgage lender, which has the right to keep possession of the property until that amount is paid off.

The study found that two-family homes were the properties most likely to be auctioned off followed by one-family homes, condos and co-ops.

Pre-foreclosures, when the homeowner still has control of the property but has negotiated with the lender to sell the home below market value, has seen a downward trend since mid-2013. But Queens has the largest amount of pre-foreclosure cases this quarter with 1,345. The total for the city is 3,312.

Last month, city officials announced the Community Restoration Program, where the city will purchase 24 distressed mortgages for one- to four-family homes — or 41 residential units — in the Bronx, Brooklyn, Queens and Staten Island.

“We are fighting to help homeowners stay in the neighborhoods they helped build. And we won’t let predators force them out,” said Mayor Bill de Blasio in a statement. “The Community Restoration Program is the first of its kind, and it puts government squarely on the side of struggling families so they can keep their homes.”

The $13 million program is being funded with $1 million allocated by the City Council and $6.9 million from Goldman Sachs’ Urban Investment Group. A $2.2 million grant from the Local Initiatives Support Corporation (LISC) and $2.9 million in funds received from Morgan Stanley as part of their settlement obtained by the New York State Attorney General will also fund the program.

“Southeast Queens has one of the largest populations still recovering from the bursting of the housing bubble of 2008,” said City Councilman I. Daneek Miller, who represents Jamaica, Hollis and St. Albans. “With a limited number of options to help them get back on sound financial footing, this program will allow families to work with an organization whose focus is on helping them stay in their home, instead of making a profit, and keeping families in their communities.”

Once the city purchases the mortgages, partnering non-profit organizations will work one-on-one with homeowners to provide counseling and identify solutions to keep them in their homes. Solutions include mortgage modification or refinancing.

If those options are not available, the city will market the homes as affordable housing or create rental housing opportunities.