A new report released by members of the state Senate found that bank-owned, foreclosed homes in Queens have caused property values to drop $17.9 million because financial companies failed to properly maintain the properties they acquired.

“Nightmare Neighbors: How Badly Maintained Homes Damage Neighborhoods” was released on Dec. 18 by the Independent Democratic Cause (IDC), an eight-member group in the state Senate. The report identified hundreds of bank-owned properties in Queens, Brooklyn the Bronx and Staten Island to analyze how these foreclosed homes affected surrounding neighborhoods.

After the housing market crash in the mid-2000s, Queens saw an increase in “zombie properties.” In 2009, then-Governor David Paterson signed a law that made financial institutions responsible for maintaining a property until it was transferred to another owner.

According to the report, however, banks circumvented this law by declining to accept ownership of the properties after the foreclosure process, leaving it up to home owners to maintain them. In 2016, the state passed a law to give municipalities and the Department of Financial Services (DFS) power to enforce the 2009 law and created a registry for these zombie properties.

For this report, the IDC chose to look at the state of bank-owned properties that have been abandoned to analyze the effects on surrounding homeowners. They dubbed these properties “nightmare neighbors.”

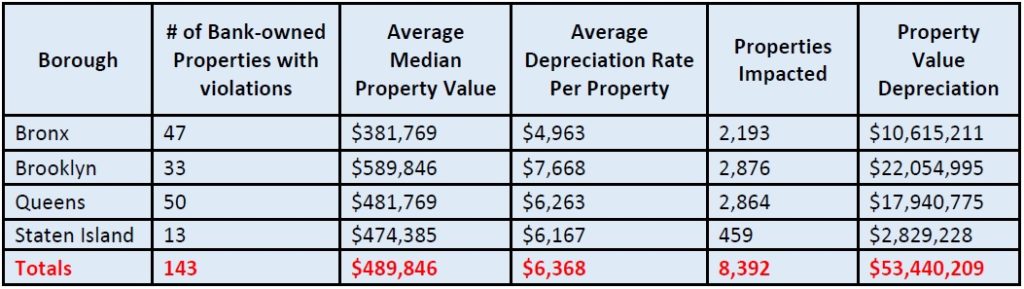

Staff members identified 336 bank-owned one- to four-family homes in the four boroughs and found that 136 had open violations listed on the Housing Preservation and Development (HUD) and Department of Buildings (DOB) websites.

The 136 properties have 2,610 open violations and the report estimates that the homes are responsible for lower property values of homes nearby by $53.44 million citywide.

Queens, with 155 bank-owned properties, had the largest number of these properties with open violations. The report found that 50 of the 155 bank-owned properties had a total of 576 open violations.

A spokesperson for state Senator Jose Peralta said members saw trash piled up in backyards and lawns, boarded up windows, chained doors and overgrown vegetation.

The analysis found that 2,864 one- to four-family properties in the borough have been impacted by these nightmare neighbors and have lost about $6,263 in value. In total, the bank-owned homes have caused more than $17.9 million in house value depreciation in Queens.

“The mortgage crisis wreaked havoc across my district and the rest of the state and the country, a tsunami that left an adverse effect in so many of our hard-working and immigrant communities,” said Peralta, who represents Jackson Heights, Corona and East Elmhurst. “Foreclosed homes became eyesores in our neighborhoods when banks failed to maintain their properties, not only affecting the property values but also creating health and public safety risks. Banks have to be accountable, and this is why financial institutions should face stiffer penalties in order for us to stop the despair of our communities.”

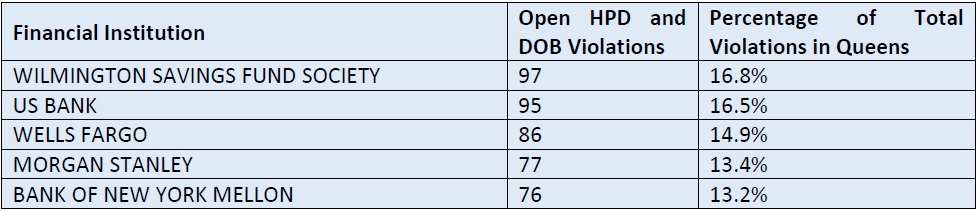

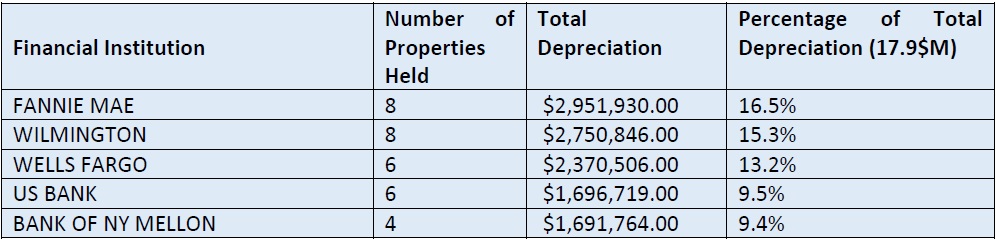

The financial institutions with the most open HPD and DOB open violations in the borough were responsible for 74.8 percent of all the violations in Queens. They included Wilmington Savings Fund Society, US Bank and Wells Fargo.

The 50 bank-owned properties with violations in Queens were owned by 16 different banks. The top financial institutions that owned most homes were responsible for $11,461,765 of the total depreciation recorded in the borough. In total, 32 of the 50 homes were owned by these banks.

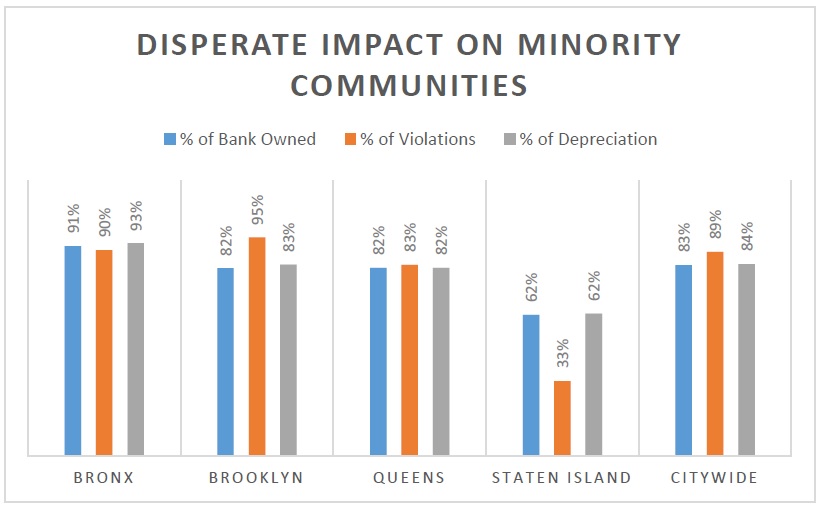

The report also found that these nightmare neighbors greatly impacted minority communities and low-income communities. Bank-owned homes in this report were located in 76 ZIP codes citywide and 46 of the total were categorized as minority communities while 26 were identified as low-income communities.

In the 76 ZIP codes analyzed, 55 had bank-owned properties with open violations. Forty-six of the 55 ZIP codes are considered minority communities, and 21 are low-income communities.

The IDC, led by state Senator Jeff Klein, is proposing legislation to hold banks accountable for these nightmare neighbors. They argue that the 2016 law should apply to bank-owned properties and that the Department of Finance registry should include the properties in the report and others like them.

“Thus, the DFS registry would contain all vacant and abandoned properties in which the bank has the duty to maintain, both prior to the judgment of foreclosure and after the judgement of foreclosure before the bank sells the property,” the report read.

The proposal would also add monetary fines to the 2009 law. Under current law, a municipality can file a lawsuit against a bank for failure to maintain the property. If the municipality wins the lawsuit, the bank would be required to reimburse the municipality for expenses incurred from maintaining the property.

The new bill would also allow DFS to bring fines of $500 per day per violation. The violations include a failure to maintain the property post-foreclosure or failing to report the bank-owned property to the registry.

In addition, the IDC is asking for $5 million to allow DFS to hire code enforcement officers to track and monitor vacant and abandoned properties to monitor their compliance.

“Queens is unfortunately all too familiar with the damage done to communities by poorly maintained bank-owned houses,” said state Senator Tony Avella, who represents Flushing, Whitestone, Bayside and College Point. “In my district alone, I seem to be in contact with the Sanitation, Buildings and Health departments monthly to ask for their help cleaning up some of these properties. Residents are growing tired of these bank-owned properties that lower the quality of life in our communities. New Yorkers deserve better. Shame on these financial institutions for allowing this to happen to our New York communities.”