The Queens Chamber of Commerce held its second webex for small business relief with the Queens Congressional delegation today to discuss focused support for small business through the Payroll Protection Program (PPP) loan program run directly through lenders designed to help small employers fund payroll costs. This can be of great assistance to the many businesses that serve the Port Authority airport of JFK and LGA in Queens. Many of these concessions, restaurants and business services have been devastated by the Covid-19 virus.

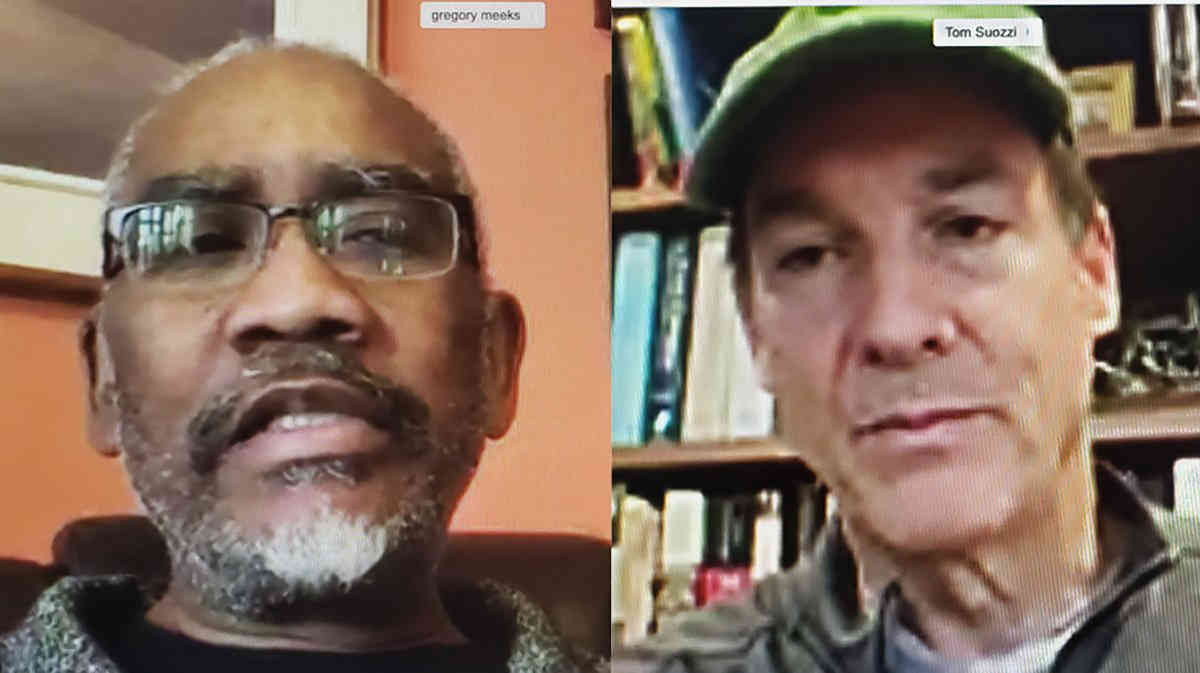

Congress people Gregory Meeks, Tom Suozzi and Carolyn Maloney spoke about need to direct funds from larger small business to local small businesses through the various financial assistance programs available from the federal government due to the Covid-19 crisis. The forum was hosted by the Queens Chamber of Commerce moderated by Chamber President Tom Grech and Peter A. Fehnel, Supervisory Economic Development Specialist (EDS) New York District Office U.S. Small Business Administration. Although not present, shouts-outs were given to Congress people Nydia Velaquez, Hakeem Jeffries and Grace Meng for their support and leadership in fighting for the Queens business community as part of the Queens delegation

Getting immediate relief through grants and loans to the small business was at the top of the agenda. Congressman Suozzi said that the bulk the PPP, from the initial $350 billion federal relief program went to the larger small business with lending institutions seemingly favoring the companies that needed in excess of one million dollars. Maloney said that the many small businesses needing $25,000-$100,000 found their applications not processed leaving the very small family businesses out in the cold. As of now that initial funding has been depleted. Congress is working on another infusion at the moment.

“Not one Queens business received a loan” from the initial dollars allocated for PPP.” said Grech. Although during the webex one business called in and reported success in notice of bank approval. This is the one documented case so far in Queens, but still left the need for very small businesses to work with a bank for a loan they all said. However, that was good news according to the participants since there is now another window of opportunity for more to come with the anticipated additional funding.

Now, as of April 21, there seems to be a deal that could be passed by the Congress and signed by the President as early as Friday April 24 to add another $310 billion to help small business. Meeks said that $30 billion of that will specifically go to the community banks, Community Development Financial Institutions (CDFI’s) and credit unions to help the truly small businesses in neighborhoods. This type of earmarking of funds is to bring relief to small businesses which failed to get funded from the first $350 billion, which do not have an existing banking relationship but need immediate relief to keep employees and keep their business afloat. To impress the importance of these funding, Meeks, Suozzi and Maloney urged everyone interested to get their paperwork in order and be prepared to apply as soon as the bill is announced. They foresee an outpouring of interest and quick depletion of the funds.

Another relief program called the EIDL, Economic Injury Disaster Loan Emergency Advance offers loans of $10,000 to businesses suffering from the Covid19 crisis. According to Peter Fun, the payments on existing disaster loans will be suspended until January of 2021 to help mitigate financial strain on suffering companies.

Each participant urged their business owners to contact them when having problems reaching the right people or assistance in the application process.

A key point was made that it was necessary to provide all the information required on all applications. Said Suozzi, make it “Tight, right and accurate” to insure proper review.

Links to relief programs:

PPP, Paycheck Protection Program. www.sba.gov/

CDFI- www.cdfif