It’s no secret that in recent years Queens has become a local hotspot for increased interest in the real estate market. Whether residential or commercial, more buyers are finding that the “World’s Borough” has plenty to offer.

However, two neighborhoods in particular are proving to be growing in popularity for residential buyers and commercial developers alike: Flushing and Jamaica.

According to StreetEasy Data Analyst Nancy Wu, Flushing and Jamaica have become more attractive areas in the market is that they are more affordable, relatively speaking, compared to the other neighborhoods. Wu attributes some to the popularity to the amenities that Flushing and Jamaica have to offer.

“[Flushing and Jamaica] also home to some of the city’s most popular attractions including sports venues, museums and restaurants offering a wide range of cuisines,” said Wu. “Downtown Flushing is a major commercial and retail district in the city, and home to the second largest Chinatown, attracting buyers and renters across the city to work and to live in the neighborhood. Jamaica is a vibrant community with convenient transportation access to the Long Island Rail Road and JFK airport.”

Downtown Flushing has been a go-to spot for businesses small and large to settle in with the high amount of foot traffic. And while Jamaica has convenient access to public transportation and JFK, Downtown Jamaica has molded its own arts district that is more affordable to live in compared to other arts districts throughout the city.

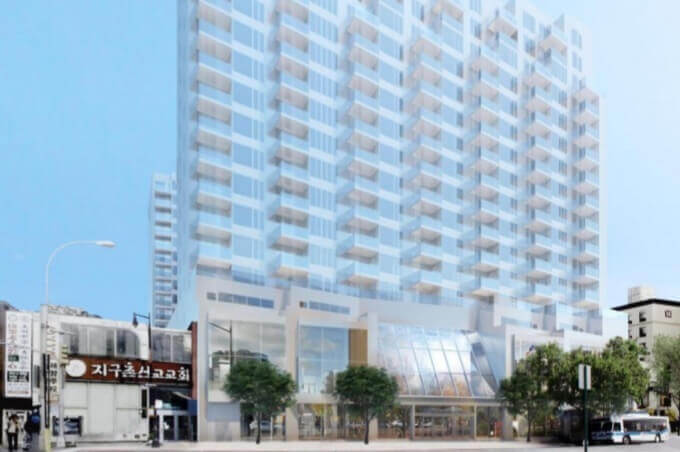

These neighborhoods have also become hotspots for development, particularly in Flushing. In April 2019, the final building of the Tangram development officially topped out, plus three 19-story, mixed-use buildings are set to rise in downtown Flushing. To add on to that, the site of Flushing’s RKO Theater is set to be replaced by another 17-story mixed-use residential development.

(Rendering courtesy of Tangram)

StreetEasy attributes the increase in new construction to the increased buyer demand in affordable neighborhoods in Queens.

According to Wu, the influx of new development is impacting how renters, buyers and developers have interacted with the borough’s housing market over the past several years.

“This influx of new construction has led to a continuing trend of new homes hitting the market,” said Wu. “In the first quarter of this year, new inventory rose by 10.6 percent in Flushing and 45.2 percent in Jamaica from last year, due to a boom in new construction, much of which is priced on the high end.”

Andrew Barrocas, CEO of MNS Real Estate, believes that the increased development in Flushing and Jamaica can prove to be good for the neighborhoods.

“If you look at new development, they benefit from more development,” said Barrocas. “Some people would think that creating competition would but what we see is that it helps one another. With more development comes more retail, which can lead to more foot traffic and diversity. You’re going to see them all benefit from each other. That’s what makes New York the special place that it is – the diversity of these well established neighborhoods.”

(Rendering courtesy of Madison Capital Realty)

But what do these latest developments in Jamaica and Flushing mean for the rest of Queens?

According to Donna Rubertone, manager of Daniel Gale Sotheby’s International Realty’s Bayside-Flushing office and Astoria-Long Island City office, the market in Queens as a whole is seeing a shift, mostly in a positive direction.

“What we’re seeing is a shift in the market. We’re starting to see inventory building up, days on market increasing, pricing is good,” said Rubertone. “The market is more balanced right now. Ten years ago we were coming out of the financial crisis, but in the last year we’ve seen a shift from a sellers market to a buyers market.”

Like much of New York, Queens was hit hard during the financial crisis in 2008, and according to Wu, had a slower recovery from the recession than Manhattan and Brooklyn. However, since 2016, the rate of price growth in Queens began to surpass that of the other boroughs, with price levels at $518,000 in the first quarter of this 2019, compared to Manhattan’s $1.1 million and Brooklyn’s $712,000.

“Price growth in Queens can be attributed to high demand for homes in the borough,” said Wu. “Home shoppers in the borough continue to find great value relative to Manhattan and Brooklyn, and have an expanding number of options from which to choose right now. As the number of new buildings in these areas continues to climb and more homes become available, sellers will have to work harder to make their homes stand out, while buyers can afford to be picky and patient, and negotiate before putting in an offer.”

Rubertone agrees, stating that buyers should jump on the chance to buy now while they still can.

“This is a great time for buyers, it’s a good time to pick something up,” said Rubertone. “We still are making sales, however buyers are more particular about pricing. They don’t want to over-buy.”

Many fear that with the increase in developments could lead to being priced out of Queens entirely. However, Barrocas believes that the city is doing what it can to keep itself affordable.

“Rental pricing is less in Jamaica and Flushing, so it will keep expanding outward,” said Barrocas. “The city is doing in its power to be affordable, and new construction take advantage of it. Having an affordable option is advantageous, it creates more affordable options and helps preserve these neighborhoods.”